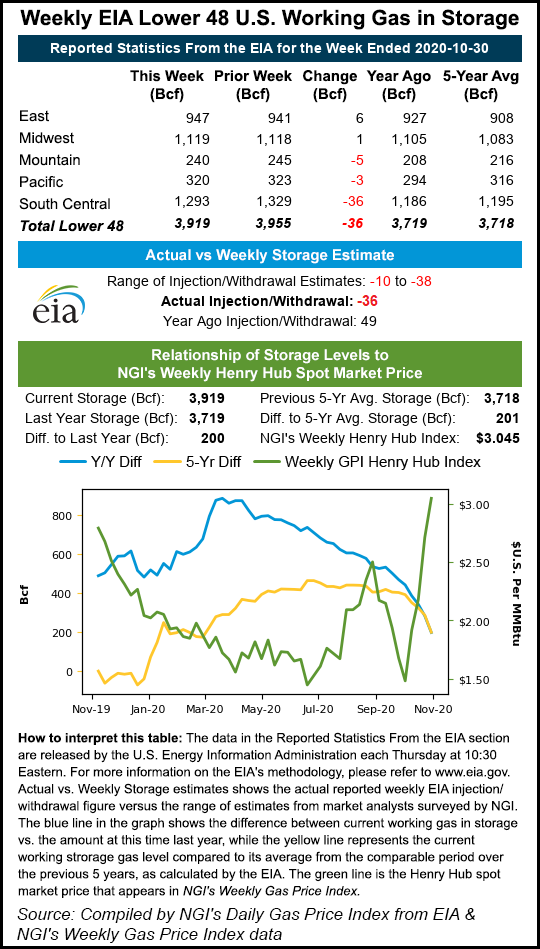

- BREAKING: U.S. EIA reports a natural gas withdrawal of 36 Bcf from storage for the week ending Oct 30, exceeding market expectations

- Natural gas futures fell for a third consecutive day

- Weak weather demand eclipsed robust liquefied natural gas levels

Natural gas futures fell for a third consecutive day Wednesday as mild fall weather and its dampening effect on demand eclipsed robust liquefied natural gas (LNG) levels and overall tightened balances.

The December Nymex contract settled at $3.046/MMBtu, down 1.3 cents day/day. January fell 1.8 cents to $3.177.

Diminished near-term weather demand also dragged spot gas prices lower. NGI’s Spot GasNational Avg. shed 28.0 cents to $2.345.

LNG feed gas volumes hovered close to 2020 highs around 10 Bcf Wednesday, as U.S. export destinations in Asia and Europe were expected to boost demand during the winter months. Bullish LNG trends outshined pleasant fall weather a week ago. However, the dynamic shifted this week as U.S. forecasts have increasingly called for warmth – and minimized heating needs – deep into November. This amounts to a delayed onset of winter and the peak demand for natural gas that accompanies the season.

“As it stands now, the pattern looks like it would remain warm into the 16- to 20-day thanks to a strong upper level trough from Alaska down the west coast of North America, allowing the downstream warm ridging to continue,” Bespoke Weather Services said.

The current pattern puts this month on track to finish as one of the top five warmest Novembers on record in terms of gas-weighted degree days, Bespoke said.

“It remains a weather-versus-balance battle, but one that weather is winning as long as we see such high-end warmth,” the firm said. “We still have no clear hints that we will move colder even into late-month at this time.”

Storage Report

All eyes will turn next to Thursday’s Energy Information Administration (EIA) storage report, with analysts expecting a bullish result for the week ended Oct. 30. Production was down during the week because of shut-ins in the Gulf of Mexico (GOM) ahead of Hurricane Zeta’s arrival last Wednesday. At the same time, LNG feed gas demand climbed during the week and, amid a cold blast in the Midwest, overall domestic demand was solid.

NGI forecasted the first withdrawal of the season, a 28 Bcf pull, on par with Energy Aspects’ preliminary estimate.

Energy Aspects estimated a 2.0 Bcf/d week/week drop in Lower 48 output. It modeled a 75% week/week increase in gas-weighted heating degree days, resulting in a 5.9 Bcf/d bump in residential/commercial demand. LNG feed gas demand rose 1.1 Bcf/d week/week, the firm estimated.

For the comparable week a year earlier, EIA recorded a 49 Bcf injection into storage. The five-year average is a build of 52 Bcf.

Major polls also reflected bullish expectations. A Bloomberg survey found estimates ranging from a pull of 22 Bcf to 38 Bcf, with a median 31 Bcf decrease. A Reuters poll found estimates ranging from a withdrawal of 10 Bcf to 38 Bcf and a median decrease of 27 Bcf.

Injection results from each of the three previous storage reports were bullish relative to median expectations.

“While a bearish mid-November weather outlook has helped to assuage winter supply adequacy concerns, it is too early for the market to be throwing in the towel,” EBW Analytics Group analysts said.

“Instead, recent bullish EIA storage reports appear to reinforce the notion that structural changes from increased working-from-home and schooling-at-home are increasing space heating demand per gas-weighted heating degree days,” EBW said. “When cold weather does arrive, it is likely that higher-than-expected demand will convince the market to add back the recently lost winter-contract premiums.”

Meanwhile, a razor-thin margin separated President Trump and Democrat challenger Joseph R. Biden Jr., with the ultimate result of Tuesday’s election still unknown at the close of Wednesday’s trading session.

Analysts noted that preliminary results pointed to Republicans retaining control of the U.S. Senate and Democrats maintaining an edge in the U.S. House, though the majority each holds looked likely to narrow. That left analysts to predict gridlock in the nation’s capital regardless of who is in the White House, potentially meaning only modest and gradual change, if any, in regulations affecting the energy sector over the next two years.

“Perhaps the biggest conclusion to be drawn at this stage is that there is only a small likelihood that existing oil and gas tax incentives will be removed in the U.S. – even if Biden emerges as the winner – given the narrow margin of victory and a probable Republican majority in the U.S. Senate,” said Rystad Energy analyst Artem Abramov.

However, Abramov added, other sectors anticipating another round of federal government stimulus may be disappointed, if inaction in Washington prevails.

“The impact on the U.S. economy in the short term could be quite negative,” the analyst said. “Washington will struggle to agree on any new stimulus package.”

Cash Called Lower

Spot gas prices on Wednesday declined across the Lower 48 along with mild temperatures and the continually unfavorable weather forecasts.

Warmer-than-normal conditions are projected for most of the country the rest of this week, with comfortable highs in the 50s and 60s throughout northern regions and 70s and 80s over much of the South, according to a National Weather Service outlook.

Production, meanwhile, has rebounded steadily this week after Zeta forced production shut-ins of nearly 1.4 Bcf/d a week earlier, Genscape Inc. said. For Wednesday, GOM dry gas production was 1.21 Bcf/d.

“While further recovery potential remains to be seen on pipelines such as Destin, Discovery GT, and MS Canyon, current activity in the Caribbean could further jeopardize these recovery efforts over the next 10 days,” Genscape said. On Tuesday, Hurricane Eta “made landfall along Nicaragua’s eastern coast as a Category 4 storm” and “is expected to do a 180-degree turn towards Cuba. Thereafter, model consensus suggests Eta will continue to the northwest upon entering the Gulf of Mexico and could further threaten gas production later next week.”

In Texas,Carthage prices dropped 29.5 cents day/day to an average $2.330, whileKaty shed 19.5 cents to $2.585.

In the Midwest, where temperatures swung from freezing less than a week earlier to highs in the mid-70s Wednesday,Chicago Citygate lost 25.0 cents to $2.390, andDawn dropped 26.5 cents to $2.405.

Out West, where prices have been volatile, SoCal Border Avg. lost 45.0 cents to $3.900, and El Paso S. Mainline/N. Baja plunged $1.185 to $2.930.

"gas" - Google News

November 06, 2020 at 01:00AM

https://ift.tt/36cesxb

December Natural Gas Futures Fall Further As Weather Worries Mount - Natural Gas Intelligence

"gas" - Google News

https://ift.tt/2LxAFvS

https://ift.tt/3fcD5NP

Bagikan Berita Ini

0 Response to "December Natural Gas Futures Fall Further As Weather Worries Mount - Natural Gas Intelligence"

Post a Comment