In a stark reversal from the prior week, temperatures climbed rapidly out of freezing territory and into the 60s and 70s across much of the Midwest, cutting off heating demand and driving down weekly cash prices.

NGI’s Weekly Spot Gas National Avg. for the Nov. 2-6 period nosedived 61.5 cents to $2.385 as comfortable fall temperatures settled in across most of the Lower 48. A week earlier, when an early shot of winter blanked the nation’s midsection, weekly prices jumped 59.5 cents.

Between the two weeks, the early winter gave way to a late round of near summer-like weather in the Midwest, and temperatures elsewhere were generally mild, minimizing furnace and air conditioner use.

Bespoke Weather Services said the week’s warmth put the current month on track to finish as one of the top five warmest Novembers on record in terms of gas-weighted degree days. The lack of weather-driven demand more than offset strong liquefied natural gas (LNG) levels. LNG feed gas volumes hovered in 2020 peak territory of around 10 Bcf throughout the week.

“It remains a weather-versus-balance battle, but one that weather is winning as long as we see such high-end warmth,” the firm said. “We still have no clear hints that we will move colder even into the late-month at this time.”

On the supply front, meanwhile, offshore production largely recovered during the latest covered week after widespread shut-ins a week earlier as Category 2 Hurricane Zeta barreled into the Gulf of Mexico. This added a layer of pressure on prices.

Weekly prices plummeted across the Lower 48. Tenn Zone 5 200L fell $1.550 to average $1.295, while Dominion Energy Cove Point dropped $1.035 to $1.395, and Algonquin Citygate sank $2.675 to $1.600.

Additionally, coronavirus outbreaks dampened economic activity and energy demand over swaths of the United States, particularly in the Upper Midwest. Several states in the region – Wisconsin, Iowa and the Dakotas – were all grappling with surges and record case levels.

While natural gas prices are poised to recover when colder weather returns, the pandemic threatens to intensify as people are indoors more in the winter, hastening virus spread. “The situation is likely to get worse,” said Robert Yawger, director of energy futures at Mizuho Securities USA LLC.

Futures Falter

The December Nymex contract also struggled throughout the week as forecasts looking deep into November showed little to drive demand.

The prompt month declined each day of the trading week and lost nearly 50 cents over the course of the week. It rallied briefly Thursday morning – after the U.S. Energy Information Administration (EIA) reported the first withdrawal from natural gas storage of the season – but even the bullish result was not enough to distract traders from the weather for long.

The December Nymex contract fell 10.4 cents on Thursday and shed another 5.4 on Friday to close the week at $2.888/MMBtu.

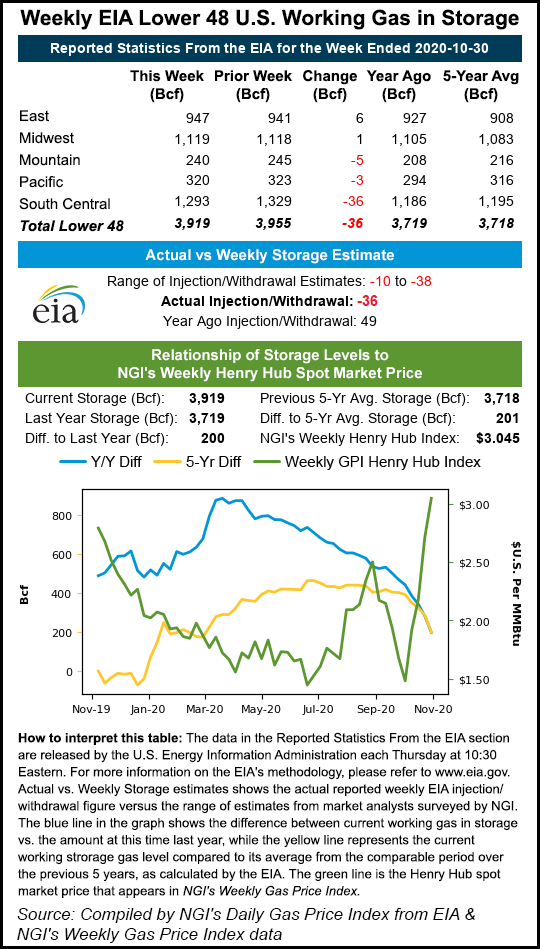

EIA on Thursday reported a pull of 36 Bcf from storage for the week ending Oct 30. The withdrawal exceeded market expectations. Major polls showed median estimates for draws in the high 20s or low 30s Bcf. The result also compared favorably to the 49 Bcf injection a year earlier and the five-year average build for the week of 52 Bcf.

The overall decline for the latest covered week reduced inventories to 3,919 Bcf. Genscape Inc. analyst Eric Fell said it was the first stockpile drop during the month of October in more than 10 years and that it reflected “a very tight supply/demand equation.”

At least, that is, up until the end of October. November started off warm and, if forecasts hold up, will remain so – curbing demand and likely necessitating storage injections over the first two weeks of the month, analysts said.

In fact, stocks remain high relative to the year-earlier level of 3,719 Bcf and the five-year average of 3,718 Bcf.

Meanwhile, the uncertainty imposed by a presidential election that was not settled during the trading week cast a shadow over markets. Analysts were left to ponder a divided Washington and the specter of gridlock.

While the results of Tuesday’s election were not finalized by Friday’s close, “the most likely scenario is a Biden win with Republicans retaining control of the Senate and a slimmer Democrat majority in the House — an outcome with huge implications for the natural gas industry,” analysts at EBW Analytics Group said.

“On a positive note, a Biden win is likely to lead to a quick end of the trade war with China, potentially opening the door to larger purchases of U.S. LNG by the second largest LNG purchaser in the world,” the analysts said. However, Republican control of the Senate “is likely to significantly constrain the scope of new legislation, if any can be enacted, forcing Biden to focus on administrative actions.” Biden could “suspend new federal leasing of oil and gas reserves immediately and block new natural gas pipelines.”

Cash Clunks

Spot gas prices fell further Friday, extending a week-long slump.

Benign weather that generated little heating or cooling demand all week is expected to extend into next week across most regions.

“Warmer-than-normal conditions continue across the U.S. with perfect highs of 70s and 80s over the southern” areas of the country, with the exception of 90s over the Southwest. “The northern U.S. is also quite comfortable for this time of the year with highs mostly in the 60s to lower 70s,” NatGasWeather said.

“Colder air is still expected into the West and Plains late this weekend and next week, although the intensity and coverage of subfreezing air has decreased considerably. National demand will still increase slightly late next week as cold air over the Plains spreads across the rest of the Midwest with lows of 10s to 30s,” the forecasts said. “But what continues to make the coming pattern quite bearish is warmer than normal conditions are forecast to hold over the East through Nov 20. As such, until more impressive cold arrives across the Midwest and East, bearish weather headwinds will continue.”

In the Northeast, Algonquin Citygate prices dropped 40.0 cents day/day to an average 37.5 cents, while PNGTS lost 13.5 cents to $2.825.

Prices in the Midwest were down across the board. Dawn shed 27.5 cents to $2.015, and Joliet fell 23.5 cents to $1.960.

Elsewhere, prices in Tenn Zone 4 200L plunged 95.5 cents to 60.0 cents, and Dominion North declined 19.0 cents to 26.0 cents.

On the pipeline front, Genscape Inc. said meter maintenance work at El Paso Natural Gas Pipeline would block deliveries to the Newman power plant in El Paso County, TX, Monday through Friday. The work is expected to cut deliveries to the power plant to zero for the work week.

Deliveries have averaged 148 MMcf/d during the last 30 days and the 736 MW Newman power plant is the largest generator in El Paso Electric’s generating portfolio, Genscape said. The plant serves Southern New Mexico and the panhandle of Texas. “There is potential for these maintenance-impacted volumes to back up towards the Permian Basin,” the firm said.

"gas" - Google News

November 07, 2020 at 06:31AM

https://ift.tt/35b95ix

Weekly Natural Gas Prices Plunge as Mild Temperatures Sap Demand - Natural Gas Intelligence

"gas" - Google News

https://ift.tt/2LxAFvS

https://ift.tt/3fcD5NP

Bagikan Berita Ini

0 Response to "Weekly Natural Gas Prices Plunge as Mild Temperatures Sap Demand - Natural Gas Intelligence"

Post a Comment