Natural gas futures skidded lower on Thursday after the latest government inventory report showed looser supply/demand balances. Still, prices recovered in afternoon trading as the market shifted its focus back to cold weather in the East this week and the potential for more widespread freezes later in November.

At A Glance:

- Futures rally amid high demand expectations

- Cold weather arrives in the East

- Demand for U.S. exports holds strong

The December Nymex contract climbed 4.6 cents day/day and settled at $5.716/MMBtu. It marked the third straight day of gains for the prompt month. January rose 4.6 cents to $5.826.

A chilly weather system settled in across the Midwest and Northeast on Thursday, with highs of 40s to 60s and lows in the 20s and 30s. Icy rain showers and sporadic snow flurries added to heating demand on the day, National Weather Service data showed. The chilly evening lows were expected to extend into the weekend.

After jumping a day earlier to compensate for the cold, however, cash prices edged lower on Thursday. NGI’s Spot Gas National Avg. shed a half-cent to $5.485.

The early blast of chill may not have been enough to sustain a cash price rally, but it reminded futures traders that winter looms large.

The outlook for next week showed mostly mild temperatures; however, by the following week, forecasts called for frigid temperatures across broader swaths of the northern United States.

“We suspect there is still additional colder risk around mid-month, given good model agreement on some redeveloping blocking in the north Atlantic, along with a ridge going up in the western U.S.,” Bespoke Weather Services said.

Demand for U.S. exports of liquefied natural gas, meanwhile, is holding strong, particularly from Europe. Supplies in storage for winter are lean this year on the continent following a scorching summer and extreme conditions last winter.

Rystad Energy analyst Nikoline Bromander said European gas prices are “rife with volatility” and storage “is still inadequate for a harsh winter.” While Russia has vowed to ramp up pipeline deliveries to Europe as soon as next week to address shortages, it “may not be enough.”

The challenges in Europe, Bromander said, should continue to put upward pressure on U.S. LNG demand and support Henry Hub prices.

In-Line Storage Print

These bullish factors ultimately outshined a neutral U.S. Energy Information Administration (EIA) inventory report that, briefly in morning trading, pushed futures into the red.

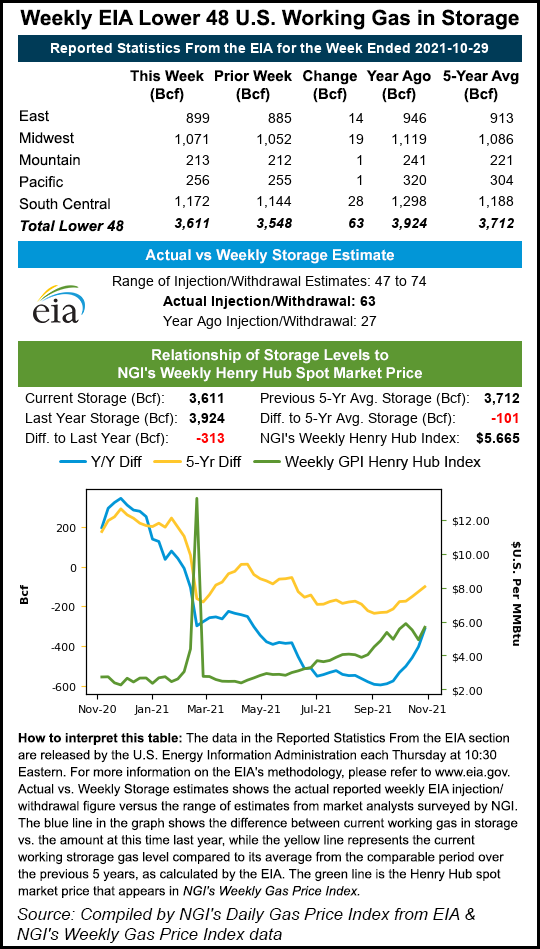

EIA on Thursday reported an injection of 63 Bcf natural gas into storage for the week ended Oct. 29. The result was essentially on par with median estimates of major polls, which coalesced around a build in the mid-60s Bcf. NGI’s model predicted a 68 Bcf injection.

The latest print, however, easily exceeded the 27 Bcf injection recorded for the year-earlier period and the five-year average build of 38 Bcf. Markets temporarily gave up ground on the news. Analysts on The Desk’s online energy platform Enelyst noted that a large deficit to historic norms at the start of autumn had all but been eliminated, suggesting supplies were catching up to demand.

The print marked the eighth straight week that EIA’s reported build narrowed the current inventory deficit versus the five-year average. Working gas in storage was 3,611 Bcf, according to EIA estimates. Stocks were 313 Bcf less than in the comparable week last year but just 101 Bcf below the five-year average.

Analyst James Bevan of Criterion Research said during the Enelyst chat that the U.S. market is on pace to emerge from the depths of the 2021-22 winter next March with 1.4 Tcf of gas in storage – signaling sufficient supplies.

Bevan also noted, however, that Criterion’s early estimate assumed normal winter weather. Harsh domestic conditions, combined with continued robust demand for U.S. exports, could eat into supply more substantially.

Production, meanwhile, has climbed early this month to around 94 Bcf – near 2021 highs – in response to strong demand. But it remains below pre-pandemic highs, and Bevan noted that U.S. producers are under relentless pressure from investors to conserve capital and invest in renewable fuels, rather than ramp up output of oil and gas.

“We believe the current strategies among upstream companies for 2022 will keep a lid on any significant production growth,” Bevan said.

The combination of peak winter demand and modest output continues to galvanize bulls. “As such Henry Hub prices remain strong,” Bromander said.

Spot Prices Sputter

Next-day cash prices on Thursday traded in a narrow range throughout most regions of the Lower 48, following price surges a day earlier.

Maxar’s Weather Desk’s Brad Harvey, senior meteorologist, noted the first cold air mass of the season impacted much of the eastern half of the country Wednesday and Thursday, with below-normal temperatures.

He also said the pattern is expected to transition in the six- to 10-day period, with above-normal temperatures spanning from the interior West to the central United States, for unseasonably mild temperatures. Highs in the East are projected to warm back toward more seasonal levels.

The coming pattern is expected to ease national demand and, after strong gains early this week, traders took profits and cash prices dipped lower.

Prices across most of the East fell Thursday. Millennium East Pool lost 13.0 cents day/day to average $5.135, while Algonquin Citygate shed 27.0 cents to $5.750 and Tenn Zone 6 200L lost 15.0 cents to $5.730.

In the Midwest, prices were mixed, with most hubs eking out modest gains. Chicago Citygate tacked on 2.5 cents to $5.565.

While the Upper Midwest and Northern Plains, along with the Northeast, get outsized attention among natural gas traders as winter approaches, BTU Analytics energy analyst Jon Bowman said markets should be watching the West this year.

“After enduring numerous challenges resulting in both increased gas demand and lowered gas supply” – notably including severe drought that limited hydropower and pipeline problems – “the West Coast enters winter with storage levels 50 Bcf below the five-year average,” Bowman said.

That, he added, is the “lowest level seen in at least the last 11 years,” leaving western markets “highly vulnerable to blowout pricing in the event of either colder than expected weather or additional supply disruptions.”

Cash prices on the West Coast, including California, have been volatile but ultimately lofty this year. The California Regional Avg. on Thursday closed down 6.0 cents to $5.490.

"gas" - Google News

November 05, 2021 at 09:24PM

https://ift.tt/3o3Yhut

December Natural Gas Futures Advance a Third Day - Natural Gas Intelligence

"gas" - Google News

https://ift.tt/2LxAFvS

https://ift.tt/3fcD5NP

Bagikan Berita Ini

0 Response to "December Natural Gas Futures Advance a Third Day - Natural Gas Intelligence"

Post a Comment