Natural gas futures fell again Monday as forecasts for more mild fall weather and light demand eclipsed robust liquefied natural gas (LNG) levels. The December Nymex contract settled at $5.186/MMBtu, down 24.0 cents day/day. January fell 22.4 cents to $5.305.

At A Glance:

- Futures extend losing streak

- Forecasts call for a mild November

- Cash prices drop across the South

Trading Monday extended a steep downward trend. Futures shed more than 75 cents over the final two trading days last week.

NGI’s Spot Gas National Avg. slid 6.0 cents on Monday to $5.020.

U.S. LNG feed gas volumes hovered close to 2021 highs above 11 Bcf Monday, according to NGI data, as demand held strong from export destinations in Asia and Europe ahead of winter.

However, as forecasts have increasingly called for warmth into mid-November – minimizing domestic heating needs – markets braced for a delayed onset of winter and the peak demand for natural gas that accompanies the season.

“Warmer changes ruled the models over the weekend, with the changes coming after this week,” Bespoke Weather Services said. A “turn back warmer as we move into the middle third of November… generally looks to be on track. Given that we are into the time of year when weather becomes a dominant force in price action, this keeps things rather uncertain.”

NatGasWeather also noted the tilt toward mild conditions this month. It said the European weather model lost “a hefty” 16 heating-degree days over the weekend “on warmer trends over the eastern half of the U.S. late this week into the following week.”

The firm also noted that global gas prices had declined late last week after news reports that Russia would send more natural gas to Europe to ease tight supplies there. Such a development could taper demand for U.S. exports.

EBW Analytics Group analysts highlighted “strong production indicators” last week that developed as the demand outlook weakened. Production had hovered close to 94 Bcf at points last week, near 2021 highs.

EBW’s analysts also observed projected heating demand declines between Friday and Nov. 18 associated with “bearish anomalies” strengthening over the Upper Midwest and through the Northeast.

“Although there are signs that renewed cold may return for the latter half of November, price declines are likely to follow the weekend demand loss early this week,” the EBW team said.

Storage Outlook

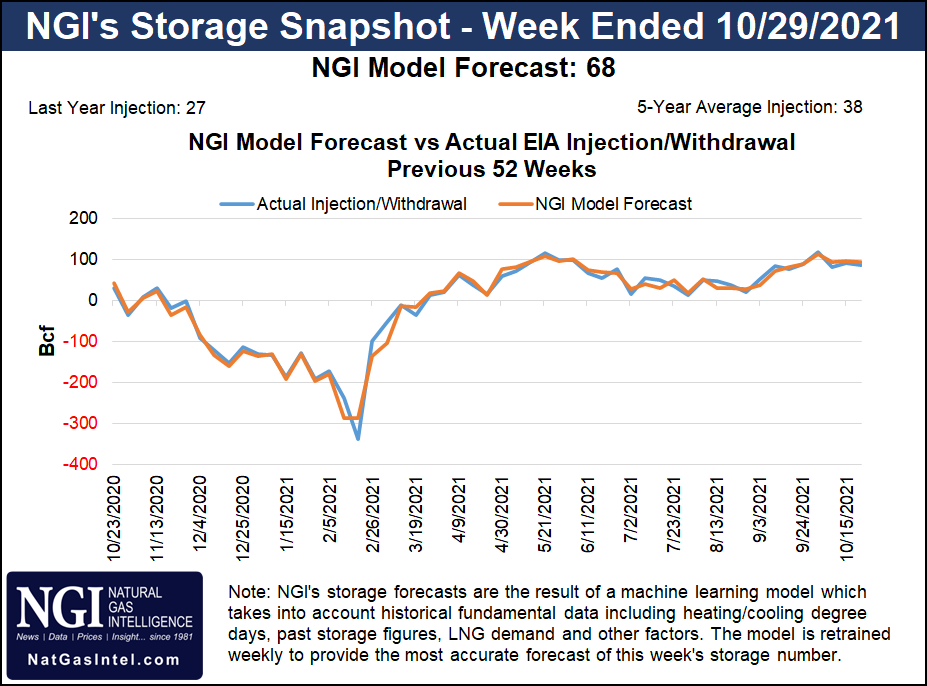

All eyes are likely to soon turn to the next Energy Information Administration (EIA) storage report, with analysts expecting another solid increase for the week ended Oct. 29. Though production climbed in the week, demand proved modest for much of the period, given comfortable autumn weather across much of the Lower 48.

NGI forecasted a build of 68 Bcf with Thursday’s EIA report. Bespoke estimated an increase of 65 Bcf. For the similar week last year, EIA reported an injection of 27 Bcf. The five-year average is 38 Bcf.

For the week ended Oct. 22, EIA printed an 87 Bcf injection. Federal inventory reports have proven stout throughout most of the fall.

That noted, total working gas in storage at the close of the Oct. 22 week was 3,548 Bcf — 403 Bcf below year-earlier levels and 126 Bcf below the five-year average.

Additionally, while output may be on the rise, there is still some question whether producers can ramp up quickly enough should the looming winter ultimately prove harsh and demand, by extension, become exceptionally strong. Nearly half of all U.S. households use natural gas to heat their homes.

RBN Energy LLC analyst Sheetal Nasta noted that large, publicly traded producers have been slow to boost output because of pressure from investors to remain conservative and either return more capital to shareholders or invest in renewable fuel projects.

“Wall Street has drawn a hard line when it comes to capital and environmental discipline in the energy industry,” Nasta said. “More midstream capacity is needed for production to grow, but it’s harder than ever for that infrastructure to get built, which means constraints for some period of time are all but a certainty.”

Cash Called Lower

Spot gas prices on Monday declined across most of the Lower 48 along with mild temperatures to start the week and the unfavorable weather outlook.

“A chilly weather system with rain and snow showers will track across the Midwest and Northeast this week with highs of 40s-50s and lows of 20s-30s, including rain and snow with lows of 30s dropping down the Plains,” NatGasWeather said.

“A milder system will track into the West midweek with highs of 50s and 60s,” however, and the “southern U.S. will be comfortable with highs of 60s and 70s,” the firm said. National demand will ease to even lighter levels by the weekend as highs of 50s to 70s expand across much of the country.

Looking to next week, the forecaster expects “high pressure will rule much of the U.S. with warmer-than-normal highs of 50s-70s.”

Against that backdrop, prices dropped across the southern third of the country and led overall averages down.

In the Southeast, Florida Gas Zone 3 lost 16.0 cents to $5.180 and Transco Zone 5 fell 19.0 cents to $5.195.

Prices fell throughout Texas as well, with El Paso Permian down 90.0 cents to $4.000 and Waha off 93.0 cents to $3.950.

On the pipeline front, Kern River Gas Transmission Co. announced a force majeure at its Goodsprings Compressor Station in Nevada, limiting capacity at the station to 1,800,000 MMBtu/d and cutting up to 60,000 MMBtu/d of flows until Nov 28.

“This force majeure comes as a result of an unexpected mechanical issue on one of the compressor units at the station, which prompted an engine exchange,” said Wood Mackenzie analyst Quinn Schulz.

The Goodsprings station takes gas produced in Wyoming, as well as gas from interstate interconnects, and flows it south into California, Schulz noted. Several California hubs bucked the downward price trend on Monday. SoCal Citygate gained 41.0 cents to $6.545 and SoCal Border Avg. climbed 20.5 cents to $5.690.

"gas" - Google News

November 02, 2021 at 04:53AM

https://ift.tt/3CCiVIv

Pressure Persists on Natural Gas Prices, with December Futures Down a Third Straight Day - Natural Gas Intelligence

"gas" - Google News

https://ift.tt/2LxAFvS

https://ift.tt/3fcD5NP

Bagikan Berita Ini

0 Response to "Pressure Persists on Natural Gas Prices, with December Futures Down a Third Straight Day - Natural Gas Intelligence"

Post a Comment