X

Story Stream

recent articles

Over the past three weeks, there has been some celebration as oil prices have “recovered” due to oil companies cutting production and some global demand beginning to return. This is normal. The low extremes of April have created a sense of hope in $30 territory. However, while an $70 per barrel gain—from -$37 to $33 per barrel—is great, we are nowhere near a price to sustain US operations. This is a harsh reality for some. I heard this said just last week, “At $50, we had 800 rigs running in the US, right? So if we can get back into the high 40’s, we should be close, right?”

Wrong.

The fact is, drilling rigs are a real-time indicator of activity. But they are not a leading indicator. For that, drilling permits are a better measure. Now, it is true that permits and drilling rigs do not always move perfectly in sync. But if they are off, it is usually because drilling rigs are being laid down but permits continue to be applied for. After all, it only costs a couple thousand dollars to get a drilling permit, so companies can easily continue to ask for them, even if they may wait a year to drill. In addition, one may not need a new permit if a well is being recompleted. That said, over the past five years, drilling permits have been a relatively consistent leading indicator of rig count and workload, although it can take 3 to 9 months for them to sync up.

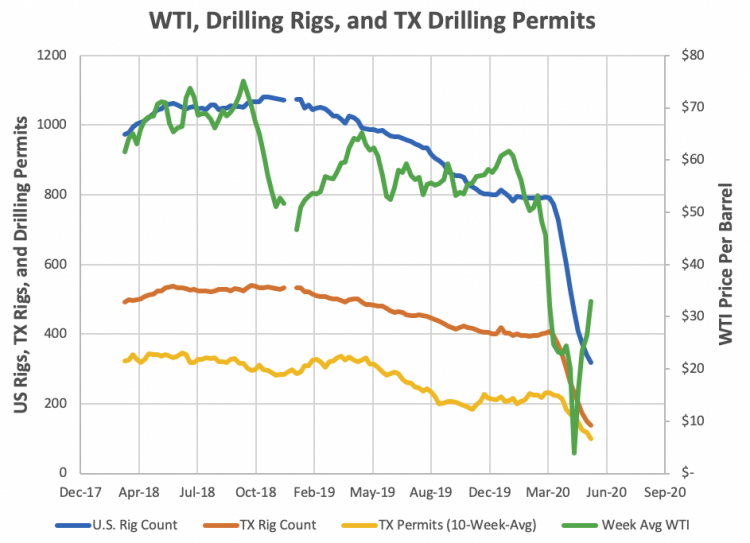

So, using public data for WTI price, rig count, and drilling permits from the Texas Railroad Commission, we can examine the trends prior to March of 2020 and the demand destruction of COVID-19 lockdown. In doing so, there is a striking correlation: The data PRIOR to coronavirus shows us that even $55 per barrel was going to lead to a downturn. This graph shows the levels correlated to prices:

From March to October of 2019, WTI prices were trending up nicely, and averaging right at $69 per barrel. During that time and for a couple of following months, US and TX Rig count hung just above 1,000 and 500 respectively. After October of 2018, oil prices took a hit, but then popped back up in a few months and averaged $56 per barrel from June of 2019 to February of 2020. During this time, US rig count trended down and leveled off at 800, while TX rig count leveled off at 400. In short, an average price drop from $69 to $56 (19%), correlated to a 20% drop in rigs. And while the similarity in these numbers is coincidence, the overall trend makes sense.

But now let’s examine drilling permit count. When oil prices averaged $69 per barrel, TX was issuing an average of 317 permits per week, and showing a slight downward trend. But after oil prices dropped, the trend down was substantial, and in the six-month period of Sept 19 to Feb 20, the permits leveled off and averaged 209 per week. Oil prices had lost 19%, rig count lost 20%, and permits dropped by 33%.

Unfortunately, it appears that in order to sustain US production and keep people employed, we need to be issuing around 300 permits a week. And this data shows that is questionable, even at $70 per barrel. So, for the hundreds of companies hoping to avoid bankruptcy, and the tens of thousands of workers being furloughed, $35, $45, even $55 per barrel does not signify a return to production.

To be clear, I am very bullish on oil prices at the middle to end of 2021 and forward. And I have gotten more bullish during coronavirus. Why? The industry has seen unprecedented demand destruction during these government lockdowns, and unlike virtually every other industry, has received virtually no support from government. So, as demand returns, there will less capability to fill it. High demand without supply means one thing… higher prices. When we consider that many major oil production projects offshore and in other nations have been slowed or stopped over the past couple of years, supply issues will be even more exacerbated.

So, the oil industry will continue to struggle mightily this year, and we will continue to see bankruptcies, shutdowns, and layoffs. However, all of this is going to lead to banner years in 2022 and beyond.

My bold prediction is this: Before the end of 2022, we may see $100 barrel oil again. We just have to make it through to get there.

Ryan Sitton is a professional engineer, the founder of PinnacleART, a global leader is reliability data analysis, author, and Texas Railroad Commissioner. The Railroad Commission of Texas regulates oil and gas production in the state.

"Oil" - Google News

June 05, 2020 at 05:35PM

https://ift.tt/3dEDqre

What the Data Tells Us: US Oil Needs $70 Per Barrel to Sustain Operations - RealClearEnergy

"Oil" - Google News

https://ift.tt/2SukWkJ

https://ift.tt/3fcD5NP

Bagikan Berita Ini

0 Response to "What the Data Tells Us: US Oil Needs $70 Per Barrel to Sustain Operations - RealClearEnergy"

Post a Comment