Range Resources Corp. has ended production curtailments imposed in September and October in response to weak Appalachian natural gas prices, but even with an improved outlook, there are no plans to increase activity.

Range cut 210 MMcf/d of natural gas production during the second half of September and most of October as Appalachian storage levels remained high and maintenance on multiple infrastructure projects squeezed takeaway capacity. Volumes were returned to sales by the end of October. Still, even as prices are expected to improve significantly in 2021 and 2022, Range is unlikely to change course.

“We believe the forward curve remains below a sustainable long-term price,” said CEO Jeff Ventura during a call last Friday to discuss third quarter results. “This is not a market that’s incentivizing any growth, instead range will seek to maintain production around current levels and optimize cash flow similar to our capital program this year and use excess cash flow to reduce debt and ultimately return this free cash flow to shareholders.”

Appalachian operators have continued to stress discipline this earnings season, with debt reduction, cost cutting, free cash flow generation and plans to hold production flat next year emerging as the dominant themes.

Range is now a pure-play Appalachian operator after it closed the sale of its Cotton Valley Sands Terryville Complex assets in North Louisiana to Castleton Resources LLC. Proceeds were used to cut bond maturities through 2024, which Range has reduced by $1.2 billion this year. Total debt still stands at more than $3 billion, but the company has cut it in each year since 2018. Ventura said Range expects to hit its near-term leverage targets in the “not-too-distant future” with more reductions expected in 2021.

Range’s well costs also continue to average less than $600/lateral foot, part of the reason why the company has cut its 2020 capital spending forecast by $15 million to $415 million.

Average realized prices during the third quarter, including derivatives, were $2.32/Mcfe, compared with $2.69 in the year-ago period. Average natural gas prices were $1.53/Mcf, or 42 cents below the average New York Mercantile Exchange price because of higher local inventories and constrained takeaway in Appalachia.

Natural gas liquids (NGL) continue to be a bright spot for Range, which exports some volumes from the Marcus Hook Industrial Complex near Philadelphia for premiums to domestic prices at Mont Belvieu, TX. Pre-hedge NGL realizations were $16.27/bbl during the third quarter, up $1.21 from the year-ago period. Range is one of the country’s leading NGL producers.

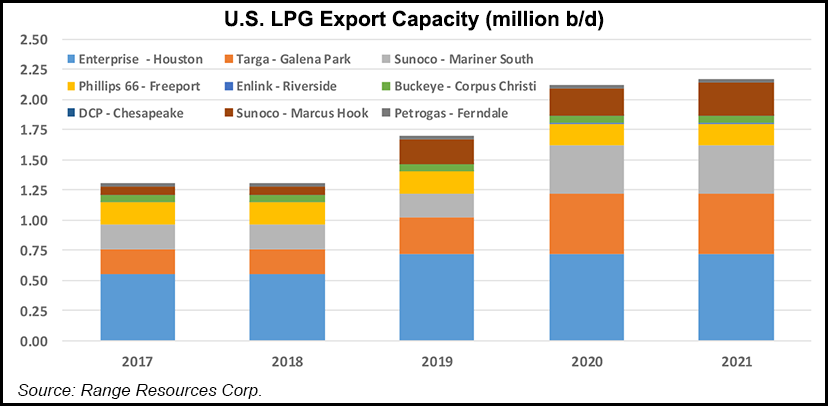

“Range expects NGL balances to tighten further with ongoing declines in associated NGL production and improving demand,” management said. “With respect to propane and butane, the start of winter should boost domestic demand while new liquefied petroleum gas export capacity becomes operational on the Gulf Coast.”

The company expects 4Q2020 and 2021 pre-hedge NGL prices to reach their highest levels since early 2019 given the current strip.

Range produced 2.19 Bcfe/d in the third quarter, down 2% from the year-ago period. Assets in Southwest Pennsylvania accounted for the bulk at 2.04 Bcfe/d. The other 81 MMcf/d came from Northeast Pennsylvania. The divested properties in North Louisiana, which had underperformed since being acquired in 2016, accounted for 73 MMcfe/d.

Range reported a third quarter net loss of $680 million (minus $2.83/share), compared with a year-ago net loss of $27.6 million (11 cents). The 3Q2020 loss included $522 million of exit costs related to the Cotton Valley Sands sale and a $125 million derivative loss.

"gas" - Google News

November 04, 2020 at 04:44AM

https://ift.tt/32d5ePR

Range Remaining Disciplined Despite Improving Natural Gas Outlook - Natural Gas Intelligence

"gas" - Google News

https://ift.tt/2LxAFvS

https://ift.tt/3fcD5NP

Bagikan Berita Ini

0 Response to "Range Remaining Disciplined Despite Improving Natural Gas Outlook - Natural Gas Intelligence"

Post a Comment