- Speculative traders drive massive sell-off across Nymex futures curve

- EIA stuns market with miniscule 1 Bcf draw

- Cash falls deep into red as temperatures start to moderate

As if Wednesday’s 10-cent decline wasn’t enough, another warmer shift in the latest weather models sent January natural gas futures into a freefall early Thursday. A huge bearish miss on the latest storage data hammered the final nail in the coffin, with the January Nymex contract settling the day 27.3 cents lower at $2.507. February plunged 26.3 cents to $2.515.

Spot gas prices also tumbled, with losses upward of 60.0 cents in the Northeast. NGI’s Spot Gas National Avg. dropped 23.0 cents to $2.475.

The warning signs started to blink “double barrel red” on Wednesday, when the market fell 3.47% to $2.780 after trading as high as $2.934 earlier in the session, according to Mizuho Securities USA’s Robert Yawger, director of Energy Futures. The warmer forecast for the middle of the month, reinforced with the midday data, put pressure on the market and the slide was on, with the market actually falling by 5.2% from top to settle.

“Overnight, the January/February front of the curve spread slipped to contango. Natural gas heating fuel slipping to contango before winter could even get underway,” Yawger said.

Much of the decline may be attributed to speculative traders unwinding their long positions. Several analysts have noted recent Commodity Futures Trading Commission data, which showed net longs dropping more than 20% to 65,975 contracts. This is down significantly, Yawger said, “but still large enough to do damage if everybody gets out at once, though I am guessing a significant chunk got out Thursday.”

EBW Analytics Group agreed that “machine-driven” trading played an important role in Thursday’s price collapse, but so did the bearish risks to the latest government storage data. The firm pointed out that while the consensus forecast was for a 10-15 Bcf draw, some predictions were for a small single-digit build.

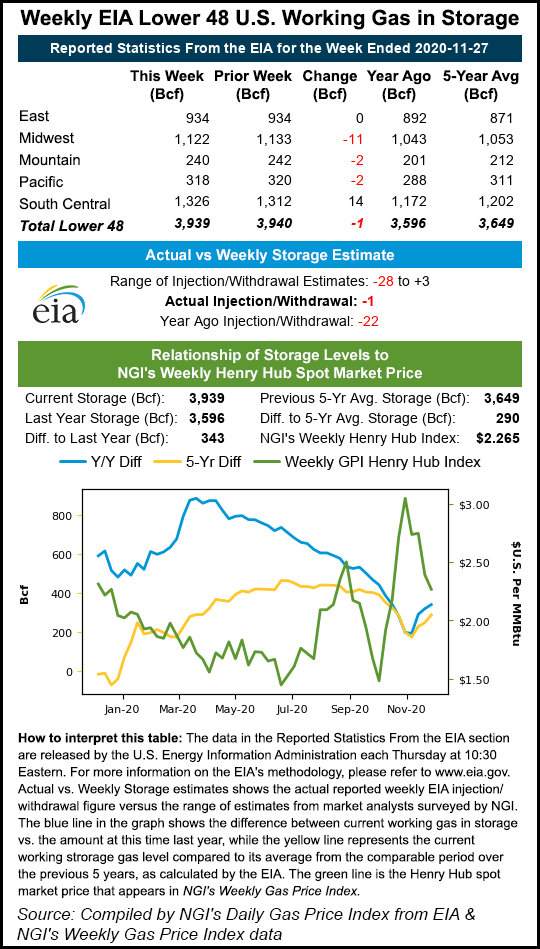

The Energy Information Administration (EIA) did not report an injection into storage for the week ending Nov. 27, but said inventories fell by a scant 1 Bcf. This compares with last year’s 22 Bcf withdrawal and the five-year 41 Bcf average draw.

Bespoke Weather Services chief meteorologist Brian Lovern was looking for a pull around 18 Bcf and said “it appears there was just a good deal more holiday impact than we gave credit for.

“Balance wise, this number is very weak, even factoring in the holiday, but it is worth noting that we are seeing improvements in the data this week, suggesting that future numbers will be back tighter,” Lovern said.

Broken down by region, the Midwest reported an 11 Bcf withdrawal from storage, while the Mountain and Pacific regions each notched a 2 Bcf decline in inventories, according to EIA. The East reported no change in stocks, and the South Central added a whopping 14 Bcf. This included 12 Bcf into salt facilities and 2 Bcf into nonsalts.

Total working gas in storage as of Nov. 27 stood at 3,939 Bcf, which is 343 Bcf higher than year-ago levels and 290 Bcf above the five-year average, EIA said.

Yawger said the next big event for the market would be the March/April so-called “widow-maker” spread switching from backwardation to contango. The spread sat at 4.2 cents on Thursday “and is threatening to switch to summer over winter before the first snow even gets here.”

Last year, the 2020 version switched to contango on Dec. 31, according to Yawger, with spot prices eventually trading to a 25-year low of $1.432 on June 26. Henry Hub cash on Thursday averaged $2.450.

EBW analysts said despite the warmer trends in the latest weather data, it was important for the market not to lose track of the big picture. The milder weather expected in Week 2, which is likely to further depress natural gas cash prices, is not nearly as warm as weather was in November, it said. Furthermore, degree days in Weeks 3 and 4 still are expected to be “reasonably close” to normal, raising space heating demand to its highest point this winter.

Meanwhile, liquefied natural gas exports remain strong, and there are early signs that production is starting to weaken, albeit slightly. If these trends hold, cash prices are likely to bounce back strongly with large withdrawals in December, EBW said.

Since traders focus heavily on whether near-term weather is slightly colder or warmer than normal, it may take time for the big picture to become fully apparent, according to the firm. “As January progresses and storage continues to decline, however, the structural supply deficit in the U.S. market is likely to become increasingly apparent, driving February and the remainder of the 12-month strip higher.”

Steep Cash Losses

With chilly weather relegated to the central United States, including into North Texas, spot gas prices came crashing down across the country Thursday as milder weather set up elsewhere.

NatGasWeather said the eastern part of the country is forecast to warm back into 50s and 60s to ease national demand back to lighter levels before a cold weather system hits the region over the weekend. However, the rest of the country is to be “exceptionally comfortable” by early December standards, according to the forecaster, including the Midwest. Temperatures in the region are forecast to be as much as 25 degrees above average through next week.

Chicago Citygate next-day gas prices tumbled 32.5 cents day/day to average $2.295, and OGT plunged 30.5 cents to $2.305.

El Paso Permian fell 30.0 cents to $2.320, slightly more than other markets across Texas.

Genscape Inc. said Texas Eastern Transmission (Tetco) on Friday is set to conduct cleaner tool runs on the 30-inch diameter system Line 16 from Angleton to Mont Belvieu, TX. Deliveries to the Brazoria Interconnector Gas Pipeline (BIG) intrastate at the Angleton interconnect are to be limited to 195 MMcf/d for the duration of the run.

“Deliveries to BIG have averaged 276 MMcf/d over the last 14 days but have consistently reached above 300 MMcf/d in that timeframe, even maxing at 351 MMcf/d on Nov. 29,” Genscape analyst Josh Garcia said. “The BIG Pipeline delivers gas to Freeport LNG at Stratton Ridge and as such, feed gas deliveries may be affected, but additional delivery capacity to Freeport exists on Gulf South and elsewhere on Tetco.”

Steep spot gas declines extended across Louisiana and into the Southeast, where Transco Zone 4 dropped 28.0 cents to $2.415.

Farther east, Columbia Gas cash was down 28.0 cents to $1.995, and Transco Zone 6 non-NY was down 51.0 cents to $1.930.

"gas" - Google News

December 05, 2020 at 12:38AM

https://ift.tt/39JhT1u

January Natural Gas at $2.50 After Bearish Weather, Storage Data - Natural Gas Intelligence

"gas" - Google News

https://ift.tt/2LxAFvS

https://ift.tt/3fcD5NP

Bagikan Berita Ini

0 Response to "January Natural Gas at $2.50 After Bearish Weather, Storage Data - Natural Gas Intelligence"

Post a Comment