As the United States and Europe falter under the weight of ever-increasing coronavirus cases and a general lull in markets, the health of the Asian crude market has arguably pulled crude prices and differentials away from the adverse ramifications of second wave coronavirus. China, India, Japan, South Korea; all of them are increasing their crude intake, increasing refinery runs and riding the waves of healthy refining cracks. At the same time, the early December OPEC+ meeting has tainted the upbeat sentiment a bit – the parties’ agreeing to meet every month to realign on the correctness of the production quotas and their splits infers a certain inherent fragility of the deal looking into 2021. The previous 6-month covenant had the benefit of providing strong binding guidelines for the market, whilst monthly quarreling on the necessity of putting out even more crude into recovering economies might create (unnecessary) market reverberations. Looking at the Middle Eastern OSP increases across the board, it might come as a bit of surprise to learn that, even though Chinese demand has been an instrumental element in Asia coming back to the crude market, its crude imports in December 2020 have palpably slowed down. This is due to a combination of concurrent developments – 2020 import quota limits running out and state refiners are approaching winter maintenance season. The prospects for January-February 2021 indicate further growth after the current lull, with West African grades showing considerable growth amid tepid interest in Europe (all of Angola’s spot January cargoes are going to China). As middle distillate cracks remain profitable enough, the usual suppliers of heavy barrels to China are the ones to suffer for now, as demonstrated by Brazil and Colombia seeing their exports decreasing for the third consecutive month already.

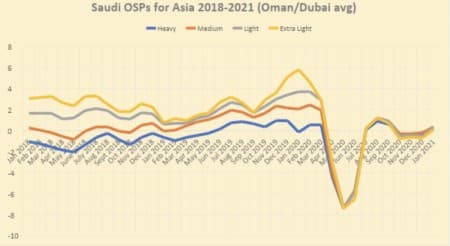

Graph 1. Saudi Aramco’s official selling prices to Asian markets (against the Oman/Dubai average).

Source: Saudi Aramco.

Amidst a general upbeat mood about Asian demand recovering back to where it should generally be, Saudi Aramco has issued its January 2021 official selling prices, a harbinger of things to come in the Middle East. The Saudi NOC has hiked prices across the board for January by 40-80 cents per barrel – the lighter the grade, the higher was the month-on-month increase. This was very much in line with what the market expected; having ensured that the OPEC+ talks do not collapse into chaos and perpetuate the good synergies of late 2020, Saudi Aramco’s OSPs reflected on the healthy middle distillate margins and increasing refinery runs in all of East Asia’s key economies. At the same time, European OSPs for Arab Light and Arab Extra Light were simply rolled over and the heavier streams were dropped by 50-80 cents per barrel as the Old Continent struggles to recover

Graph 2. United Arab Emirates OSPs, as issued by ADNOC in 2017-2020 (against Dubai Average).

Source: ADNOC.

ADNOC has surpassed Saudi Aramco in the extent and ambition of its January 2021 OSPs, hiking selling prices even more than the Saudis, by 75-95 cents per barrel. Underlying such audacity ADNOC continues to make good on its pledge to compensate for this summer’s overproduction and seemingly remains intent on curbing production into January 2021 – the Emirati NOC has informed term lifters in Asia that it would cut export volumes by 20% for Murban, 15% for Das and Upper Zakum and 5% for Umm Lulu. Albeit significant, the production cuts are smaller than those of November and December, indicating that ADNOC would gradually wind down its quota regime and from most probably from February 2021 onwards bring exports to normal levels.

Related: Oil Prices Drop On Weak Short-Term Demand Outlook In a slight turn of events from October-November, India’s demand for February and March-arrival cargoes is just as instrumental in pushing OSP differentials higher. Recent tenders by IOC and Mangalore Refinery have heated up interest in Emirati crudes by buying 5-6 million barrels of Upper Zakum and Murban in a timeframe of several days. All this on the back of quite intense WAF buying – in fact, Nigerian deliveries to India in December 2020 are going to be the highest in more than 5 years (May 2015) at 18 MMbbls. One of the largest crude suppliers to the Indian market, Iraq has slipped from its 11-month high in November (32.5 MMbbls) to a slower pace of loadings in December.

Graph 3. Iraqi official selling prices to the Asian market in 2018-2021 (against Oman/Dubai Average).

Source: SOMO.

Ever since the Iraqi state oil marketer SOMO expressed its intention to create a triad of Basrah grades instead of the traditional Light/Heavy split, the market was abuzz speculating where the new Iraqi grade, Basrah Medium (28° API, 3% Sulphur) would be priced. Well, right in the middle of Basrah Light and Basrah Heavy, as it turned out. The Asia-bound OSP for Basrah Medium was set at $-0.65 per barrel to Oman/Dubai, whilst Basrah Light was dropped 5 cents to $+0.40 per barrel and Basrah Heavy decreased a whopping 65 cents to $-1.60 per barrel. Interestingly, both Iraq and Kuwait have refrained from moving their January 2021 OSPs upwards as both nations tilt towards heavier production streams. Keeping Iraq’s January OSPs largely intact is also a great ruse to ramp up exports – Arab Medium that was hiked 40 cents on the month by Aramco is largely the same quality as the new Basrah Light (assessed at some 31.5° API and 2.7% Sulphur), decreased by 5 cents m-o-m.

Related: Large Oil Trader Trafigura Books Strongest Trading Year Ever

Buoyed by the demand recovery and by the prospect of Joe Biden becoming the United States’ 46th President on January 20, 2021, Iran has also started a PR campaign claiming that next year will witness a tangible return of the Islamic Republic on the global crude markets. President Hassan Rouhani claimed NIOC plans to export an average of 2.3mbpd crude during 2021, roughly corresponding to the amounts that stipulated in Iran’s 2021 budget. There persist heavy doubts that the new US Administration would be willing to rejoin the JCPOA and normalize relations with Teheran as soon as it takes the helm, most analysts assume that any decision to ease the sanctions regime would be preceded by a rather prolonged series of negotiations.

Graph 4. Iran’s Crude Exports in 2017-2020 (million barrels per day).

Source: Thomson Reuters.

Iran today produces some 1.9-2mbpd of crude lately but most of it gets refined domestically. By commissioning and ramping up the Persian Gulf Star (PGS) condensate splitters the state refining company NIORDC has managed to hike gasoline production capacity at PGS alone to more than 300kbpd, allowing Teheran to look back on 2019/2020 as the first couple of years in the 21st century when Iran was fully self-sufficient in terms of its fuel production. Despite the self-sufficiency drive, Iran has surreptitiously maintained a part of its export stream, averaging 0.33mbpd in 2020. The overwhelming majority of Iranian exports went either to Singapore or China, always with transponders switched off and following a route too difficult to follow. Iran’s January 2021 OSPs indicate a willingness on the Iranian side to straighten up its exports, for the first time since March 2020 Iranian Light went into a discount to its main regional peer, Arab Light (see Graph 4).

Graph 5. Iranian Light vs Arab Light (against the average of Oman/Dubai).

Source: NIOC, Saudi Aramco.

The Asian marine fuels market deserves a separate mention as it has been one of the star segments of November-December 2020. The healthy cracks have incentivized refiners across the board to step up their production and seek additional spot outlets as the Q4 2020 Singapore low Sulphur crack spread heretofore hovered around $9-10 per barrel. Although market activity was muted in the past couple of days, it points rather to the market anticipating the Christmas and New Year festivities rather than to a structural weakening of demand. High sulfur marine fuel was seeing even better prices as some East Asian countries ran into unexpected bouts of shortage – first and foremost South Korea whose only HSFO producer GS Caltex is currently incapable of catering for the country’s needs all by itself, sending the South Korea-Singapore differential soaring some $50 per ton week-on-week.

By Viktor Katona for Oilprice.com

More Top Reads From Oilprice.com:

Viktor Katona

Viktor Katona is an Group Physical Trader at MOL Group and Expert at the Russian International Affairs Council, currently based in Budapest. Disclaimer: views set…

More Info"Oil" - Google News

December 14, 2020 at 08:00AM

https://ift.tt/3oNIM8P

Middle East Oil Prices Rise As Asian Demand Recovers - OilPrice.com

"Oil" - Google News

https://ift.tt/2SukWkJ

https://ift.tt/3fcD5NP

Bagikan Berita Ini

0 Response to "Middle East Oil Prices Rise As Asian Demand Recovers - OilPrice.com"

Post a Comment