After an earlier dip, natural gas futures recovered to ultimately close out Wednesday’s session nearly flat as the prospects for more cold in early January appeared to dim.

With a sharp increase in liquefied natural gas (LNG) demand and the potential for a much larger-than-normal storage withdrawal, the January Nymex contract settled at $2.677, down a half-cent from Tuesday’s close. February climbed one-tenth of a cent to $2.681.

Spot gas prices were mixed, but the Northeast mounted more gains as snow fell on the region. NGI’s Spot Gas National Avg. climbed 14.0 cents to $3.385.

The blockbuster winter storm pummeling the East Coast notwithstanding, any momentum in the futures market was sapped early Wednesday as the latest weather data decreased the risk in achieving a colder pattern into the turn of the new year. This change was most apparent in the European ensemble, according to Bespoke Weather Services.

“While the late-month situation remains a lower confidence one, a failure of cold to materialize would imply that the La Niña state is able to resist any notable shift eastward in tropical forcing,” the forecaster said.

This could keep the overall warm state rolling into January, absent a strong North Atlantic Oscillation block. “This is what all of the long-term climate modeling suggests will occur, and is our lean as well, as even if we are to get colder in early January, we are not convinced of its durability,” Bespoke said.

The midday Global Forecast System (GFS) model gained some demand for the Dec. 24-27 period, but remained mild in the days before and after that period, according to NatGasWeather. The forecaster pointed out, though, that the GFS was colder for Dec. 25-27, which moved it closer in alignment with the European model. The European model, however, is still more than 20 heating degree days colder compared to the GFS.

Bespoke said the weather models have been inconsistent all week, “…so we must expect swings in forecast demand through the end of the week.”

Other fundamentals were more or less stable, according to the forecaster, but LNG demand bounced back from a brief drop. NGI data showed feed gas flows to U.S. terminals moving back above 11 Bcf on Wednesday after plunging below 10 Bcf on Tuesday.

The temporary decline in feed gas volumes was because of an overnight utility plant trip that resulted in all three liquefaction trains at Cameron LNG being shut down. The issue was resolved later Tuesday and operations were continuing to ramp up midweek.

Even with the rebound in LNG demand, traders appeared to need more convincing to move prices more decisively one way or the other. That could occur on Thursday, when the latest government storage data is released.

The Energy Information Administration (EIA)’s weekly storage inventory report has been increasingly scrutinized this winter as the market attempts to gauge how Covid-19 has impacted demand. Mild weather in November left the hefty storage inventory overhang generally intact, but last week’s 91 Bcf draw reinforced the notion that the supply/demand balance is tight.

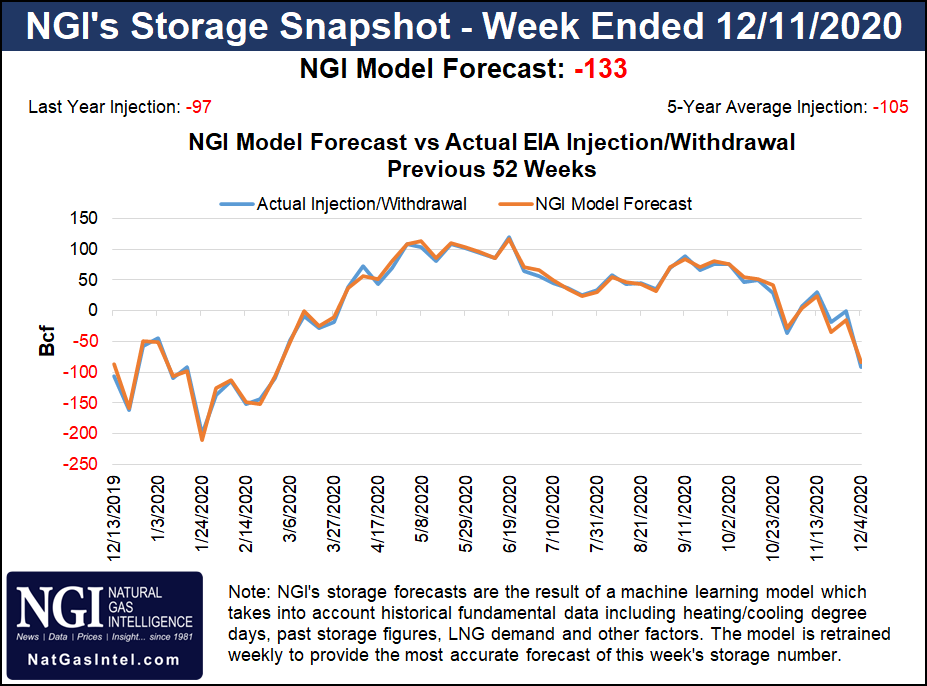

This week, analysts are expecting another large draw. A Bloomberg survey of analysts produced a withdrawal range from 105 Bcf to 138 Bcf, with a median of 119 Bcf. A Wall Street Journal poll had the same results, while a Reuters poll produced a median draw of 120 bcf. NGI projected a 133 Bcf draw.

The estimates compare with the 97 Bcf decrease the EIA recorded in the similar week last year, while the five-year average decline for that week stands at 105 Bcf.

EBW Analytics Group said analysts have been out of lockstep with the EIA in recent weeks, with a string of bullish storage reports in October followed by repeated bearish reports in November. Last week’s tight EIA figure may be indicative of structurally higher demand per gas-heating degree day stemming from the pandemic, according to analysts.

“If Thursday’s report is similarly bullish, it could help confirm structurally higher demand and bolster winter contracts. If bearish — which we slightly favor — a resumption of bearish momentum may be the more likely result.”

‘Storm of Debilitating Proportions’

After days of talking about it, a Nor’easter finally began hitting the East Coast midweek, prompting state declarations of emergency as temperatures plunged and snow fell.

Snow, ice and rain stretched from the Ohio Valley to the Southeast as the storm began taking aim at the mid-Atlantic and the Northeast, according to AccuWeater. Although projected to be a fast-mover, this will be a big storm that may bring whiteout and blizzard conditions to some places and result in power outages where the storm hits the hardest.

The National Weather Service issued winter storm watches and warnings on Tuesday across numerous states spanning from North Carolina to Maine ahead of the Nor’easter. More snow is forecast from the storm than from all the storms last winter combined in Washington, D.C., Philadelphia, New York City and Boston.

Even though warm ocean air and the short duration of the storm are expected to limit snowfall totals in Washington, D.C., Baltimore and Philadelphia, heavier precipitation is forecast for the Interstate-95 cities farther to the north, according to AccuWeather. In New York City, the snow is forecast to pile up to a depth of 10 to 15 inches.

Farther inland, a “storm of debilitating proportions” and a general 12-18 inches of snow is predicted. The heaviest snow is expected to bury areas from central and eastern Pennsylvania, with a total of 18-24 inches of snow forecast.

However, AccuWeather said the wintry precipitation is forecast to end over the southern Appalachians by Thursday morning, in the mid-Atlantic and central Appalachians by midday and finally taper off in New England by the evening.

Unlike the rest of the country, Northeast spot markets have strengthened each day this week, ahead of the storm’s arrival. Algonquin Citygate set a seasonal average high of $7.53 on Wednesday and then jumped another $1.910 Thursday to average $9.440.

“This was after the previous second highest print of the season occurred on Monday’s trading session,” said Genscape Inc. natural gas analyst Josh Garcia.

Both Northeast points along the Transcontinental Gas Pipe Line system also set fresh highs on Tuesday, and continued to strengthen on Wednesday. Transco Zone 6 non-NY next-day gas climbed $1.275 to $5.410.

The New England demand sample increased slightly from 3.97 Bcf/d Tuesday to 4.09 Bcf/d Wednesday, according to Genscape. However, Appalachia demand was down 100 MMcf/d day/day to 20.27 Bcf/d.

“Still, based on the pipeline demand sample, this is the second highest demand day of the season so far for the EIA East,” Garcia said.

The analyst said most major Northeast pipes declared operational flow orders (OFO) on Monday. However, Dominion Energy Transmission on Tuesday released a notice declaring low system flexibility, while Nexus Gas Transmission declared a customer-specific OFO and Southern Natural Gas declared an OFO.

With the chilly air blanketing the Southeast, prices moved slightly higher on Wednesday, but bigger gains were seen at Transco Zone 5, which jumped $1.365 to $5.460.

Louisiana also finished the day in the black, as did most Midwest hubs. Prices across Texas were mostly lower, but losses were capped at around a dime.Much steeper decreases were seen farther West, where Opal was down 18.5 cents to $3.365 and Malin was down 18.5 cents to $3.355.

"gas" - Google News

December 17, 2020 at 05:09AM

https://ift.tt/3mqCQRM

Natural Gas Futures Prices Still Steady Ahead of Potentially Larger-than-Normal EIA Storage Report - Natural Gas Intelligence

"gas" - Google News

https://ift.tt/2LxAFvS

https://ift.tt/3fcD5NP

Bagikan Berita Ini

0 Response to "Natural Gas Futures Prices Still Steady Ahead of Potentially Larger-than-Normal EIA Storage Report - Natural Gas Intelligence"

Post a Comment