Natural gas futures slid further on Wednesday as weather models backed off the upcoming winter blast targeting the Lower 48. Some profit-taking also likely factored into the midweek pricing behavior, with the March Nymex contract slipping 5.6 cents day/day to $2.789. April fell 4.6 cents to $2.772.

Spot gas started to retreat as well, though prices on the East Coast remained strong. NGI’s Spot Gas National Avg. dropped 20.5 cents to $3.545.

After such weighty gains in projected demand in recent weather models, some modest changes to the outlook were to be expected. Nevertheless, the 15-day forecast remained strongly supportive, according to NatGasWeather. The Global Forecast System (GFS) and the European model still are a massive 70-plus heating degree days (HDD) colder than normal, it said.

The overnight weather data lost a few HDDs for this coming Sunday and Monday, according to the forecaster, but “made up for it” by trending further colder with a second reinforcing Arctic shot Feb. 10-14. The most recent GFS data maintained the Arctic shot across the northern United States this weekend but wasn’t quite as cold across the southern and eastern part of the country.

However, the GFS trended even colder beginning late next week through mid-February as a second reinforcing Arctic blast is forecast to spread “aggressively” across the country. The European model’s afternoon run was in agreement.

Regarding Wednesday’s price action, NatGasWeather said sometimes natural gas market price moves “don’t make sense after huge breakouts, as prices often retrace more than what should be expected.”

The forecaster noted that the March Nymex contract traded at $2.68 midday last Friday (Jan. 29). Since then, both the GFS and the European weather models have gained more than 60 HDDs on “huge” colder trends, or more than 90 Bcf in demand. “Yet prices an hour ago were only at $2.75,” NatGasWeather said in its midday update. “Essentially, a massive colder trend was only valued as being worth a 7-cent gain in March prices.”

Bespoke Weather Services agreed that Wednesday’s price slide didn’t make sense. Weather outlooks remain solidly frigid, and there is nothing on the fundamentals side that jumps out as bearish versus the last few days, the firm said. “It seems the mentality in the market is simply that we can price anywhere since we will not run out of gas, but perhaps this action is simply an aberration that will correct itself. If it does, we should at least climb back toward the $2.90 level. Confidence is lower, however, given the irrationality currently.”

Supply Concerns

EBW Analytics Group said the recent downside moves along the Nymex curve demonstrate that natural gas traders continue to have a short-term focus, and do not yet recognize the severity of the current supply deficit. The firm noted that as of last week’s Energy Information Administration (EIA) storage inventory report, total working gas in storage was 78 Bcf above year-ago levels and 244 Bcf above the five-year average.

“Many traders also believe that production will increase quickly if the market tightens,” EBW said.

The market’s focus on the total natural gas inventory surplus as of the last storage report misses the bigger picture, according to EBW. Aggregate storage east of the Rockies (East, Midwest and South Central) is already below year-ago levels. In addition, early one-third of the surplus versus the five-year average is in the Pacific Region and the Rockies, “where it is of little use in meeting demand in the East.”

More important, according to the firm, is that despite very mild weather for much of the winter, the storage surplus has been declining all season and is on a trajectory to shrink by several hundred Bcf during the remainder of the withdrawal period. This, it said, is “a sure sign of an undersupplied market.”

Over the next few months, production is likely to continue to decline even if prices rise from current levels, according to EBW. By next week, resistance at $3.00 is likely to be retested.

“If cash prices rise strongly enough, and the next few storage reports are bullish, it is possible resistance will be broken,” it said. “Traders’ misperceptions, however, create continued downside price risk for natural gas, despite bullish supply/demand fundamentals.”

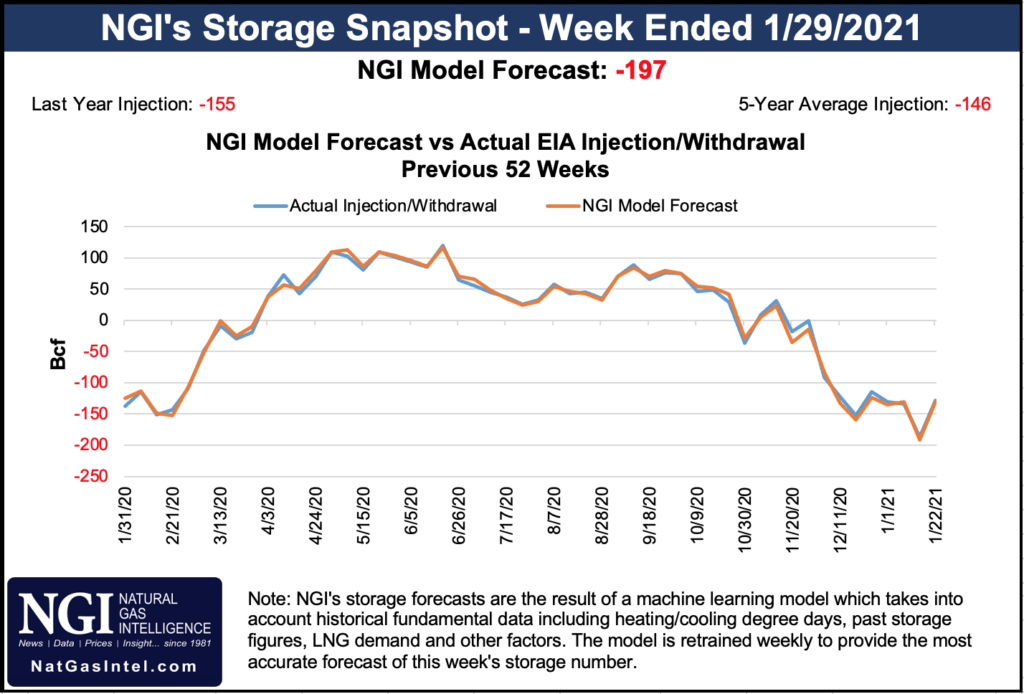

Ahead of the next EIA report, scheduled to be released at 10:30 a.m. ET Thursday, analysts were looking for a withdrawal close to 200 Bcf. A Reuters poll of 18 analysts produced estimates ranging from withdrawals of 202 Bcf to 172 Bcf, with a median decrease of 193 Bcf. A Bloomberg survey and a Wall Street Journal poll also showed estimates within that range, with both producing a median 194 Bcf decrease. NGI modeled a 197 Bcf pull.

For reference, EIA recorded a draw of 155 Bcf during the similar week a year ago, and the five-year average withdrawal stands at 146 Bcf for the period.

Cash Crushed

Spot gas prices across the Lower 48 retreated on Wednesday amid a brief break in between winter storms in the country’s more densely populated regions.

AccuWeather said after dropping more snow over the Rockies Wednesday night, a storm is expected to gain strength and cause much more “wintry trouble” over the Plains and Midwest on Thursday. Ultimately, it would yield more long-lasting cold in the North-Central states. This storm is forecast to be “fast-moving but intense” in terms of wintry weather, according to the forecaster.

“Most places in Nebraska, Iowa, southern Minnesota and southern Wisconsin will receive most if not all of their snow during a six-to-10-hour period on Thursday,” AccuWeather senior meteorologist Mike Doll said.

The same storm is forecast to spread a swath of rain, wintry mix and snow into the Appalachians, mid-Atlantic and Northeast on Friday. All or mostly rain would likely fall from New York City to Washington, DC, and on to the south, according to AccuWeather. “A wintry mix may end as a period of snow in parts of West Virginia, western and northern Pennsylvania and central New England with all or mostly snow farther to the northwest on Friday.”

Despite Old Man Winter’s grip remaining firmly in place on the Northeast, prices throughout much of the region plunged on Wednesday. Transco Zone 6 NY next-day gas dropped $2.290 to $3.170, while Tenn Zone 5 200L fell $3.510 to $3.330.

The exceptions were pricing locations in New England. For example, Algonquin Citygate spot gas picked up another 7.5 cents day/day to average $12.060. It traded as high as $15.000.

Appalachian markets were solidly in the red midweek, with the majority of losses in the region capped at about 30.0 cents. Texas Eastern M-3, Delivery stood out from the pack, tumbling $1.810 to $3.115.

Losses were a bit more tempered in the Upper Midwest and across Texas. Waha next-day gas was down only 5.5 cents to $2.765.

In California, SoCal Citygate cash fell 6.5 cents to $3.175.

Wood Mackenzie said the frigid winter conditions on the West Coast have prompted Southern California Gas (SoCalGas) to withdraw gas from the Aliso Canyon storage facility under an operating protocol that has been seldomly used in the past several years. Aliso Canyon withdrawals are restricted and can only occur if at least one of four conditions are met.

SoCalGas invoked Condition 2 this month, the first time since the current withdrawal protocol went into effect more than 18 months ago. This condition is the only one of the four that allows Aliso withdrawals contingent only on Aliso inventories, regardless of any other system-wide dynamics, according to Wood Mackenzie.

“It is triggered if Aliso Canyon inventory is above 70% of its maximum allowable inventory during February or March,” said Wood Mackenzie analyst Joseph Bernardi. “That maximum is currently 34 Bcf, so the corresponding 70% mark is 23.8 Bcf.”

Despite the recent cold snap that drew down system-wide storage by nearly 5 Bcf/d over 10 days, SoCalGas’ start-of-February storage levels still are at their highest point since before the Aliso Canyon leak, according to Wood Mackenzie. This year’s inventories have now surpassed those for the same date in 2016 – when the leak was still ongoing – “making the current inventory of 68 Bcf the highest for February since six years ago in 2015.”

"gas" - Google News

February 04, 2021 at 06:17AM

https://ift.tt/3oQ4kBk

Natural Gas Futures Fall, but Price Action Seen as 'Aberration' with Storage Set to Shrink Considerably - Natural Gas Intelligence

"gas" - Google News

https://ift.tt/2LxAFvS

https://ift.tt/3fcD5NP

Bagikan Berita Ini

0 Response to "Natural Gas Futures Fall, but Price Action Seen as 'Aberration' with Storage Set to Shrink Considerably - Natural Gas Intelligence"

Post a Comment