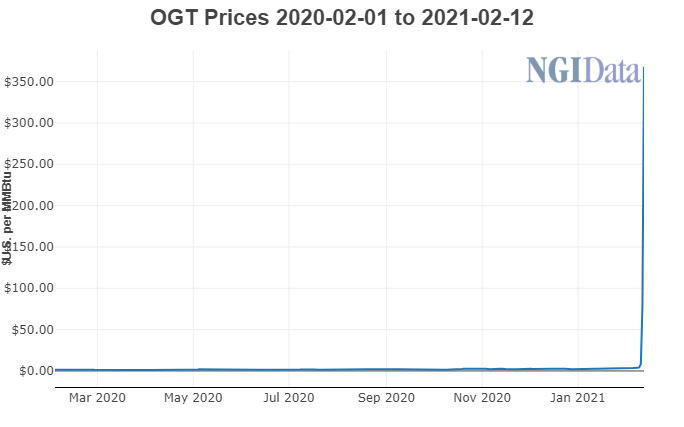

In what will likely go down as one of the wildest days in the natural gas market ever, cash markets stole the show on Friday. Gas buyers paid hundreds of dollars to meet what is expected to be record-setting heating demand over the four-day Presidents’ Day holiday weekend. Fueled by OGT’s $600/MMBtu record high, and similarly stout gains across much of the country, NGI’s Spot Gas National Avg. soared $57.42 to $61.960.

Nymex futures, meanwhile, struggled to capture the same level of enthusiasm over the bitter cold penetrating the Lower 48. The March Nymex gas futures contract closed the week at $2.912, up only 4.4 cents from Thursday’s close. April climbed 4.0 cents to $2.876.

A handful of midstream companies had already begun reporting issues at some of their gas plants on Thursday and by Friday, some pipelines were reporting operational issues. New England’s Algonquin Gas Transmission experienced an unplanned outage on the Mainline that prompted the pipeline to reduce the operating pressure by about 5% between Cromwell and Burrillville compressor stations until the issue is resolved.

The polar air had already reached Texas overnight, and wellhead freeze-offs were starting to surface in West Texas and southeastern New Mexico, where RBN Energy LLC said Permian Basin production fell 1.5 Bcf day/day on Friday.

AccuWeather said temperatures were forecast to dip to record levels in the 20s, teens and even the single digits in some cases in portions of Arkansas, Kansas, Oklahoma and Texas — and that is likely to set the stage for a major winter storm.

“It is a stormy, stormy pattern across the country,” said AccuWeather meteorologist Bernie Rayno.

The forecaster noted that anytime an Arctic air mass moves into Texas, there is concern about snow and ice because, at some point, warmer air is going to try to return. When warmer air collides with that colder air, “you get clouds and precipitation,” Rayno said.

“The other thing you look for is if you have any energy in the atmosphere coming toward Texas, and the answer is yes,” he added.

The setup, which is forecast to trigger an extensive swath of snow and ice, will be brought on by the interaction of Arctic air in place and a flow of warmer and moist air originating from the Pacific that is to sweep across Mexico and into Texas.

The electric grid operator for most of the Lone Star State warned of record power demand over the multi-day stretch of punishing weather. The Electric Reliability Council of Texas (ERCOT) said generators were asked to take necessary steps to prepare their facilities for the expected cold weather. The checklist includes reviewing fuel supplies and planned outages and implementing winter weatherization procedures.

ERCOT also is working with transmission operators to minimize transmission outages that could reduce the availability of generation or otherwise impact the ability of the system to serve demand.

Based on the current load forecast, and if temperatures continue to decline, ERCOT could set a new all-time winter peak demand record Monday morning. The current winter peak demand record is 65,915 MW set on Jan. 17, 2018.

Spot gas prices in the Midcontinent, often the cheapest in the Lower 48, surged to as high as $600.00 on Friday as snow, ice and subfreezing temperatures saturated the region.

Oneok Gas Transmission, aka OGT, had been gaining traction over the past couple of days as a train of winter storms began barreling across the United States. At the start of the week, the Oklahoma point was trading in the $3.00 range. By Friday, no transaction was executed below $125.00. The pricing hub averaged $367.850 after adding $289.94 to Thursday’s levels.

“That is really just a very large gathering system for a number of connecting pipelines that move gas to different parts of the country,” said NGI Director of Strategy & Research Patrick Rau. “That’s a lot of straws looking to drink from a significantly reduced supply pool.”

The deep freeze, and potential for up to 3 inches of snow by Monday, also sent gas prices skyrocketing at the Houston Ship Channel ahead of the long holiday weekend. Cash traded as high as $225.00 on Friday before averaging $164.565 higher day/day at $175.305. The reduced output in the Permian boosted Waha prices as high as $350.00, but they averaged $149.60, up $138.295.

“Over the last year in Texas and Oklahoma, we’ve now had prices that have ranged between minus $10.00 to $600. Amazing,” Rau said.

Mizuho Securities USA LLC’s Robert Yawger, director of Energy Futures, said it was odd that gas is “bid to the moon” in West Texas/Oklahoma/New Mexico at the same time oil “explodes to the upside.” He noted that there is plenty of gas/oil infrastructure overlap in West Texas, though the oil rally may be primarily driven by reports of an attack by Yemen’s Houthi rebels on a Saudi Arabia airport.

“Brent has also ripped higher, which tends to point to the Houthi angle as the reason for the rally…just speculating, but the gas situation is out of hand,” Yawger said.

Meanwhile, hefty price gains extended far and wide across the country.

In the Rockies, Cheyenne Hub cash jumped as high as $350.00, and averaged $190.805, as overnight lows were forecast to tumble some 12 degrees below zero in Denver by Sunday.

The surge in heating demand has resulted in rare storage withdrawals at the Aliso Canyon facility in Southern California. Wood Mackenzie said Friday Aliso had withdrawn a total of 2.57 Bcf over the past week.

SoCal Citygate spot gas traded to a $195.00 high for the four-day gas period. It averaged $132.71 higher day/day at $144.000.

On the East Coast, where snow and other wintry conditions are more common, prices started to come off recent highs. Algonquin Citygate spot gas tapped out at $14.00 on Friday, off from the $16.00 high the previous day. Transco Zone 6 NY hit $7.00, but averaged slightly lower day/day.

After this week’s rollercoaster, Bespoke Weather Services said price action after the long holiday weekend is difficult to predict. There is the possibility that cash strength continues, especially if there are additional freeze-offs that cut into production. This could promote more rallying even if there is no additional cold coming in the medium-range weather forecasts.

“Should we see more physical strength and have material colder weather changes, it could get even wilder,” the forecaster said.

On the flip side, as strong cold wanes over the coming week, cash prices could recede quickly, and if no additional cold is seen coming, Nymex futures would easily move lower at the front of the curve, according to Bespoke.

Its view is that the pattern “goes tame” into late February and early March. As the current “madness” around this cold shot winds down, Bespoke expects the curve to move back lower, though perhaps only by 10-15 cents at most given that the market will be drawing down storage considerably with this cold.

“But again, confidence in near-term price action is quite low with all of the issues at play — which are almost impossible to predict,” Bespoke said. “We suspect things will remain quite choppy in trading early in the week, either way, providing some opportunities in both directions.”

"gas" - Google News

February 13, 2021 at 07:13AM

https://ift.tt/2Nl2YS3

Natural Gas 'Madness' Ensues as Arctic Plunge Ushers in Natural Gas Price Records - Natural Gas Intelligence

"gas" - Google News

https://ift.tt/2LxAFvS

https://ift.tt/3fcD5NP

Bagikan Berita Ini

0 Response to "Natural Gas 'Madness' Ensues as Arctic Plunge Ushers in Natural Gas Price Records - Natural Gas Intelligence"

Post a Comment