The Heritage Foundation energy economist Nick Loris provides an update on the blockage in the Suez Canal and the impact it will have on energy markets.

The shipping vessel stuck in the Suez Canal may escalate into a crisis for U.S. energy markets and the White House is paying close attention.

"We do see potential impacts on energy markets...it is one of the reasons we have offered assistance. We are going to continue to monitor market conditions and will respond appropriately if necessary" said White House press secretary Jen Psaki during the Friday briefing.

SUEZ CANAL MAY JEOPARDIZE YOUR MORNING CUP OF JOE

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| USO | UNITED STATES OIL FUND L.P. | 41.53 | +1.64 | +4.11% |

West Texas Intermediate crude crossed the $61 per barrel level on Friday, rising over 4% or $2.41, over concerns the ship, the size of the Empire State Building, may take weeks to be dislodged.

U.S. NAVY TAPPED TO TROUBLESHOOT STUCK SUEZ CANAL SHIP

“With the backlog of vessels on both sides of the canal, we are talking about a huge bottleneck for coming into the port and leaving the port, so you have dozens of oil tankers, as well as nearly 200 vessels on either side that are ready...We’ve seen the impact on oil prices and the longer it takes to dislodge this vessel the higher prices might go” said Nick Loris, energy economist at The Heritage Foundation, during an interview on FOX Business.

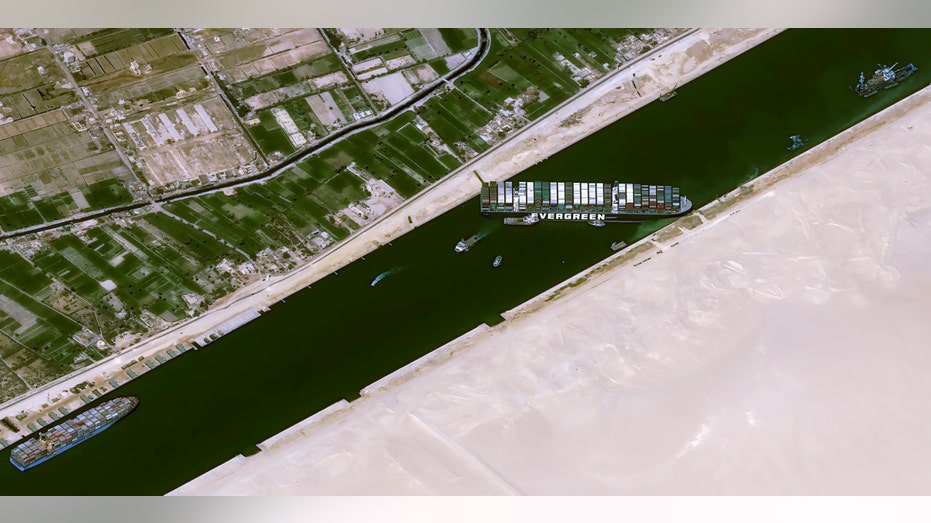

This satellite image from Cnes2021, Distribution Airbus DS, shows the cargo ship MV Ever Given stuck in the Suez Canal near Suez, Egypt, Thursday, March 25, 2021. The skyscraper-sized cargo ship wedged across Egypt's Suez Canal further imperiled glob

As of Friday, there are conflicting reports as to when the vessel will be dislodged. Over the weekend, the U.S. Navy will be on the scene to troubleshoot the stuck ship.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| UNG | UNITED STATES NATURAL GAS FUND LP UNIT (POST REV SPLIT) | 9.66 | +0.02 | +0.21% |

The Suez Canal is one of the most strategic routes for Persian Gulf oil and natural gas shipments to Europe and North America. It, along with the Sumed Pipeline, accounts for 9% of the world’s seaborne oil trade according to EIA data.

If the vessel remains stuck, other ships will be forced to be re-routed around the canal, delaying deliveries for all kinds of products, including oil and natural gas. Loris estimates being re-routed could take vessels an extra two weeks to 40 days, depending on final destinations.

That could spell trouble for energy deliveries.

Loris did note one "saving grace" that could keep oil prices stable; European lockdowns which have been reinstated due to an uptick in COVID-19 cases.

This has reduced demand which resulted in the third straight week of declines for oil which equates to a 7.75% drop.

Developments over the weekend will dictate the oil trade in the coming days.

"Oil" - Google News

March 27, 2021 at 03:51AM

https://ift.tt/3lWHKaq

Oil spikes as White House eyes Suez Canal energy impact - Fox Business

"Oil" - Google News

https://ift.tt/2SukWkJ

https://ift.tt/3fcD5NP

Bagikan Berita Ini

0 Response to "Oil spikes as White House eyes Suez Canal energy impact - Fox Business"

Post a Comment