Haynesville shale gas producer Vine Energy Inc. tested the market's waters in the first oil and gas IPO in years and found the temperature tepid.

Vine, led by former Encana executives and backed by investment giant Blackstone Group Inc., priced its initial stock offering $2 below the expected range at $14 per share late March 17, and investors clipped another 1% off Vine shares in the first day of trading March 18.

While Vine is marketing itself around low costs for extraction and its proximity to both the Henry Hub pipeline nexus and Gulf Coast LNG terminals — banking on a worldwide expansion in natural gas demand — investors had little appetite for another heavily indebted, capital intensive, shale gas driller despite the success of Appalachian gas producers' stocks over the past year.

Another advantage, Vine said, is that it has no minimum volume commitments to its midstream gathering providers and no firm transportation agreements with pipelines, giving it the flexibility to throttle gas flows to better match demand while keeping costs down.

According to Andrew Dittmar, an analyst at oil and gas market data firm Enverus, Vine also has the advantage of being a pure-play Haynesville gas entity. The only other driller with that focus is Comstock Resources Inc., he said.

"The mid-cap space on the public side is just pretty saturated," Dittmar said. "I don't know anybody really wants to try to work their way into that without a really differentiating factor ... I don't know if there's any hidden niches that aren't already pretty well-covered."

Vine is carrying $1.22 billion in debt, most of it due in 2023, with a debt/EBITDA ratio of more than 5x, according to S&P Global Market Intelligence. After some refinancing, S&P Global Ratings raised its rating from CCC- to CCC+ but was still concerned about the looming 2023 debt wall.

"Although we expect the company to generate enough free cash flow to pay down its revolver in 2021, the company will likely have to find other sources of liquidity to offset the anticipated decrease in its [reserve-based lending facility]," Ratings said Jan. 21. "We also believe the refinancing of Vine's unsecured notes due April 2023 could prove challenging, as current yields on the company's unsecured debt remain high."

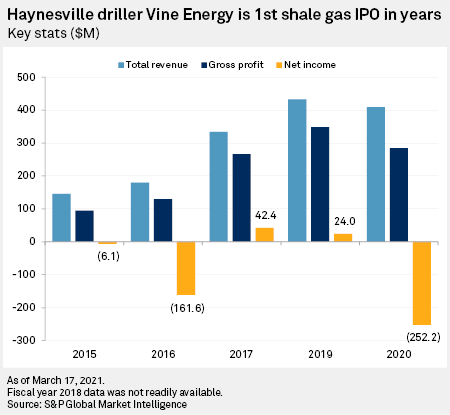

In 2020, Vine reported an unadjusted $252.2 million in losses with $42.8 in positive free cash flows after making interest payments — a non-GAAP measure — according to the IPO prospectus.

Built around a chunk of Haynesville Shale acreage purchased for $1.2 billion from Royal Dutch Shell PLC in 2014, Vine is a conglomeration of its core Vine Oil & Gas LP and two smaller gas firms. Pro forma for the combination, Vine Energy averaged 892 MMcf/d of production in 2020 with Vine Oil & Gas contributing 658 MMcf/d, an increase of 20% over 2019 for the Vine unit, according to the prospectus. At the same time, its average realized price for that gas dropped 7% to $2.25/Mcf.

This S&P Global Market Intelligence news article may contain information about credit ratings issued by S&P Global Ratings. Descriptions in this news article were not prepared by S&P Global Ratings.

"gas" - Google News

March 19, 2021 at 10:34AM

https://ift.tt/3qXwDyJ

Pure-play shale gas driller Vine gets chilly reception on Wall Street - S&P Global

"gas" - Google News

https://ift.tt/2LxAFvS

https://ift.tt/3fcD5NP

Bagikan Berita Ini

0 Response to "Pure-play shale gas driller Vine gets chilly reception on Wall Street - S&P Global"

Post a Comment