Natural gas futures vaulted higher on Thursday as production eased, export demand jumped and traders looked ahead to colder weather and the onset of winter storage withdrawals. The December Nymex contract rose 8.6 cents day/day and settled at $4.902/MMBtu. January added 8.1 cents to $4.995.

At A Glance:

- U.S. LNG volumes gain momentum

- EIA prints a storage injection of 26 Bcf

- Spot prices advance ahead of Eastern freeze

Coming off a 36.1-cent selloff in the previous session, Thursday’s prompt month gain marked the third time futures advanced this week.

NGI’s Spot Gas National Avg. gained 11.0 cents to $4.955, led higher by advances in the Northeast ahead of an anticipated shift to freezing conditions on Friday.

Nationally, NatGasWeather said Thursday the American and European models trended slightly cooler for next week but warmer for the Nov. 27-Dec. 2 timeframe, resulting in little overall change and essentially normal conditions. Normal weather at this time of year, however, tends to result in steady heating demand, particularly moving into December.

Meanwhile, forecasts for Europe on Thursday projected colder than normal conditions from days six through 15 of the outlook period, the firm noted. This “could aid European prices, which have the potential to carry over to U.S. markets.”

Indeed, with storage levels precariously light in Europe, demand for U.S. exports of liquefied natural gas (LNG) has proven strong through the fall and is now expected to intensify as winter arrives. Russian deliveries of natural gas to Europe were expected to accelerate in November – following vows from President Putin – but volumes have only ticked up so far.

What’s more, a German regulator this week indefinitely suspended its certification of Russia’s new Nord Stream 2 pipeline, which as recently as last week was slated to begin transporting additional natural gas to Europe by mid-winter.

Absent Russian supplies, Germany and other countries throughout Europe are clamoring for U.S. gas. LNG feed gas volumes hovered close to all-time highs above 12 Bcf earlier this month and approached that level again Thursday. NGI estimated U.S. volumes at 11.8 Bcf.

Echoing NatGasWeather, Maxar’s Weather Desk said demand could soon mount even more. Maxar said a total of 70.4 heating degree days are expected across Europe from Tuesday (Nov. 23) through Nov. 27, well above the 10-year normal of 61 days.

Stout Storage

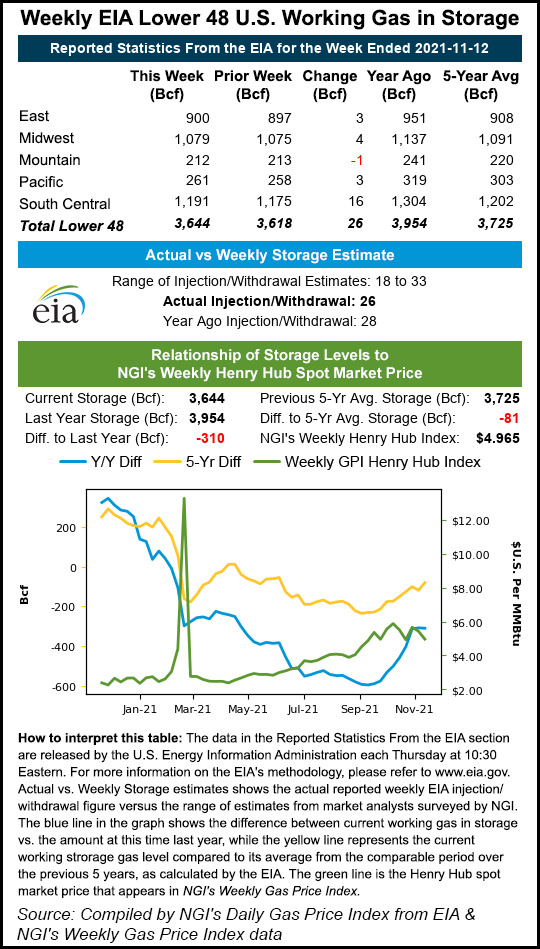

The U.S. Energy Information Administration (EIA) on Thursday reported an injection of 26 Bcf natural gas into storage for the week ended Nov. 12. Working gas in storage totaled 3,644 Bcf.

The result was in line with expectations, though bountiful by historic standards.

Major surveys ahead of the print settled around a build of 25 Bcf. NGI’s model predicted a 23 Bcf build.

The five-year average for the week, however, was a withdrawal of 12 Bcf, according to EIA. The stout build did give traders pause, and futures pulled off of their double-digit intraday highs after the print.

NatGasWeather noted that it “was warmer than normal over almost the entire U.S. besides portions of the West and Gulf coasts.” That in turn created mild conditions and modest demand, enabling utilities to store more gas for winter.

Still, stocks were 310 Bcf lighter than a year earlier and 81 Bcf below the five-year average of 3,725 Bcf.

Looking ahead, most analysts on The Desk’s online energy platform Enelyst expected the market to shift into withdrawal mode with next week’s storage report. Chilly temperatures and snow barraged parts of the Mountain West early this week before moving into the Midwest. Forecasts called for the weather system to push toward the Northeast late this week.

Wood Mackenzie analyst Eric Fell estimated that, assuming normal weather over the remainder of this month, total withdrawals for November would hover around 100 Bcf. He cautioned on Enelyst, however, that forecasts have been erratic this week and “where we are heading depends mostly on the weather.”

It is “the magical time of year when the gas market becomes a game of weather model roulette,” Fell said.

For the latest injection, the South Central build of 16 Bcf led all regions and included a 10 Bcf injection into nonsalt facilities and an increase of 7 Bcf into salts. EIA noted totals may not equal the sum of components because of independent rounding.

The Midwest followed with a build of 4 Bcf, according to EIA. The Pacific and East regions each posted injections of 3 Bcf. Mountain stocks decreased by 1 Bcf.

Physical Prices Ascend

Cash prices climbed higher Thursday as hubs in Appalachia and the Northeast posted solid gains.

A chilly weather system tracked across the Midwest Thursday, delivering rain, snow and freezing temperatures, NatGasWeather said.

While most of the rest of the Lower 48 enjoyed mild temperatures and dry conditions, minimizing heating needs, the Midwest system was expected to “race across” the East on Friday, bolstering national demand to close out the trading week, the firm said.

In Appalachia, Eastern Gas North jumped 27.5 cents to $4.600, while Columbia Gas rose 21.0 cents to $ 4.650 and Millennium East Pool gained 29.0 cents to $4.585.

Prices also advanced throughout the Northeast region, with Algonquin Citygate up 48.0 cents to $5.035 and PNGTS ahead 21.0 cents to $5.330.

Benign conditions were expected for much of the country over the weekend, NatGasWeather said. However, early next week a winter-like weather system is expected to drift over the northern United States “for a swing back to stronger demand,” the firm said.

Further out, the forecaster added, snow and chilly highs of 30s-40s are expected in northern areas in the final days of November and early December. The western and southern United States, however, were expected to see comfortable highs from the 50s to the 70s.

"gas" - Google News

November 19, 2021 at 05:04AM

https://ift.tt/3HBocTp

December Natural Gas Futures Find New Footing Amid Export Demand Strength - Natural Gas Intelligence

"gas" - Google News

https://ift.tt/2LxAFvS

https://ift.tt/3fcD5NP

Bagikan Berita Ini

0 Response to "December Natural Gas Futures Find New Footing Amid Export Demand Strength - Natural Gas Intelligence"

Post a Comment