- First, the good news: despite a lot of nerve-racking volatility, the price of crude oil is expected to go on a downward trend, reversing the record levels we've seen so far this year.

- The bad news: That isn't likely before 2023, and anything can happen between now and then.

- Don't blame gas station owners or the president. They have less control over the situation than we'd like to think. It's a complex global landscape out there.

You may have felt a slight tingle if you visited a gas station after July 4. Whatever libations you may have consumed during the fireworks or the tinnitus that came after is not our concern. It's gas prices: They went down for the first week in months. But are they on a downward trend that will get us back to pre-pandemic levels? The answer is no, not this year.

Republicans blame Joe Biden, Democrats blame Big Oil, the Greens would like us to convert to bicycles, and in northern Connecticut, Ralph Nader is laughing at everyone. What's happening with record-high gas prices is simple and yet so complex that not one single actor deserves all the blame. Let's dive into the crude world of gasoline.

A Non-Political Explanation of Crude Oil Prices

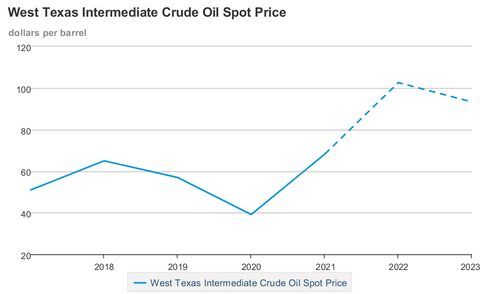

In North America, we track oil prices using West Texas Intermediate (WTI), a crude blend sourced primarily from Texas that serves as one of several global benchmarks for oil futures, or the contracts that buyers agree to pay oil producers for a barrel of crude at a specified future date. The WTI price you see quoted in the news is what's called a "front month," which refers to the futures contracts that expire closest to the current date. At present, WTI closely mirrors Brent crude, which makes up the majority of European and global oil futures.

WTI prices for a barrel of crude dipped below $100 this week for the first time since May 10, according to the Wall Street Journal's price chart. Oil began trading above $100 in the week after the Russian invasion of Ukraine began in late February, when investors worried that Russia's lucrative oil reserves could be upset with potential economic sanctions. But oil prices were already rising before the war, in sync with the general uptick of the global economy since the 2020 shutdown when WTI briefly traded negative and barely rose above $40. With resurgent demand and economic activity in 2021, WTI rose into the $60s, $70s, and low $80s. It climbed again during the first quarter of 2022 and reached into the high $80s and low $90s during the weeks and days before the invasion. Crude is a huge portion of every gallon of retail gasoline—nearly 60 percent, according to the Energy Information Administration.

Retail gas prices and crude prices go hand in hand, as everyone has watched since a gallon of regular-grade gas sank to a low of $1.77 in April 2020 and then rose to $2.85 by the end of March 2021, according to EIA records. Average prices rose past $3 last July, mirroring the rise in crude, and matched the crude spike in early March 2022 when prices soared past $4—and never went back. Gas reached a record $5 on June 13, only to trickle down to $4.77 on July 4, according to the EIA. The last time gas was this expensive (when it was $4 during July 2008), crude prices had peaked just as high as they have this year.

Crude oil has been especially volatile for the past four months. WTI prices shot past $120 early in the Russian invasion and after European sanctions blocking all Russian oil took effect on June 1. In this same time span, crude fell to the mid-$100s only to rise days or weeks later. Final closing prices on July 5 and July 6 dipped below $100, yes, but this happened at least nine times since the first spike in March. The war, record-high inflation, surging interest rates, the worry over slumping global demand from the high shipping costs that high oil prices cause and trickle into equally high consumer prices—it has been another unpredictable year, to put it lightly.

This past week, the Biden administration floated the idea of a cap on Russian oil prices, which make up close to 10 percent of the global supply. The New York Times called it a "novel and untested effort to force Russia to sell its oil to the world at a steep discount" that could "starve Moscow's oil-rich war machine of funding and . . . relieve pressure on energy consumers." It's too soon to know whether other countries will agree to such a plan.

Meanwhile, its latest forecast, the EIA predicts WTI prices will remain around $102 and then dip to $93 sometime in 2023. Futures contracts seem to agree, with contracts expiring as far out as April 2023 trading in the mid-$80s, according to Barron's. But literally anything can happen between now and then to shift that trajectory.

The Added Costs of Federal Regulations

There's competition for crude. While gasoline and diesel are the main product that comes out of U.S. refineries, the same barrel of crude goes to making kerosene, jet fuel, heating oil, asphalt, solvents, and other petroleum products like waxes and lubricants. There is product overlap among the various companies that sell these products, and yet they are all diverse industries with differing demands.

Beyond the huge conglomerates that still have to import foreign oil to meet demand across the entire country, factor in the 9000 smaller oil producers in the U.S., which operate in very different markets with varying state regulatory mandates. Now consider how the Environmental Protection Agency regulates smog by requiring at least 14 summer gasoline blends tailored to specific regions (which many, consequently, have to switch to winter blends).

Then there's the Renewable Fuel Standard Program, which requires more ethanol and biodiesel blends than the industry can feasibly produce. The industry publication Fuels Market News noted that the 2022 targets "were deliberately set at a high level to facilitate investments in E15 and E85 infrastructure." These targets have contributed to high ethanol credit prices that refiners must buy to stay in compliance (similar to California's zero-emissions credits). Ultra-low-sulfur diesel is costlier than the soot-burning diesel of years past, and it's not getting cheaper. Producing premium and mid-grade gasoline requires special additives that are costly to make, too—higher octane doesn’t come cheap. None of these costs are insignificant, and they're all reflected at the pump.

Shocker: President Can't Command Oil Industry to Lower Prices

Over the July 4 weekend, President Biden tweeted this: "My message to the companies running gas stations and setting prices at the pump is simple: this is a time of war and global peril. Bring down the price you are charging at the pump to reflect the cost you're paying for the product. And do it now."

This content is imported from Twitter. You may be able to find the same content in another format, or you may be able to find more information, at their web site.

He's right to some degree, as margins between the price of Brent crude and the wholesale price of gasoline—the price gas stations pay before adding their costs, profit, and state taxes—have reached record highs at gasoline stations. The EIA reports that those margins were $1.17 per gallon in May. But even with diesel hitting $6 in many places, are gas stations really out to destroy America? The Association for Convenience and Fuel Retailing, an industry lobby, reports that individual gas stations—more than half of which are run by independent owners that franchise with large brands—typically make only 10 cents a gallon after all costs and fees. Believe that or not, but most gas station owners make more money from in-store sales than pump sales. We all know how far we're willing to drive for even a five-cent drop in prices.

As we've described, oil companies and gas stations play on a national and global market and can't control what independent U.S. oil producers do or what Middle Eastern countries in OPEC choose to do. OPEC has agreed to increase oil production and President Biden has been begging Venezuela and Saudi Arabia to increase production—both of which would not reduce gas prices any more than his canceling of the Canadian Keystone XL pipeline would raise them. As the New York Times reported, Keystone XL was only 8 percent complete and was a planned extension to an already hefty pipeline. Neither situation would be a game changer at the pump.

Biden has demanded that oil companies increase production, but they physically can't. While the shale boom has more than doubled domestic oil and gas production since 2008, the nation's 125 refineries are operating at or near max capacity just as they were before the pandemic. As of January 1, the U.S. was refining 17.8 million petroleum barrels a day—again, for all petroleum products, not just gasoline and diesel—compared to the 18.5 million barrels as of January 1, 2020. Crude production from U.S. oil fields is down from its 2019 peak, but at 11.6 million barrels per day as of April, the oil industry is sucking more dino juice out of the ground than ever—it's more than double the amount they barreled in 2008.

Biden also said that there are 9000 approved permits for oil producers who he claimed "could be drilling right now, yesterday, last week, last year," except the Poynter Institute says it's standard practice to have thousands of unused permits in any presidency and that it's economically unviable to rush on a permitted land. Drilling—a huge investment with huge potential losses—takes a lot of careful measurements. It's not a stick-it-in-the-ground operation by any means.

Biden has proposed a federal gas tax holiday, but longer relief would be felt if the EPA could relax the Renewable Fuel Standard Program and temporarily suspend the regional requirements to formulate summer gasoline. Even so, the oil market goes beyond what Congress or a president can attempt to influence. Right now, we're just stuck with high prices.

This content is created and maintained by a third party, and imported onto this page to help users provide their email addresses. You may be able to find more information about this and similar content at piano.io

"gas" - Google News

July 10, 2022 at 09:13PM

https://ift.tt/XbhQ7rs

When Will Gas Prices Come Down to Earth? You May Not Like the Answer - Car and Driver

"gas" - Google News

https://ift.tt/P4Omp1q

https://ift.tt/pwr9l7t

Bagikan Berita Ini

0 Response to "When Will Gas Prices Come Down to Earth? You May Not Like the Answer - Car and Driver"

Post a Comment