Liberty Energy Inc. CEO Chris Wright said threats to the global economy – from inflation and soaring interest rates in the United States and Europe to pandemic-related lockdowns in China – are real and could impact demand for natural gas and oil.

However, for exploration and production (E&P) companies and the completion experts such as Denver-based Liberty that work with them, a tight global market for both oil and natural gas likely means volatile but favorable prices and motivation to maintain strong output and meet increasing energy needs across the globe – through this year and the foreseeable future.

“As we look ahead, risks to the delicate balance in oil and gas markets come from both demand and supply,” Wright told analysts after posting third-quarter earnings on Oct. 18. The CEO issued written commentary and helmed an earnings conference call. “A mild recession likely only modestly impacts the global demand for energy and may already be reflected in prices. A deeper global economic downturn would result in increased demand destruction, further pressuring commodity prices. On the other hand, global supply risks are even larger.”

E&Ps have responded to the latter this year. Oil production reached pandemic-era highs over the summer and natural gas output in the Lower 48 hit a record level earlier this month.

Liberty moved with them. The oilfield services giant aggressively pursued acquisitions in 2021 to expand its offerings. The centerpiece: Schlumberger Ltd.’s OneStim, the massive U.S. and Canada onshore completions business.

Confident in demand for its services, Liberty this year deployed six additional fleets of equipment acquired from OneStim.

Now, a pullback in oil production by OPEC-plus, the cartel led by Saudi Arabia and Russia, could galvanize further U.S. output efforts, Wright said. Citing recessionary fears, OPEC-plus this month said it would cut production by up to 2 million b/d beginning in November.

Pending European Union (EU) sanctions on Russia’s seaborne crude exports in protest of the Kremlin’s war in Ukraine could further hinder global supplies, Wright noted.

“Together, these factors are likely to strengthen the demand for secure North American energy. Today’s commodity prices continue to offer strong returns for E&P operators, even after the decline in oil and gas prices in recent months,” Wright said.

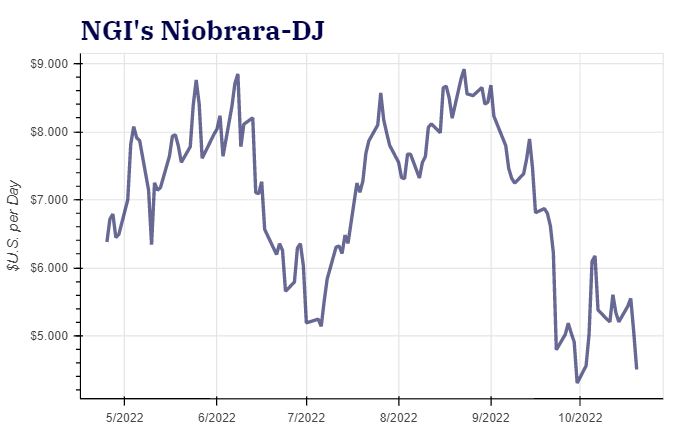

Natural gas futures hovered near 14-year highs around $9.00/MMBtu over the summer before declining below $6.00 amid autumn weather. Futures remain up about 40% from the start of 2022. West Texas Intermediate (WTI) crude surged to $120/bbl in June, up more than 50% from the beginning of the year but has since retreated back to around $85. WTI is still up more than 10% on the year.

The combination of capital discipline among the public operators and tight supply chains, particularly in the frac services market, are constraining activity levels and could make it difficult for producers to ramp up substantially in the near term, Wright said. But the strong 2022 levels through the third quarter are likely to be maintained in the current quarter and into 2023.

“As we close out the year, we expect fourth quarter results to be relatively flat compared to the third quarter, as incremental activity from third quarter fleet deployments is offset by normal holiday and weather seasonality,” Wright said.

“The North American market is healthy across the energy value stream, including E&Ps, service companies, midstream and downstream providers. This environment is strengthening balance sheets, beginning to restore investor confidence and keeping global energy consumer eyes focused on North America, the largest and most reliable hydrocarbon supplier,” Wright added. “We believe this cycle has strength and duration, and we look forward to the opportunities ahead of us as our industry continues to better lives across the world.”

Liberty’s net income was $147 million (78 cents/share) in 3Q2022, compared with $39 million a year-earlier (22 cents). Revenue climbed 82% year/year and to $1.2 billion.

"gas" - Google News

October 22, 2022 at 12:40AM

https://ift.tt/oIzyQFw

Liberty Energy CEO Says Global Natural Gas, Oil Supply Risks Outweigh Recession Threats - Natural Gas Intelligence

"gas" - Google News

https://ift.tt/lFXaTZB

https://ift.tt/7CXn4uH

Bagikan Berita Ini

0 Response to "Liberty Energy CEO Says Global Natural Gas, Oil Supply Risks Outweigh Recession Threats - Natural Gas Intelligence"

Post a Comment