Summer wasn’t ready to loosen its grip on U.S. natural gas cash markets this week, with heat and humidity in the wake of Hurricane Isaias driving up demand on the East Coast early in the week and 100-degree temperatures driving power loads in California. NGI’s Weekly Spot Gas National Avg. jumped 20.0 cents to $2.050.

With highs in the upper 80s and 90s across the East to start the week, spot gas prices throughout the region rallied. Sharp increases of more than 50 cents were seen at Texas Eastern M-3, Delivery and at Transco Zone 6 NY, but prices ultimately plunged as temperatures eased. Overall, the majority of Northeast hubs averaged less than 15.0 cents higher week/week and closed out the week below $2.00.

California posted more meaningful gains as the heat showed no signs of abating. SoCal Citygate jumped 1.735 week/week to average $3.835, though cash had soared as high as $7.600. Rockies hubs also posted notable increases, with Opal climbing 30.5 cents on the week to a $2.100 average.

The bump in downstream demand and conclusion of some pipeline maintenance events led prices higher in the Permian Basin as well. Waha shot up 40.5 cents week/week to average $1.420.

Increases were prevalent across the rest of the country, but gains were limited to around 20 cents or so at the majority of pricing hubs.

Spikes Keep Coming

Fresh off a steep climb during the first week of August, natural gas futures experienced more volatility for the better of the Aug. 10-14 period, particularly at the end of the week when algorithmic trading may have had a hand in erratic price behavior.

With mixed messages on the weather front, other fundamentals factored heavily on this week’s market action. Lower production weighed on the market early in the week, while a sustained rise in liquefied natural gas (LNG) feed gas volumes also captured the market’s attention. As always, Thursday’s government storage data also factored into the week’s gyrations, especially given the quick pace at which storage inventories have filled thus far in the injection season, which still has more than two months remaining.

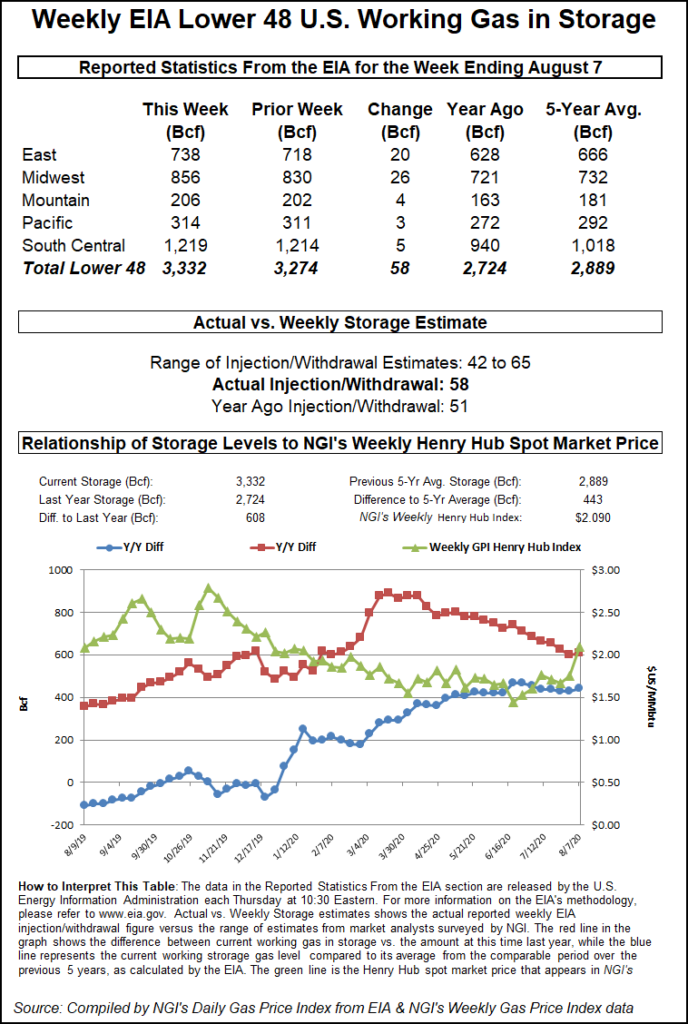

The Energy Information Administration (EIA) said that Lower 48 stocks for the week ending Aug. 7 grew by 58 Bcf, which was on the high end of wide-ranging expectations and a few Bcf above consensus. Last year, the EIA recorded a 51 Bcf injection for the similar week, while the five-year average stands at 44 Bcf.

Broken down by region, the Midwest added 26 Bcf into inventories, and the East added 20 Bcf, according to EIA. Mountain and Pacific stocks each grew by less than 5 Bcf, while the South Central region reported a net injection of 5 Bcf, which included a 1 Bcf build into salt facilities and a 5 Bcf build in nonsalts.

Total working gas in storage as of Aug. 7 stood at 3,332 Bcf, which is 608 Bcf higher than last year at this time and 443 Bcf above the five-year average of 2,889 Bcf, EIA said.

Analysts see regional balances coming to the forefront in the coming weeks, with Tudor, Pickering, Holt & Co. (TPH) pointing out that the “South Central and Midwest are on the wrong side of the five-year range, and the East is knocking on the door.” Five-year average build profiles would push the Midwest through capacity, according to TPH, with the East reaching 99% and South Central 97%.

“To make matters worse, we’re modeling above-normal injections the rest of the way, in part due to reduced power burn as gas prices are pulling coal back into the stack,” said analysts.

Het Shah, managing director of The Desk’s Enelyst online chat, questioned whether the market would be “hitting storage ratchets” in late September given that East and Midwest inventories were sitting at their highs. “If so, we could see cash in those markets fall apart.”

However, EBW Analytics Group said the tides could turn before August draws to a close, as the storage surplus is projected to begin declining rapidly, potentially falling 200 Bcf (2.9 Bcf/d) through the end of the injection season. “While the gas market has evolved greatly over the past five years, the barometer of a shrinking storage surplus, at the same time production likely turns lower and LNG rises into the early heating season, may create conditions that let Nymex natural gas futures to move higher this fall.”

Nevertheless, weather may regain control of the market, and with milder weather expected in the coming week, and production expected to rebound once pipeline maintenance events conclude, “downward price pressure could resume soon.”

“Soon” may be as early as the coming week, especially after Friday’s unexplainable surge in the face of cooling forecasts, higher production and weaker LNG demand. Both the September and October Nymex contracts shot up about 17 cents in a move that most analysts said was tied to computer trading.

“We did not have this on our radar this morning, actually feeling there was more risk of bleeding a little lower,” Bespoke Weather Services after the market close Friday.

For the Aug. 10-14 week, the September contract climbed around 20 cents to close out the week at $2.356. October was up about 21 cents to $2.495.

Strong Cash

It may be starting to cool off on the East Coast, but it’s still summer in Texas and California, where triple-digit temperatures drove more gains for cash markets on Friday.

Katy hub prices were up 12.5 cents for gas delivered through Monday to $2.300, and NGPL S. Texas was up 14.0 cents to $2.220.

California experienced another day of wild gains, with prices at SoCal Citygate jumping $2.190 to average $6.655 for the three-day period. PG&E Citygate climbed 35.0 cents to $3.305, while in the Rockies, Northwest Sumas shot up 26.0 cents to $2.380.

Spot gas prices also were strong in Louisiana, where benchmark Henry Hub posted one of the smallest gains in the region as it tacked on 9.0 cents to hit $2.210.

Appalachia prices were mixed but mostly shifted within a nickel of Thursday’s levels, while farther east, Algonquin Citygate cash plunged 21.5 cents to $1.270.

"gas" - Google News

August 15, 2020 at 06:14AM

https://ift.tt/3433gDs

California Leads Weekly Natural Gas Prices Higher as Heat Drives Up Demand - Natural Gas Intelligence

"gas" - Google News

https://ift.tt/2LxAFvS

https://ift.tt/3fcD5NP

Bagikan Berita Ini

0 Response to "California Leads Weekly Natural Gas Prices Higher as Heat Drives Up Demand - Natural Gas Intelligence"

Post a Comment