During what may be one of the last blasts of cold before the end of the year, a chilly weather system that descended far south into Texas sent weekly spot gas prices soaring higher to start December. Large gains were seen across much of the country, boosting NGI’s Weekly Spot Gas National Avg. up 33.0 cents to $2.655.

Some of the biggest movers were on the West Coast, where system-wide demand on the Southern California Gas system has been above 2.7 Bcf/d for more than a week straight, according to Genscape Inc. The plunging temperatures prompted a “relatively steady” pull on storage, with net withdrawals averaging around 170 MMcf/d during that time. Aliso Canyon was used for minor withdrawals for the first several days in December, totaling only about 125 MMcf withdrawn.

SoCal Citygate cash prices averaged $3.635 for Nov. 30-Dec. 4 period, up $1.00 week/week.

Looking ahead, Genscape meteorologists were forecasting warmer weather in the coming days before another cold snap is expected to start around Thursday. This blast of cold air could drop temperatures even lower than the recent marks, Genscape said.

Meanwhile, California continued to grapple with wildfires, with utilities in both the northern and southern parts of the state implementing public safety power shut-offs over the past week.

Over in the Rockies, Northwest S. of Green River cash jumped 33.5 cents on the week to average $2.545.

Similar gains extended farther upstream into the Permian Basin, where El Paso Permian climbed 39.0 cents to $2.505. Smaller gains were seen in the Midcontinent producing region, while farther east in Appalachia, Dominion South launched 52.0 cents higher week/week to average $1.915.

The solid gains on the East Coast occurred as an early-week cold weather system hit the region. Although the blast was quick-moving, the gains mounted early in the week were further supported by a second blast of frigid air set to hit the region over the weekend. Algonquin Citygate tacked on 35.5 cents to average $2.555. Larger gains were seen in New York, where Transco Zone 6 NY rocketed some 63.5 cents higher to $2.415.

A Bloody Mess

Natural gas futures trading was “a complete disaster” for bulls coming back from the Thanksgiving holiday. After netting a small gain to start the week, an increasingly warm December outlook sent speculative traders stampeding toward the exit in a move that left the historically premium January Nymex futures contract looking more like a summer contract.

The first big move of the Nov. 30-Dec. 4 period occurred on Wednesday, after weather models started hinting that the mid-December they had been projecting may not happen after all. The January contract settled 10.0 cents lower that day at $2.780. Before the first cup of coffee was brewed Thursday morning, the prompt month was down another 20 cents-plus.

“It’s hard to imagine how the start of winter could be any worse for gas bulls,” said The Schork Report.

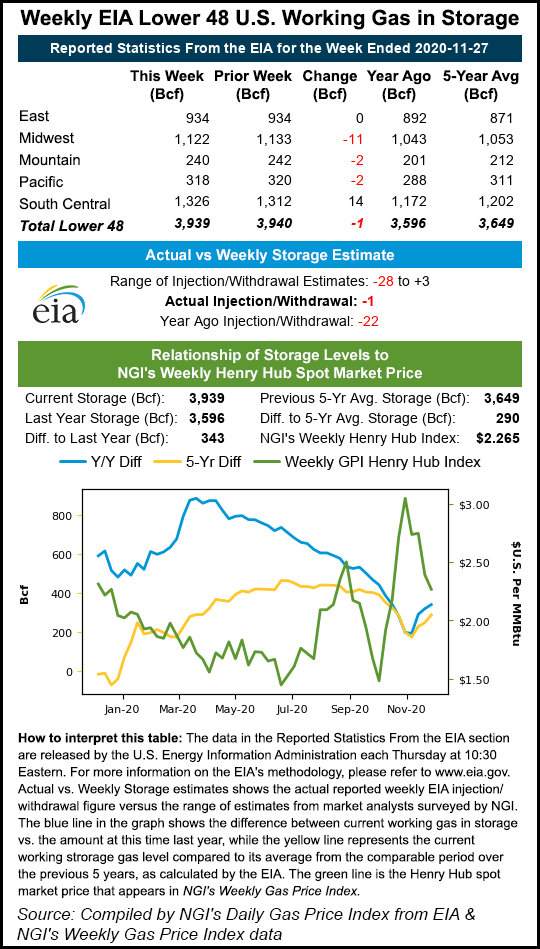

Analysts pointed out that after a “gargantuan” withdrawal from storage inventories in the final full week of October, the market went on to inject a net 20 Bcf over the last four weeks. Thursday’s government storage data failed to provide any sort of optimism for bulls to hang their hat on. Estimates ahead of the Energy Information Administration’s (EIA) weekly inventory report coalesced around a draw in the mid- to high teens Bcf. Instead, the EIA said a “mind-numbingly” meager 1 Bcf was pulled from stocks.

“Given last week’s mild temperatures in the northern latitudes, plus the Thanksgiving Day holiday, a subpar delivery was expected, albeit not as small as 1 Bcf,” said The Schork Group analysts. “In light of Thursday’s report, we venture there is a 60% probability of finishing this season above the five-year average of 1.694 Tcf.”

Broken down by region, the Midwest reported an 11 Bcf withdrawal from storage, while the Mountain and Pacific regions each notched a 2 Bcf decline in inventories, according to EIA. The East reported no change in stocks, and the South Central added a whopping 14 Bcf. This included 12 Bcf into salt facilities and 2 Bcf into nonsalts.

Total working gas in storage as of Nov. 27 stood at 3,939 Bcf, which is 343 Bcf higher than year-ago levels and 290 Bcf above the five-year average, EIA said.

Not unexpectedly, futures managed to end the week on the positive side of the ledger. However, gains were rather moderate since the latest weather data did nothing to renew hopes of any cold in the coming couple of weeks.

Bespoke Weather Services said every model cycle is pointing to what would likely be “a warm to very warm” signal for the United States as a whole, focused in the eastern two-thirds of the country. The forecaster also noted that projected demand is moving further away from the five-year and 10-year normal now, with the 15-day forecast more than 20 gas-weighted degree days warmer than the five-year norm.

That said, supply/demand balances appear to be tightening week/week, with continued strong liquefied natural gas demand and solid power burns. “This gives some hope for a snapback higher after such a steep sell-off,” Bespoke said.

The January Nymex contract closed the week at $2.575, off about 31 cents from where it settled on Monday. February stood at $2.586.

Northeast Blizzard

With all the talk of how warm December is expected to be, spot gas traders did not overlook the blast of cold set to pound the Northeast. Prices for gas delivery through Monday shot up nearly $1.00 at some pricing locations in New England, which was expected to bear the brunt of the wintry conditions.

AccuWeather said the storm that brought heavy snow to parts of the southern Plains in recent days was forecast to re-energize along the Eastern Seaboard and take a track off the Northeast coast through Saturday night, putting central and northern New England in the path of the heaviest snow.

A storm track offshore would allow it to undergo significant strengthening, which could add to the intensity of impacts across New England, according to the forecaster. The same anticipated scenario could allow the mid-Atlantic and central Appalachians to dodge much, but not all, of the storm’s effects.

“Boston will be on the edge of the heavy snow with one-to-three inches forecast in the heart of the downtown area as some rain will fall for a time, but a three-to-six-inch snowfall is expected to start around Route 128 with accumulations trending upward farther to the north and west,” said AccuWeather senior meteorologist John Feerick.

A small amount of accumulating snow also was forecast over parts of northwestern New Jersey, the Hudson Valley of New York and in the mountains of West Virginia, western Maryland, northern and western Pennsylvania, as well as parts of western and central New York, according to AccuWeather. However, the storm was expected to quickly dissipate, setting the stage for a rather quick warm-up by the middle of the week.

Nevertheless, Algonquin Citygate cash prices shot up 93.0 cents to average $3.080 for gas delivered through Monday, while Tennessee Zone 6 200L jumped 98.5 cents to $3.405. Transco Zone 6 NY was up 70.0 cents to $2.560.

Smaller increases were seen farther upstream in Appalachia. Dominion South rose 14.0 cents to $1.925. Gains in the Southeast were generally limited to around a dime, similar to the price action across Louisiana, the Midcontinent and the Midwest.

Spot gas prices in Texas moved slightly lower on Friday, with Waha falling 8.0 cents to $2.245 for the three-day gas delivery. Kinder Morgan Inc. told NGI Friday that the Permian Highway Pipeline was mechanically complete on Nov. 1 and is now fully operational. The 2.1 Bcf/d pipeline’s full in-service is expected in the first quarter of 2021.

California prices also tumbled as more moderate weather was expected to move into the region after the recent cold blast that fueled some storage withdrawals in the region. SoCal Border Avg. cash plunged 66.5 cents to $3.255.

"gas" - Google News

December 05, 2020 at 07:47AM

https://ift.tt/39Jbe7v

Early December Cold Blasts Spark Big Rally for Weekly Natural Gas Prices - Natural Gas Intelligence

"gas" - Google News

https://ift.tt/2LxAFvS

https://ift.tt/3fcD5NP

Bagikan Berita Ini

0 Response to "Early December Cold Blasts Spark Big Rally for Weekly Natural Gas Prices - Natural Gas Intelligence"

Post a Comment