After Thursday’s bloodbath, natural gas futures rebounded a bit on Friday even as weather models continued to add warmth to the December outlook. The January Nymex gas futures contract finished the week at $2.575/MMBtu, up 6.8 cents day/day. February picked up 7.1 cents to reach $2.586.

Spot gas prices were mixed, with the most notable changes occurring in the Northeast ahead of a quick-moving cold blast. NGI’s Spot Gas National Avg. picked up 5.5 cents to $2.530.

Natural gas traders waking up Friday morning may have had their heads still spinning from Thursday’s dizzying tumble in the futures markets. The prompt month was down nearly 20 cents soon after the open in what EBW Analytics Group characterized as “panic-selling” after the latest weather models trended even warmer for December. January went on to settle at $2.507.

Friday’s action was a bit less volatile. After the carnage of the last two days, Bespoke Weather Services said it may become popular to try to determine if it was a “capitulation bottom,” but picking tops and bottoms in any market is “inherently very difficult.” While Thursday’s move was clearly about much more than weather, the moves in the weather pattern were looking “increasingly unfriendly” to bulls yet again, Bespoke said, as the positive Eastern Pacific Oscillation’s return increased the risk for more demand losses to come.

The increasingly mild December forecast doesn’t bode well for plump storage inventories that have struggled to shed some of the weight amassed during the summer. After an early start to the traditional withdrawal season, the market since then has recorded a couple of weeks with little change in stocks and some weeks with injections.

On Thursday, the Energy Information Administration (EIA) reported a meager 1 Bcf draw from inventories for the week ending Nov. 27, which included Thanksgiving. While a small draw was to be expected given the holiday week, the 1 Bcf pull was more than 10 Bcf lower than the consensus draw.

Compared to degree days and normal seasonality, including around 14 Bcf of holiday impact, the reported withdrawal appeared loose versus the prior five-year average by around 0.5 Bcf/d, according to Genscape Inc. Actual weather for the reference week was well below normal for the third week in a row, the firm said, which drove a much smaller withdrawal versus the five-year average.

“The odds of storage deliverability issues this winter have fallen sharply over the last month due to weather, a production rebound and November inventories ending over 3.9 Tcf,” said Genscape senior natural gas analyst Eric Fell. “This has driven a sharp sell-off in winter risk premium (January/March/April spreads) with the January/April spread currently around 10 cents versus 45 cents at the end of October.”

With the winter risk premium close to zero at this point, and (some degree of backwardation likely needed to incentivize 1Q2021 withdrawals assuming anything resembling normal weather), “the market may now be shifting more attention to the summer 21 injection season,” Fell said.

Tudor, Pickering, Holt & Co. analysts agreed that the recent price action, with the January and February contracts now trading below July and August, suggested the market had completely given up on winter weather, despite nearly half the degree days typically occurring in January and February.

“However, if 1Q2021 weather turns out to be extremely weak, akin to the 1Q2017 residential/commercial 35 Bcf/d versus the currently modeled 41 Bcf/d, then we’d expect inventories to exit winter at a bloated 2.5 Tcf,” the TPH team said. “This would likely necessitate a collapse in the summer strip towards $2.25-2.35 to incentivize more gas-fired power generation in order to balance inventories.”

That said, the shape of the forward curve “doesn’t make a lot of sense” to TPH analysts and likely indicates much of the weakness was driven by an unwind of speculative positioning concentrated in the front end of the curve. Barring a further deterioration in weather, analysts stood by their fiscal year 2021 forecast of $2.70, “although it’s hard to believe it’s now a bullish call.”

Goldman Sachs analysts also said despite the massive collapse along the Nymex curve, 2021 fundamentals remained intact. In fact, the price plunge ultimately may incentivize higher demand via higher coal-to-gas substitution.

Goldman analysts maintained a “constructive” view for Calendar Year 2021 Nymex gas prices but given the lower storage stock-out risk for the end of March, they see less upside for 1Q2021 gas prices than previously. “Hence, we lower our 1Q2021 Nymex gas price forecast to $3.25/MMBtu from $3.50 previously, still well above current forwards at $2.51/MMBtu.”

Goldman also is holding its $3.25 summer 2021 forecast intact, as analysts believe higher U.S. gas prices are still required to bring end-October storage to more comfortable levels. Near term, however, the still elevated net long positioning in the market is likely to keep gas prices volatile, “with further downside from current levels possible in the absence of support from cash markets.”

EBW Analytics Group joined the chorus of analysts expressing optimism for 2021. The firm warned that Thursday’s “fierce” sell-off drove the 12-month strip to a level that “can’t be sustained under any realistic scenario.” Its model, which assumes warmer-than-normal weather for the remainder of the winter, indicates that at Thursday’s closing prices, end-of-March storage is likely to be reduced to only 1,200 Bcf.

After that, only 1,175 Bcf would be added during the 2021 injection season, far less than in any injection season over the past 20 years, according to the firm. This would bring mid-November storage to 2,275 Bcf, 1.5 Tcf below minimally acceptable levels.

“During the following winter, storage would fall to less than zero, creating major risks to public safety,” said EBW. “The market will never tolerate this. Instead, over the course of the next 12 months, steep price increases will be required. The longer prices remain near current levels, the steeper these increases will be.”

Northeast Blizzard

With all the talk of how warm December is expected to be, spot gas traders did not overlook the blast of cold set to pound the Northeast. Prices for gas delivery through Monday shot up nearly $1.00 at some pricing locations in New England, which was expected to bear the brunt of the wintry conditions.

AccuWeather said the storm that brought heavy snow to parts of the southern Plains in recent days was forecast to re-energize along the Eastern Seaboard and take a track off the Northeast coast through Saturday night, putting central and northern New England in the path of the heaviest snow.

A storm track offshore would allow it to undergo significant strengthening, which could add to the intensity of impacts across New England, according to the forecaster. The same anticipated scenario could allow the mid-Atlantic and central Appalachians to dodge much, but not all, of the storm’s effects.

“Boston will be on the edge of the heavy snow with one-to-three inches forecast in the heart of the downtown area as some rain will fall for a time, but a three-to-six-inch snowfall is expected to start around Route 128 with accumulations trending upward farther to the north and west,” said AccuWeather senior meteorologist John Feerick.

A small amount of accumulating snow also was forecast over parts of northwestern New Jersey, the Hudson Valley of New York and in the mountains of West Virginia, western Maryland, northern and western Pennsylvania, as well as parts of western and central New York, according to AccuWeather. However, the storm was expected to quickly dissipate, setting the stage for a rather quick warm-up by the middle of the week.

Nevertheless, Algonquin Citygate cash prices shot up 93.0 cents to average $3.080, while Tennessee Zone 6 200L jumped 98.5 cents to $3.405. Transco Zone 6 NY was up 70.0 cents to $2.560.

Smaller increases were seen farther upstream in Appalachia. Dominion South rose 14.0 cents to $1.925. Gains in the Southeast were generally limited to around a dime, similar to the price action across Louisiana, the Midcontinent and the Midwest.

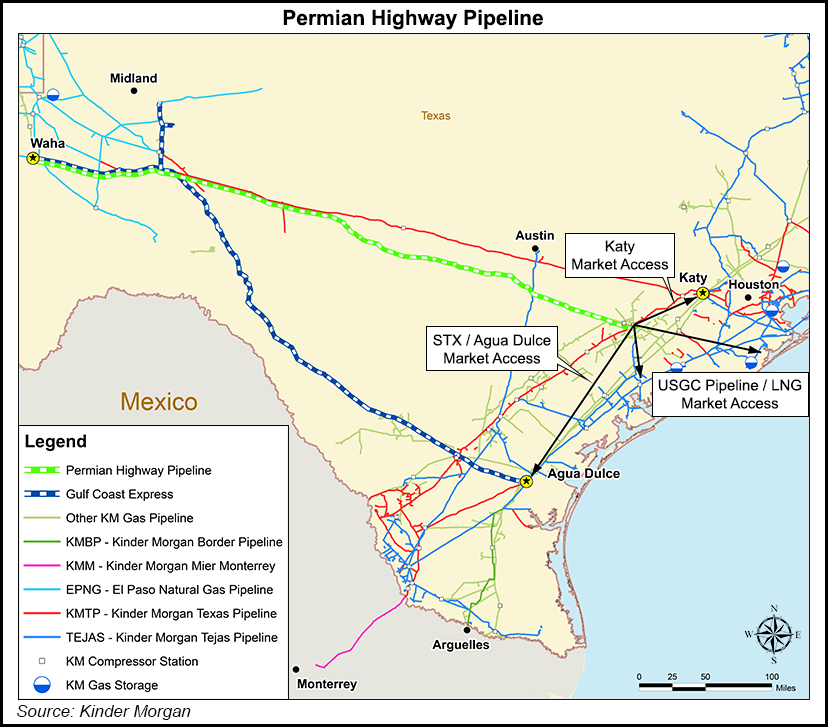

Spot gas prices in Texas moved slightly lower on Friday, with Waha falling 8.0 cents to $2.245. Kinder Morgan Inc. told NGI Friday that the Permian Highway Pipeline was mechanically complete on Nov. 1 and is now fully operational. The 2.1 Bcf/d pipeline’s full in-service is expected in the first quarter of 2021.California prices also tumbled as more moderate weather was expected to move into the region after the recent cold blast that fueled some storage withdrawals in the region. SoCal Border Avg. cash plunged 66.5 cents to $3.255.

"gas" - Google News

December 05, 2020 at 06:28AM

https://ift.tt/3ore3OQ

Natural Gas Futures Regain Pulse Following Massacre, but Weather Looks 'Increasingly Unfriendly' - Natural Gas Intelligence

"gas" - Google News

https://ift.tt/2LxAFvS

https://ift.tt/3fcD5NP

Bagikan Berita Ini

0 Response to "Natural Gas Futures Regain Pulse Following Massacre, but Weather Looks 'Increasingly Unfriendly' - Natural Gas Intelligence"

Post a Comment