By Anthony Di Paola on 6/20/2021

(Bloomberg) - Iran will continue talks aimed at reviving a nuclear deal during its transition to a new government, yet the election of a conservative cleric as president lowers traders’ expectations of a quick return to the world oil market, said Sara Vakhshouri, president of SVB Energy International LLC.

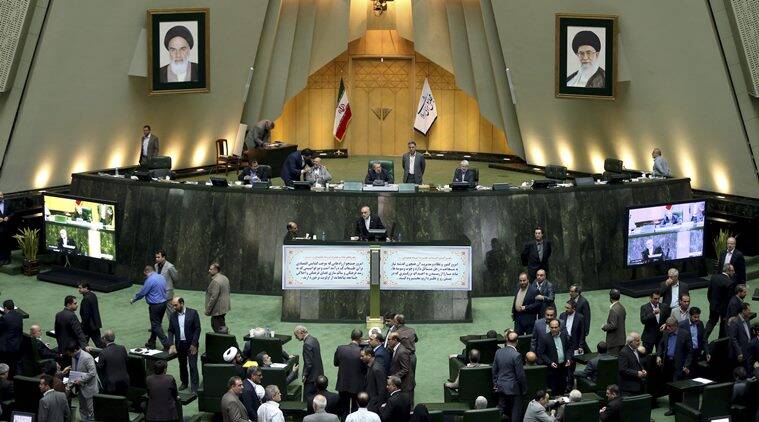

Voters picked Ebrahim Raisi, seen as the more hardline candidate, to become Iran’s next president in Friday’s election. He’ll take office in August, replacing Hassan Rouhani, whose administration reached the multilateral nuclear deal in 2015.

Related story: Iran’s new, hardline leader Raisi may complicate U.S. sanctions deal

That agreement eased sanctions on Iran’s economy and allowed for greater oil sales in return for limits on the country’s nuclear program until President Donald Trump pulled the U.S. out of the accord in 2018.

Oil prices surged to more than $70 a barrel this month on an improved demand outlook for the second half and the perception that more Iranian barrels won’t be coming back until the latter part of the year, Vakhshouri said at the daily energy forum hosted by the Dubai-based consultancy Gulf Intelligence.

Rising demand and continued production restraints by OPEC+ and U.S. shale producers means that markets will be short by as much as 1.5 million barrels a day by the end of the year, she said.

“Having Iranian oil back in the market will be absorbed by demand if it moves to the second half or last quarter of 2021,” Vakhshouri said of the potential timing for increased crude exports from the Islamic Republic. “The election of a hard-liner delays the expectation of a rapid return of Iranian oil to the market,” which could have happened more quickly if a broader nuclear deal lifted or suspended more sanctions, she said.

Oil prices came under pressure earlier this year from concerns that a quick revival of the nuclear deal could bring Iranian barrels flooding back to the market. With talks dragging on, and Iran’s sales still limited, traders are buying oil out of storage to meet demand, reducing stockpiles and supporting prices.

The Organization of Petroleum Exporting Countries, which includes Iran, and partners such as Russia have cut output to make up for a drop in demand due to the coronavirus pandemic. Oil use is recovering, though, and nearly at pre-pandemic levels. Iran has been exempted from any OPEC+ production cuts since its output is still curtailed by U.S. sanctions.

U.S. and European companies will be less likely to seek longer-term term contracts and work in Iran’s oil industry since uncertainty will likely remain around sanctions. The new Iranian administration will likely favor continued oil sales to China in return for investment, Vakhshouri said.

U.S. sanctions on Iran’s energy sector have cost the country more than $100 billion in lost revenues, Oil Minister Bijan Namdar Zanganeh said in a statement on Sunday, according to the state-run Shana news agency.

"Oil" - Google News

June 20, 2021 at 08:44PM

https://ift.tt/2SF14Pr

Iran's election results will likely slow a return to global oil markets - WorldOil

"Oil" - Google News

https://ift.tt/2SukWkJ

https://ift.tt/3fcD5NP

Bagikan Berita Ini

0 Response to "Iran's election results will likely slow a return to global oil markets - WorldOil"

Post a Comment