(Bloomberg) -- U.S. equity-index futures fluctuated between gains and losses, as crude oil surged above $76 per barrel and investors weighed the potential for a more hawkish tilt at the Federal Reserve and worsening OPEC+ tensions over oil production.

Contracts on the S&P 500 Index were little-changed after the benchmark index notched up another record on Friday. West Texas Intermediate crude rose for the fourth time in five days after the oil-exporters club called off another meeting to discuss United Arab Emirates’ opposition to an extension of output increase. News related to corporate deals buoyed European stocks.

The U.S. jobs report Friday signaled the economy is gaining steam but not at a pace that would prompt the central bank to taper stimulus quickly. Fed watchers awaited June Federal Open Market Committee meeting minutes due Wednesday to gauge how far divisions among members have widened on the tapering time line. U.S. stock and bond markets remain closed for the July 4 Independence Day holiday.

“Today’s public holiday suggests trading will be quiet, although the Fed story will very much re-emerge on Wednesday evening when investors pore through the minutes of the pivotal June 16th FOMC meeting,” ING Groep strategists including Chris Turner wrote in a note. “Before then, we expect much focus on the commodity complex.”

WTI oil continued its inflationary surge above $76 a barrel with the bitter spat between Saudi Arabia and the UAE pushing OPEC+ to abandon its planned meeting and leaving the oil market facing much tighter supplies than had been expected. Brent crude briefly rose above $77 for the first time since 2018.

“As oil prices move higher it should force the hand of UAE to resolve a mutual framework that works for OPEC,” Christyan Malek, head of EMEA oil & gas research at JPMorgan Chase & Co. said in an e-mailed response to questions.

While the jobs report eased concerns about the Fed’s hawkish pivot last month, central banks around the world are beginning to pull back from from the emergency stimulus they deployed to fight the pandemic-driven global recession. For instance, the Reserve Bank of Australia is expected to pare back some stimulus at its Tuesday meeting despite ongoing curbs against a recent Covid-19 flareup.

Meanwhile, a gauge of China’s services industry slowed sharply in June following virus outbreaks in some parts of the country and weaker new orders. The survey shows a deeper downturn in services than the official non-manufacturing gauge released last week.

Shares in British retailer Wm Morrison Supermarkets Plc jumped 12% to the highest price since 2018 as a takeover battle intensified. Investors will watch Didi Global Inc. when U.S. markets reopen after China expanded a cybersecurity probe.

Elsewhere, Bitcoin fell 5.4% to about $33,626, heading for the biggest drop since June 25.

Here are some events to watch this week:

Reserve Bank of Australia policy decision TuesdayFOMC minutes WednesdayThe Group of 20 finance ministers and central bankers meet in Venice on FridayChina PPI and CPI data released on Friday

These are some of the main moves in markets:

Stocks

Futures on the Dow Jones Industrial Average were little-changed as of 1:26 p.m. New York timeThe Stoxx Europe 600 rose 0.3%The MSCI World index rose 0.1%

Currencies

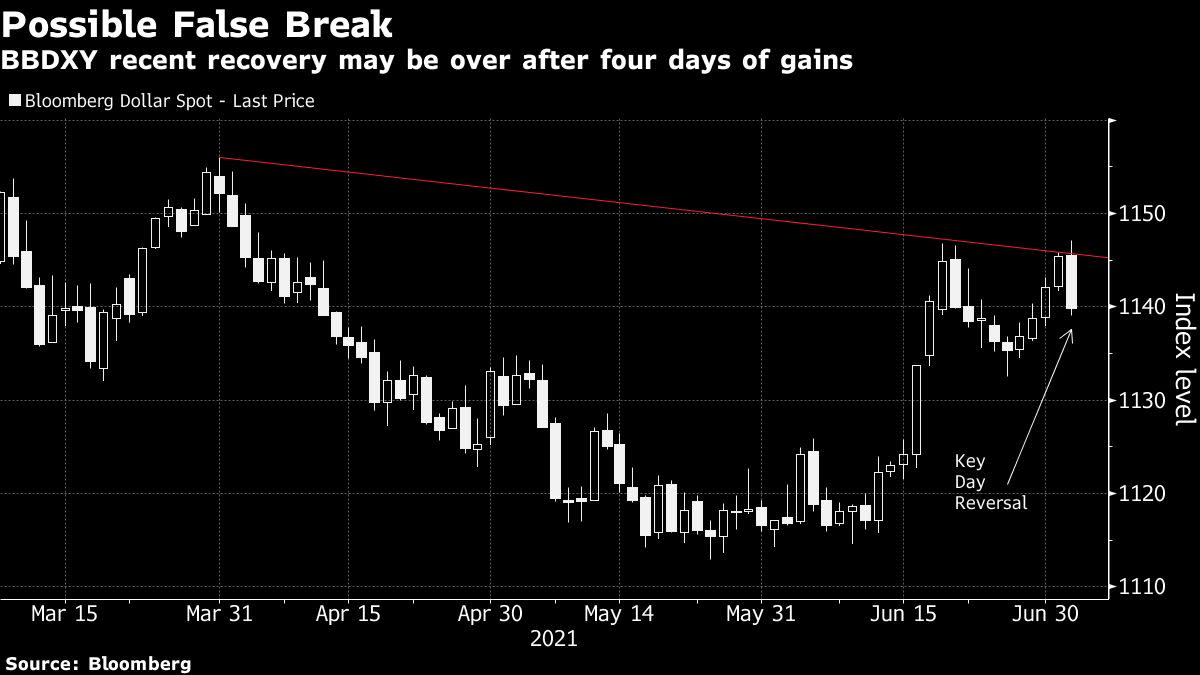

The Bloomberg Dollar Spot Index was little changedThe euro was little changed at $1.1868The British pound rose 0.2% to $1.3853The Japanese yen strengthened 0.1% to 110.9 per dollar

Bonds

Germany’s 10-year yield advanced two basis points to -0.21%Britain’s 10-year yield advanced one basis point to 0.71%

Commodities

West Texas Intermediate crude rose 1.6% to $76.36 a barrelBrent crude climbed 1.1% to $77.00Gold futures rose 0.3% to $1,791.86 an ounce

More stories like this are available on bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.

"Oil" - Google News

July 06, 2021 at 12:31AM

https://ift.tt/3hE6FOj

Oil Jumps as OPEC+ Spat Worsens; U.S. Futures Rise: Markets Wrap - Yahoo Finance

"Oil" - Google News

https://ift.tt/2SukWkJ

https://ift.tt/3fcD5NP

Bagikan Berita Ini

0 Response to "Oil Jumps as OPEC+ Spat Worsens; U.S. Futures Rise: Markets Wrap - Yahoo Finance"

Post a Comment