Natural gas futures continued to retreat sharply midweek in yet another display of the market being largely disengaged from fundamentals. After bouncing back to a $7.410 intraday high, the May Nymex gas futures contract settled Wednesday at $6.937/MMBtu, down 23.9 cents from Tuesday’s close. June futures slid 21.2 cents to $7.065.

At A Glance:

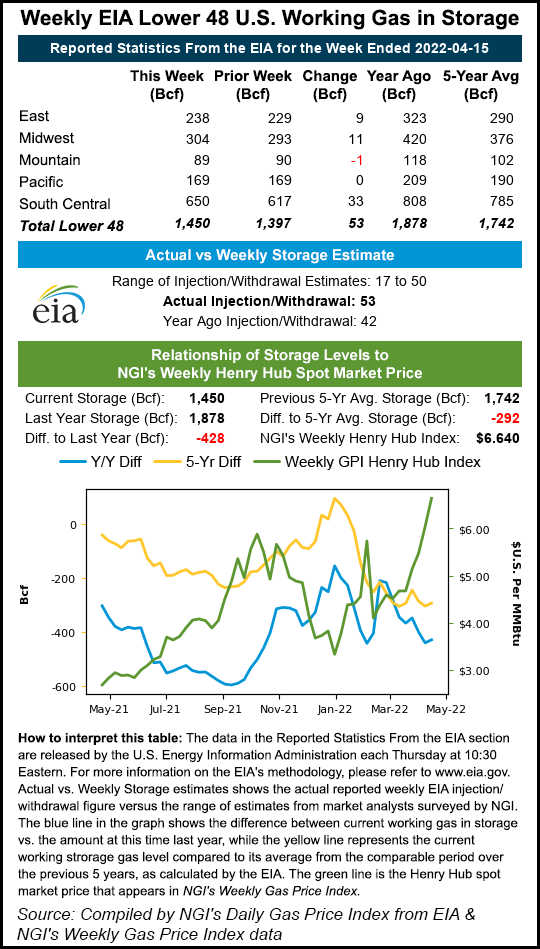

- BREAKING: U.S. EIA reports 53 Bcf storage build

- Upside still in play until output climbs

- Warmer weather sinks cash

Spot gas prices also continued to soften, with the coldest weather that slammed the East Coast this week now in the rearview mirror. NGI’s Spot Gas National Avg. dropped 27.0 cents to $6.695.

After the meteoric rise over the past month and a half, a pullback in Nymex futures was expected. However, after losing 64 cents on Tuesday and another 24 cents on Wednesday, analysts questioned whether gas has hit its peak or if the two-day slide is a temporary rest stop on the road higher.

“Our best guess remains that” the recent selloff was “a much needed breather,” Bespoke Weather Services said. Traders with long positions likely took profits, which allowed for the pullback.

However, there also was market chatter of robust production growth late this year into 2023, according to Bespoke. “Modeled predictions are nice, but until we see those production gains show up, the risk remains skewed toward higher prices later this year.” An ultimate move back above $8.000 is “still very much in play,” it said.

How Vulnerable Could U.S. Be This Winter?

In the near term, the forecaster said Thursday’s government inventory report may briefly move the price needle. Barring any huge miss, though, the price action should not be a “game changer.”

Ahead of the Energy Information Administration’s (EIA) weekly report, analysts reported a wide range of injection estimates. A Bloomberg survey of five analysts showed injections as small as 28 Bcf to as high as 42 Bcf. The median build was 40 Bcf.

Reuters polled 14 analysts, whose injection estimates ranged from 17 Bcf to 50 Bcf, with a median increase of 37 Bcf.

A 42 Bcf injection was recorded in the same week last year, while the five-year average is also a 42 Bcf injection.

Total working gas in storage as of April 8 stood at 1,397 Bcf, which is 439 Bcf below last year and 303 Bcf below the five-year average.

With periods of cool weather continuing to play out across the country, the hefty storage deficits are expected to hold relatively steady through early May, at least. That leaves a steep uphill climb for the market during the rest of summer to replenish inventories.

Aegis Hedging Solutions said it modeled end-of-October stocks at only 3.3 Tcf, almost 355 Bcf below the five-year average. The firm arrived at the projection by modeling injections through the summer and using 20-year average temperatures.

Notably, stocks at the start of winter would give the market the second-lowest start to the season in the last 10 years, behind only 2018, when inventories were at 3.24 Tcf. If this were to materialize, the market would be “much more vulnerable to winter weather and heightened volatility,” according to Aegis.

“Adequate inventories are around 3.6-3.8 Tcf, and usually, anything below is viewed as insufficient,” Aegis’ Nick Hillman, associate of market analytics, told NGI. With prices surging past $8.000 earlier this week, he said it’s anyone’s guess as to how high prices can go. “This market is signaling that it needs more supply, or needs to kill demand.”

Coal-to-gas switching models have broken over the last 18 months as gas-fired power generation has proven to be very inelastic, according to Hillman. This is partly because of limited coal supplies.

Meanwhile, U.S. industrial demand has been a beneficiary of the turmoil in global markets. The sector has been competing globally with lower gas prices, which has made it more resilient to hikes, Hillman said. “The liquefied natural gas export arbitrage is wide open, and would require prices to increase by another $15/MMBtu to shut off that demand.”

Plunging Northeast Cash

Spot gas prices continued to fall a second day, with losses spread across the Lower 48. Northeast markets led the way, with warmer weather on the way to the winter-weary region.

AccuWeather said temperatures that are more typical of late May in some areas are set to expand from the central and southern Plains to the Midwest, southeast and central Appalchians for the rest of this week.

“Chicago is among the long list of cities likely to hit its high mark for 2022 so far,” AccuWeather meteorologist Ryan Adamson said. A high in the lower 80s is forecast for the Windy City on Saturday. Prior to Saturday, the highest temperature thus far for Chicago’s O’Hare International Airport was 74, which occurred on March 21.

Farther east, a warming trend is coming. The pattern in the Northeast, though, is a bit more complex than its counterparts in the central states, according to AccuWeather. Coming off a late-season winter storm, which dumped several inches of snow in some areas, highs in Syracuse, NY could climb into the upper 50s, near normal for this time of year. By Friday, Boston and New York City, where chilly ocean waters tend to hold temperatures back in the spring, are set to partake in the warming trend with a high well into the 60s.

That was enough to send spot gas prices crashing lower midweek. Algonquin Citygate next-day gas plunged $1.080 day/day to average $6.665, while Transco Zone 6 non-NY dropped a much smaller 33.0 cents to $6.450.

That decline was in line with pricing locations across Appalachia, where Texas Eastern M-3, Delivery was down 36.0 cents to $6.355.

Similar losses extended into the country’s midsection. Defiance was down 29.5 cents to $6.550, and Panhandle Eastern was down 31.5 cents to $6.430.

Price decreases were smaller farther west amid some lingering chilly weather in the region. The National Weather Service said a large upper level low would direct a slug of Pacific moisture at the West Coast, with periods of heavy rain and mountain snow expected from the Pacific Northwest south into California.

As such, Malin slipped only 10.0 cents day/day to average $6.855, while SoCal Citygate actually jumped 19.0 cents to $7.600.

"gas" - Google News

April 22, 2022 at 12:12AM

https://ift.tt/ZqL3TG4

Natural Gas Futures Slip Further on Steep Rise in Output Seen Later This Year; Cash Prices Decrease - Natural Gas Intelligence

"gas" - Google News

https://ift.tt/mjnWkbz

https://ift.tt/bHLfoiI

Bagikan Berita Ini

0 Response to "Natural Gas Futures Slip Further on Steep Rise in Output Seen Later This Year; Cash Prices Decrease - Natural Gas Intelligence"

Post a Comment