After five straight days in positive territory, natural gas bulls may struggle to keep momentum going amid continued weather model volatility. Though they managed to eke out another substantial price increase on Tuesday, warmer trends in the weather models took a hatchet to early gains. The Nymex January gas futures contract reached a $7.105 intraday high but eventually settled at $6.935/MMBtu, up 34.8 cents on the day.

At A Glance:

- Latest model runs warm slightly

- Freeport LNG chatter returns

- California utilities warn of higher prices

Spot gas prices also moved up sharply on Tuesday, with ongoing chilly weather and supply constraints fueling a surge to $75.00 in Northern California. NGI’s Spot Gas National Avg. jumped $2.365 to $14.000.

After pummeling the West Coast, a major winter storm is expected to dump more than two feet of snow in parts of the central United States this week. The accompanying spike in heating demand has kept traders on edge awaiting clarity on additional cold blasts expected to blanket the Lower 48 beginning next week. So far, the models have been choppy, trending colder or warmer daily.

As of midday Tuesday, the Global Forecast System model remained the coldest, but it shed a handful of heating degree days (HDD) to align better with the European model, according to NatGasWeather. The forecaster said the first in a series of frigid blasts is expected to sweep across the United States this weekend. Overnight lows could plunge more than 10 degrees below zero across the northern half of the country and into the upper teens in Texas and the South.

While this would likely result in strong national demand, NatGasWeather pointed out that the data are not not quite as cold as they had been. That said, the models remained impressively cold with an Arctic blast hitting the Lower 48 next Wednesday through Christmas Day (Dec. 21-25), that would send overnight temperatures in the Midwest and Plains more than 20 degrees below zero. The firm cautioned, though, that trends once viewed as bullish late in the 15-day outlook have had the tendency to warm as they roll into the front of the forecast.

As such, the system needs close monitoring since there’s potential the Arctic front advances deep into the southern United States, particularly Texas, NatGasWeather said. The forecaster noted that grid stability in the Electric Reliability Council of Texas (ERCOT) could be in play given the crippling cold.

ERCOT said last month it was prepared to meet peak winter demand of nearly 67.4 GW after “landmark reliability reforms” following Winter Storm Uri. It is expected to have 87.3 GW of resources available from December-February.

Meanwhile, Mobius Risk Group said HDDs are expected to be more than 60 higher than the 30-year norm — not to mention more than 140 higher than a year ago. As such, there is a strong possibility that 2022 will end with less than 3 Tcf in storage.

“This should be seen as a key threshold as it has only occurred twice in modern history,” Mobius senior analyst Zane Curry said.

Notably, the current forecast for next week carries the potential to deliver a storage withdrawal of more than 200 Bcf leading up to the Christmas/New Year holiday, according to Mobius. This has not happened since 2017. Only four withdrawals of 200 Bcf or more have been reported in the month of December in the past decade.

“This would also be something for the market to strongly consider, particularly if weather forecasts fail to give up the delivery of Arctic air before year end,” Curry said.

Of course, the market also continues to look for clues as to when Freeport LNG may return. The liquefied natural gas exporter has targeted late December for a restart of its terminal on the upper Texas coast.

On Tuesday, it stuck to that timeline even after FERC sent a 16-page letter asking it to address dozens of issues before operations can resume. The Federal Energy Regulatory Commission sent two separate documents requesting information on 64 questions, only one of which was made available to the public because of security reasons.

The questions were developed with the Pipeline and Hazardous Materials Safety Administration and the U.S. Coast Guard after a visit in late November. The questions also included follow-ups to information provided by Freeport since a June explosion knocked it offline.

Cold Lifts Cash To New Highs

Spot gas prices were on the move across the country on Tuesday, with West Coast prices returning to the $50-plus levels seen late last week and dwarfing what normally would be considered substantial price increases on the East Coast.

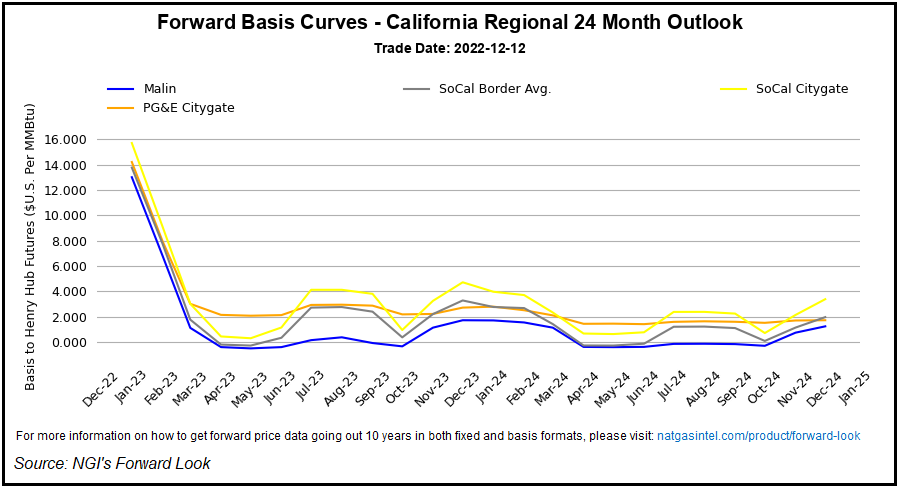

Against a backdrop of low storage inventories, heightened demand and pipeline issues, PG&E Citygate next-day gas traded at a $75.00 high for Wednesday’s gas day. The Northern California location ultimately averaged $48.170, up $9.580 on the day.

SoCal Citygate climbed $6.710 to average $49.67.

Similar price spikes were seen throughout the West, with some notable exceptions that posted even stronger gains. Kingsgate cash was up $23.525 day/day to average $47.50, and Questar was up $7.070 to $30.795. It traded as high as $43.800.

The West is expected to see the frigid conditions that have blanketed the region for weeks continue for another week and a half. Beginning next week, though, temperatures are forecast to thaw, offering some much needed relief to the region. Prices should follow suit.

That said, San Diego Gas & Electric (SDG&E) sent direct emails to customers this week keeping them apprised of the various issues that have played a role in the unprecedented price spikes. Referencing NGI’s story on the situation, SDG&E said between November and December, the residential natural gas rate jumped by 19% because the commodity price for natural gas climbed significantly.

Based on the latest market dynamics, current forecasts indicate that prices could go even higher into January when the weather in the region is typically the coldest and gas usage is generally the highest. This potentially could put more upward pressure on customers’ bills, according to SDG&E.

“SDG&E remains committed to working with our customers as prices for a variety of goods and services, including natural gas, continue to surge across the nation,” said SDG&E’s Dana Golan, vice president of customer services. “It’s important that we help customers prepare as much as possible for colder weather and higher winter energy bills and that we provide access to financial assistance.”

Elsewhere across the Lower 48, big gains were seen on the East Coast as the storm system hitting the Midwest shifts east. AccuWeather said the storm could hit near southeastern Virginia on Thursday and track off the New Jersey coast on Friday. From there, it is expected to spin near southeastern New England by Saturday.

The positioning of the storm would allow cold air from Canada to be pulled south into the Northeast and help produce a widespread snowfall for a large part of the region, according to AccuWeather meteorologist Mary Gilbert. At this early stage, “the greatest chance of six inches or more of snow will be from near and north of Interstate 80 in Pennsylvania, north through upstate New York and in central and northern New England,” she said.

Not only does the storm have the potential to produce heavy snow, but in some locations from Pennsylvania to New England, snow could fall for more than 24 hours, according to AccuWeather. The storm’s slow movement is seen increasing the potential for a foot or more of snow to fall from east-central New York to the ski country of northern New England.

The approaching cold blast sent spot gas prices at the volatile Algonquin Citygate climbing $2.610 to average $21.515 for Wednesday. Transco Zone 6 NY picked up $2.200 to average $11.690.

The highest price upstream in Appalachia was seen at Texas Eastern M-3, Delivery, which rose $2.650 day/day to $11.555.

"gas" - Google News

December 14, 2022 at 05:47AM

https://ift.tt/Zi7Leg0

Natural Gas Futures Rally, but Warmer Weather Models Trim Early Gains; PG&E Cash Hits $75 - Natural Gas Intelligence

"gas" - Google News

https://ift.tt/28hMWwZ

https://ift.tt/fNxzdq6

Bagikan Berita Ini

0 Response to "Natural Gas Futures Rally, but Warmer Weather Models Trim Early Gains; PG&E Cash Hits $75 - Natural Gas Intelligence"

Post a Comment