Blowtorch weather seen persisting through at least mid-January trumped what could be one of the largest natural gas storage withdrawals of the winter season. On its first day at the front of the Nymex futures curve, the February contract settled at $4.559/MMBtu, off 12.6 cents from Wednesday’s close. March futures slipped 7.7 cents to $4.117.

At A Glance:

- Storage deficits seen expanding

- Mild January could improve trajectory

- More losses for cash prices

Spot gas, which traded Thursday for gas delivery through Saturday, continued to move lower amid modest heating demand. NGI’s Spot Gas National Avg. tumbled $1.355 to $4.715.

With folks in Texas ditching the Uggs for shorts and t-shirts, unseasonably strong high pressure was set to expand across the southern and eastern United States the next several days as frigid cold retreated into Canada. Daytime temperatures in the 60s to lower 80s were forecast for the southern states going forward, with highs in the 40s to 60s over the Great Lakes and East. NatGasWeather said this should result in the warmest weather on record for this time of year.

The West Coast, meanwhile, should see near-normal temperatures next week as Pacific weather systems bring rain, snow and chilly conditions to the region. However, this is not nearly cold enough to counter warm conditions elsewhere, according to NatGasWeather.

There were some mixed trends in the latest weather data as the American model shifted slightly colder for the coming two weeks, while the European model shifted warmer. Even with the colder run in the Global Forecast System, however, the period through Jan. 9 remained warmer than normal.

“The official start of winter is only one week in and with still plenty of time for cold temperatures to draw on U.S. supplies,” NatGasWeather said. “However, a near-record warm pattern to end December and through the first half of January has led to massive risk-off trade and inflicted considerable damage to winter strip prices.”

‘Unequivocally Bullish Draw’

Whether continued weakness in futures prices is warranted is up for debate, but it is noteworthy that the latest government inventory data – which took several analysts by surprise – failed to stop the bleeding in the gas market.

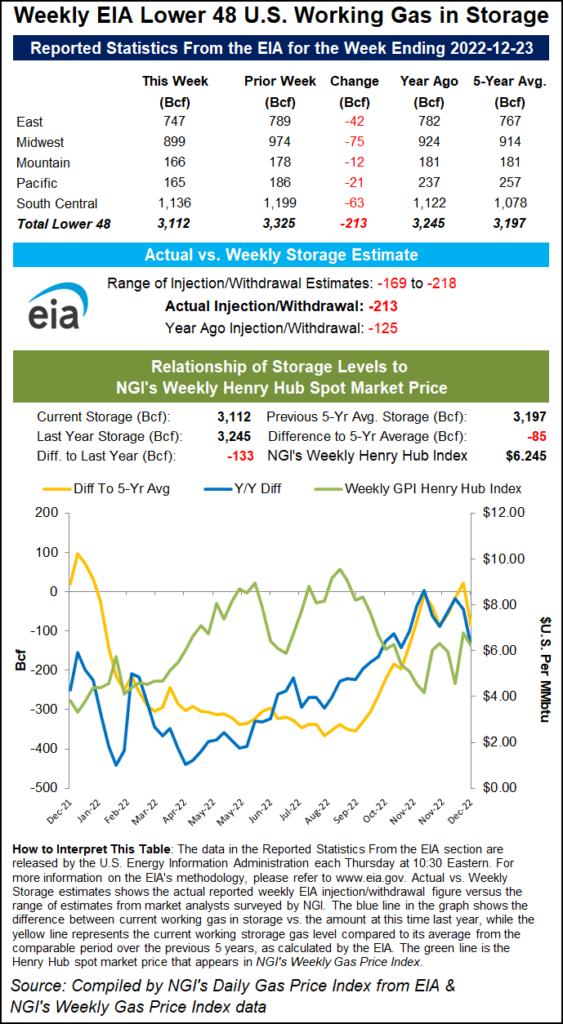

The U.S. Energy Information Administration (EIA) on Thursday reported a stunning 213 Bcf withdrawal from storage for the week ending Dec. 23. The triple-digit draw was near the high end of most major surveys, and analysts had indicated prior to the report that predicting the withdrawal would be difficult given that schools were closed, people were home, and yet some businesses were staying open later than usual.

The wide range of estimates ahead of the EIA report reflected the uncertainty in how the winter storm would impact the supply/demand balance. A Reuters survey of 11 analysts produced a range of withdrawal estimates from 169 Bcf to 218 Bcf, with a median decrease of 199 Bcf. Bloomberg had a slightly tighter range but also had a median draw of 199 Bcf, while a Wall Street Journal poll averaged a 201 Bcf pull. NGI modeled a 199 Bcf withdrawal.

For comparison, 125 Bcf was pulled out of storage in the year-earlier period, while the five-year average draw is 106 Bcf.

The latest EIA figure is a “tough number to extrapolate from…not bearish, in my opinion,” said one participant on Enelyst, an online energy chat. “Not sure it means much.”

Other Enelyst participants agreed the 213 Bcf withdrawal indicated the market was tighter than expected. However, they noted that the pull from South Central salt stocks fell short of projections. With frigid weather descending into Texas late in the reference period, they said stronger draws should be reflected in next week’s EIA report.

Broken down by region, the Midwest led with a monstrous 75 Bcf withdrawal from inventories, according to EIA. The South Central followed with a net 63 Bcf pull that included a 45 Bcf draw from nonsalt facilities and a 17 Bcf pull from salts. East stocks fell by 42 Bcf, while Pacific stocks slid by 21 Bcf. Mountain inventories dropped by 12 Bcf.

Total working gas in storage fell to 3,112 Bcf, which is 133 Bcf below year-earlier levels and 85 Bcf below the five-year average, according to EIA.

Despite the bullish EIA data, forecasts for record warmth in the first half of January proved too much to overcome. “With the early predictions of a warmish January, will need some good cold in February to pull down inventories,” said an Enelyst participant.

Celsius Energy By Force Majeure analysts agreed.

“This was an unequivocally bullish draw, but investors remain focused on the early January warmth.”

$3 Cash Prices

With weekend demand coming into the mix during Thursday trading, spot gas prices continued to post dramatic losses. Though West Coast locations remained sharply higher given ongoing cold in that region, along with a slew of other issues, the vast majority of U.S. prices sported $3.00 handles for the two-day gas delivery.

Benchmark Henry Hub tumbled 42.0 cents day/day to average $3.695, while Transco Zone 5 plunged $2.005 to $3.645.

Some Appalachia locations slid even lower. Eastern Gas South averaged $2.980 after falling 65.0 cents on the day, while Tennessee Zn 4 Marcellus hit $2.925 after tumbling 77.0 cents.

Meanwhile, more than a dozen natural gas pipelines on Thursday lifted restrictions imposed during Elliott.

However, Gulf Coast Express (GCX) alerted customers on Wednesday that maintenance is required on the Devil’s Run Compressor Station because of unforeseen circumstances. The work would result in capacity being restricted to 1.855 billion Btu/d through Friday, representing a reduction of 145,000 MMBtu/d.

The unplanned maintenance coincides with ongoing work on the Permian Highway Pipeline (PHP). Full capacity on that line has been restricted since Dec. 17 at 1.800 billion Btu/d, representing a reduction of 300,000 MMBtu/d. PHP expects capacity to remain reduced for several weeks. With little spare capacity when pipelines are operating under normal conditions, the restrictions were weighing heavily on prices in the Permian Basin. Waha tumbled $1.560 to average negative 86.0 cents.

"gas" - Google News

December 30, 2022 at 05:38AM

https://ift.tt/8l0aHKJ

Bears 'Inflict Considerable Damage' to Natural Gas Futures, Ignore EIA Storage Data - Natural Gas Intelligence

"gas" - Google News

https://ift.tt/ZRMoIJT

https://ift.tt/GYazksC

Bagikan Berita Ini

0 Response to "Bears 'Inflict Considerable Damage' to Natural Gas Futures, Ignore EIA Storage Data - Natural Gas Intelligence"

Post a Comment