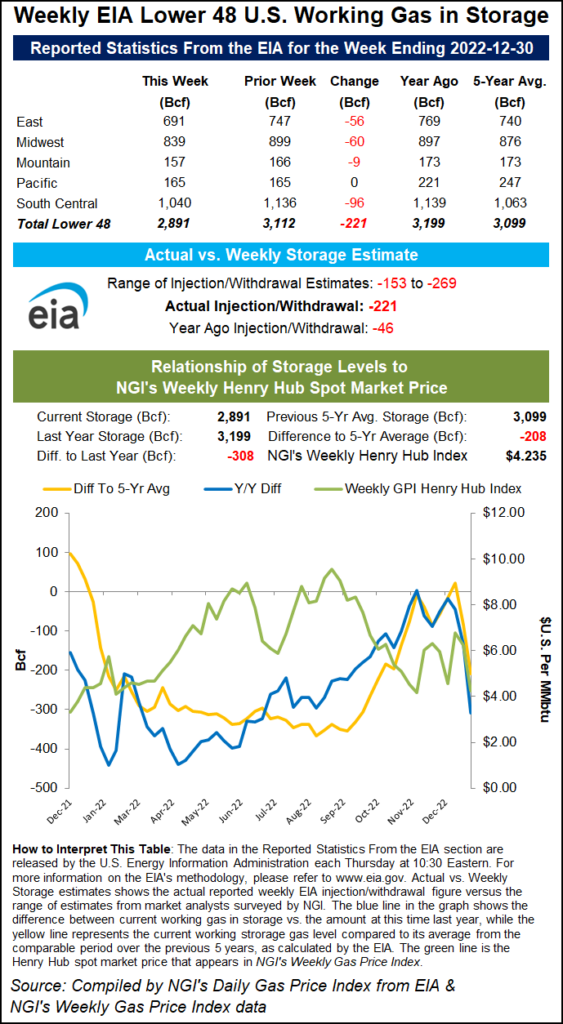

The U.S. Energy Information Administration (EIA) on Thursday reported a withdrawal of 221 Bcf natural gas from underground storage for the week ended Dec. 30. The result, while massive relative to historic norms, fell shy of expectations and left Nymex natural gas futures deep in negative territory.

Ahead of the 10:30 ET government report, the February futures contract was down 33.8 cents at $3.834/MMBtu. The prompt month slid to $3.755 when the EIA data was released.

By 11 a.m. ET, it had recovered some but was still down 36.0 cents to $3.812.

Prior to the report, projections submitted to Reuters ranged from withdrawals of 153 Bcf to 269 Bcf, with a median pull of 237 Bcf. A Bloomberg survey landed at a median pull of 240 Bcf. The Wall Street Journal’s poll found draw estimates from 156 Bcf to 265 Bcf and an average of a 228 Bcf pull. NGI modeled a 237 Bcf decrease.

EIA recorded a pull of 46 Bcf during the same week a year earlier and a five-year average of 98 Bcf.

The withdrawal for the Dec. 30 period lowered inventories to 2,891 Bcf. That compared with the year-earlier level of 3,199 Bcf and the five-year average of 3,099 Bcf.

Analysts cited bitter cold weather during the covered period that both fueled heating demand and interrupted production following wellhead freeze-offs. However, parts of the country already warmed up this week and more mild weather is forecast for the next couple weeks. Demand is expected to fade at the national level, and production already rebounded, leaving bears to maul futures markets.

“The depth of the freeze-offs was nearly as impressive as how fast volumes snapped back on,” analyst James Bevan of Houston-based Criterion Research said of production on the online energy platform Enelyst.

By region, the South Central reported a decrease of 96 Bcf, leading all others. This included a pull of 53 Bcf from salts and a withdrawal of 43 Bcf from nonsalt facilities.

The Midwest and East followed with pulls of 60 Bcf and 56 Bcf, respectively, according to EIA. Mountain region inventories fell by 9 Bcf, while Pacific stocks were flat.

Looking ahead to next week’s EIA print, analysts are generally looking for a relatively modest pull, though estimates varied widely.

Early projections for the week ending Jan. 6 submitted to Reuters ranged from withdrawals of 30 Bcf to 233 Bcf, with a median decline of 31 Bcf.

For the comparable week last year, EIA posted a decrease of 179 Bcf. The five-year average is 151 Bcf.

"gas" - Google News

January 05, 2023 at 11:28PM

https://ift.tt/1ZNTKji

February Natural Gas Futures Flop Despite 221 Bcf Storage Withdrawal - Natural Gas Intelligence

"gas" - Google News

https://ift.tt/3jB4odQ

https://ift.tt/6ioGdE3

Bagikan Berita Ini

0 Response to "February Natural Gas Futures Flop Despite 221 Bcf Storage Withdrawal - Natural Gas Intelligence"

Post a Comment