Cavan Images/iStock via Getty Images

Thesis

At the close of 2021, a popular Seeking Alpha contributor posted an article detailing why she believed that oil would experience a big move up "in the 2020s decade," setting the stage for what she calls the "Fifth Age of Oil" from which energy investors could profit. Oil did indeed experience a big rally from the pandemic-induced lows, and did spike soon after the contributor's post, but this was mostly unrelated to the contributor's arguments, and was largely caused by a voluntarily reduction of imports of Russian oil by Western states, as well as price hiking by energy companies in the wake of Russia's invasion of Ukraine.

Still, in late 2021 I had arrived at the same basic conclusion: a change in the energy sector is upon us and will dramatically take shape, and shape fortunes, throughout this decade. However, the contributor and I differ significantly on what the nature of the change in the energy sector is. She believes that the energy sector will soon return to reaping massive rewards on the strength of renewed oil sales; I take the view that multiple trends are pushing oil and other fossil fuels off of their perch atop the energy hierarchy, and that this decade will see the beginning of the end of their dominance. Further, I believe that oil and other fossil fuels are on their way out entirely, as are the companies that are too slow to abandon them for renewable energy production.

Regarding the long-term future of the energy sector, my viewpoint is based on the following phenomena and developments:

- Renewable energy sources are now becoming cheaper than fossil fuels, including oil; as this price gap between fossil fuels and renewables continues to widen, it will transform the energy market. It will accelerate both demand and supply for renewables, destroy demand for fossil fuels, and hasten the adoption of renewable energy sources in place of fossil fuels in various applications and in most regions of the world.

- Fossil fuels are responsible for making the planet less habitable for humanity; regulators and lawmakers intend to help correct this by cracking down on carbon emissions, including emissions from oil.

- The oil industry is likely to see a cancellation of government subsidies, because governments are also investing in renewables and will not continue to fund two competing energy industries.

- Oil-rich nations tend to be geopolitically opposed to interests of the United States ("US") and Western governments, and oil dependence causes turbulence and uncertainty for all nations. Continued reliance on fossil fuels for energy is therefore a significant national security risk that disincentivizes oil consumption at the geopolitical level, further reducing global oil demand long-term.

- Oil companies in particular are controversial, if not outright infamous, for their many scandals, allegations of corruption, and price hikes. Consequently, the oil industry has few loyal customers or supporters; people only use their products because they are forced to, and most will switch to renewables at the earliest opportunity.

Because of these developments, I believe that the energy boom in the aftermath of the Russia/Ukraine conflict marks the last time that oil and other fossil fuels can be relied upon to enrich contemporary energy companies that comprise much of the energy sector today. In my opinion, these companies, as well as their investors, would be wise to transition away from fossil fuels as soon as possible during the 2020s.

In the following sections, I will explain in detail why I believe that this decade represents the last age of oil, while also exploring how this affects one of the world's largest and most vertically integrated oil companies, Exxon Mobil Corporation (NYSE:XOM).

Exxon Mobil's Position as the Mighty Heir of Standard Oil

After the forced breakup of Standard Oil, an American oil behemoth, Exxon became one of the most successful divisions to be spun off the company. Exxon is among the largest privately owned and publicly traded oil companies in the world, and produces a large amount of the world's energy (~2% in 2018). It is vertically integrated, and therefore controls the upstream (exploration, drilling, extraction), midstream (transportation, storage, refining), and downstream (retail sales and distribution) handling of oil and natural gas. While it may not be the world's largest oil company (a title usually held by state-owned Saudi Aramco), Exxon is rightfully considered a giant in a massive industry, making it significantly appealing to investors.

Exxon Mobil's Financials

As formidable a company as it may be, the oil giant's past decade of financials reveal the consequences of a missed opportunity to capitalize on the US shale boom in the 2010s, and the effects of expensive pursuits of less profitable oil projects during that time.

Revenues for 2013 and 2014 were in the $350-400 billion range, but declined to the $200-250 billion range from 2015 to 2019. Revenues for 2020 were disastrous, with the company pulling in only $178 billion that year. However, 2021 was a return to form with a haul of over $275 billion, and in 2022, the year of the Russian invasion of Ukraine that prompted Western governments to reject Russian oil, revenues of Exxon increased to nearly $400 billion, since the energy giant had many more customers than usual in need of its supply.

Regarding net income, the trends are about the same, with different numbers: ~$32 billion earned in 2013 and 2014, a decline to the $15-20 billion range from 2015-2019 (with a notable drop to ~$8 billion in 2016), a disastrous decline to a loss of $22 billion in 2020, a return to form of ~$22 billion earned in 2021, and a sharp rise to ~$55 billion earned in 2022.

Lastly, cash flow from operations tells a similar story: ~$45 billion in cash flow earned in both 2013 and 2014, a decline to the $20-30 billion range for 2015-2019, a decline to $14 billion in 2020, and a rise to $48 billion and $67 billion in 2021 and 2022, respectively.

Notwithstanding the mishaps in the past decade that affected its finances, Exxon's performance is relatively impressive for having missed out on such a big opportunity in the US oil industry. A misstep like neglecting shale shouldn't have been catastrophic for the company in any case, considering it is structured to be a major player in all areas of the oil industry's operations. This means, however, that if the US and global oil industry were to collapse, there's a good chance Exxon would follow as its oil-based revenue streams unraveled.

Exxon Mobil's Valuation

As the stock of a well-known giant in the energy sector, I would expect to see XOM trade at a premium over its peers nearly all of the time. As I've said in previous articles, quality and reliability are often worth a premium in investing, and XOM is no different.

At time of writing, XOM trades at a trailing P/E ratio of ~8.7x, a negligible percentage higher than the energy sector. However, its forward P/E is 12x, ~15% above sector peers. This premium exists for XOM's P/B (price to book) and P/Cash flow as well, trading at a premium of over 25% and over 50% above the energy sector, respectively. Even though XOM's P/S (price to sales) is slightly discounted at ~10% below sector, most indicators suggest that XOM is a bit pricey, as is expected for such a dominant oil firm.

As long as the oil market remains healthy, XOM's premium is likely a fair price to pay to own one of the world's premier energy companies. However, a collapse of the oil market will rob Exxon of the revenues it needs to prop up its finances, ultimately devaluing XOM stock. Those with faith in the continued dominance of oil might feel comfortable investing in XOM, but in my opinion, this stock might be ripe for a decline, one that is not yet priced into its stock's somewhat rich valuation multiples.

Exxon Mobil's Fate

As I have stated, Exxon and XOM's fate is intertwined with the greater oil industry, due to oil's overwhelming centrality to Exxon's business model. Accordingly, to understand why XOM and Exxon are set to decline, we must understand the reasons why the oil industry, and fossil fuels overall, are set to decline. These reasons are what I will detail for much of the rest of the article, culminating in my rating for XOM stock.

Renewables Are Becoming the Cheaper Energy Source, and Will Spread by Outcompeting on Price and Preference

The Historical Reasons for Renewables Growth

To understand the argument for why the Oil Age is ending, we have to understand the dynamics of a central premise of the argument: the fact that renewables are rising. Why is this happening, and why does it mean the end of oil?

To start, the scientific innovations that first birthed renewables have birthed many other things in our history, especially in the last century or so. Technologies, chemistries, and scientific knowledge unimaginable just a few centuries ago have advanced so much that they are taken for granted today. These include new ways to generate energy.

Regarding renewable energy generation specifically, to make a long historical recap short, scientific innovations continued to improve on the technologies that made renewable energy possible. Experimentation with different configurations of various elements and other substances, different manufacturing methods, designs, and other scientific pursuits of trial and error eventually drove renewable generation components to become better at siphoning energy - more compact, energy dense batteries, greater energy absorption from solar panels, better optimization of wind turbines to capture more wind power, improved conversion rates for electrolyzers to generate energy and hydrogen, and greater durability and longer lifespans for all of these technologies and more.

These improvements to renewable technologies were ultimately aimed toward making them as efficient as possible - producing and storing as much energy as possible, for as long as possible, with the longest lifespans possible, and with the fewest materials and resources possible. As an overlooked side benefit, these innovations also ended up making these technologies very cheap. Similar to how innovations in computer technologies shrank computers from billion dollar room-sized behemoths to hundred dollar hand-sized devices, innovations in renewable technologies allowed renewables to evolve from inefficient, expensive energy production pipedreams to efficient, cheaper, viable mass-market energy sources.

Over several decades, the prices for renewable technology have fallen by very large double digit percentages due to these innovations. Now, in the 2020s, this technology has virtually reached price parity with the dominant energy sources (see Lazard data referenced later), i.e. fossil fuels, and is on track to become cheaper than fossil fuels in the coming years. This will have several profound effects on the overall energy market, which I will detail later in this section.

Supply, Demand, and Decentralization - The Dynamics Boosting Renewables Growth in the Energy Sector

As the prices for renewables fall, renewables will become a favored energy source for the people and entities whose price brackets they fall into. A major reason for this is that renewable generation devices are small enough in size, and efficient enough in energy production, that smaller industrial firms, factories, power plants, businesses, and many individual households will all be able to use renewable power technology to generate sufficient amounts of free power for themselves at will. This means that due to competitive pricing, high efficiency, and high scalability, renewable power generation is readily decentralized, setting it up for rapid mass adoption.

This is not possible with fossil fuels, it and never will be. The entire fossil fuel apparatus is as humongous as it is centralized. Massive mining and drilling devices take massive amounts of fuel out of the ground, transport the massive fuel deposits on massive vessels to massive refineries, then take the end products to massive power plants to combust it for energy that travels massive distances on incredibly long powerlines. Only production and distribution companies as massive as the fossil fuel supply itself could ever make fossil fuels as cheap an energy source as they are, because the sheer scale of fossil fuel extraction, transportation, refinement, combustion, and distribution is too large for any small firm, let alone a single household, to handle in a reasonably cost-effective manner.

By contrast, renewable energy is derived from the environment itself and is all around us almost all the time, with no transportation or combustion necessary. Extraction of renewable fuel only involves setting up the device to collect the energy, and then letting the environment fill it up from there. Distribution of renewable energy at smaller scales, such as in a virtual power plant or via vehicle-to-grid transference, is optional, but is much cheaper than the fossil fuel equivalent. The refinement process for renewables (i.e. converting renewable energy to electricity, switching its current from DC to AC or vice versa, switching its voltage from 120V to 220V or to any other desired voltage, etc.) is quick and highly efficient at every step. Simply put, the process of producing renewable energy has fewer steps and is cheaper and easier to do than producing energy from fossil fuels.

Even so, one of the most attractive features of renewable usage is that renewable energy is generated by the buyer of the technology, and the only cost he or she pays is for the generation technology itself. While fossil fuel energy sources require customers to pay for the energy (at a variable cost with no decrease over time relative to units of energy used), renewable generation devices only require a fixed cost (the one-time payment for the devices themselves) to generate power; the renewable energy produced afterward is free, and the one-time cost of the technology decreases over time relative to the free renewable energy produced.

Renewables therefore lend themselves well to the decentralization of energy production, and the favorable economics of decentralized energy for the masses means that more and more people will opt for decentralized, free power over centralized, pricey power production where possible. This does not bode well for oil companies, other fossil fuel companies, or for traditional electric and gas utility companies which are tracked by Utilities Sector SPDR ETF (XLU), Reeves Utility Income Trust (UTG), DNP Select Income Fund (DNP), Vanguard Utilities Index ETF (VPU). Whether or not these utilities are as fossil fuel-dependent as oil firms and other pure play fossil fuel companies, the wave of demand for decentralized renewable energy will put all their business at risk due to their inherently centralized structure. Put another way, when energy consumers are able to generate their own renewable electricity at home for free, they will rarely, if ever, need to pay for energy from utility companies.

Furthermore, as demand for renewables increases due to improving economics, and the costs of renewables decreases due to continued innovations on renewable technologies and devices, economies of scale will start to ramp up. High demand and lower prices will drive up sales of renewables, which will prompt greater production of renewable devices/tech, which will drive costs down due to increasing economies of scale, which will prompt further cost and price declines, which will prompt greater demand, and so on. This vicious cycle (or virtuous cycle) stands in stark contrast to the oil market, where prices seem to rarely decrease for long, no matter how much customers want or need oil and energy. As demand for renewables rises, and its unique benefits become clear, demand for oil and other fossil fuels will fall, as their disadvantages by comparison become more pronounced.

With these market dynamics at play, renewables will continue their precipitous cost declines, and will continue to see increasing demand serviced by increasing supply; meanwhile, fossil fuels will see ever-decreasing demand, and soon will not be able to compete as energy sources.

Evidence for Renewables' Imminent Rise, and the Wider Implications

For about two centuries, oil and coal were the only high-energy density fuel sources available to nations trying to rapidly advance their economies and industries. Other fuel sources emerged to compete with them, such as nuclear power and natural gas, yet oil and coal maintained their dominance to a large degree. But recent trends are tipping the balance away from these classic fuels. Natural gas itself has become cheaper than coal in recent years, and renewables are now competitive with, if not cheaper than, fossil fuels.

According to Lazard Ltd's latest analysis and comparison of the Levelized Cost of Electricity/Energy (or "LCOE", essentially the lifetime cost of energy produced) for renewable energy sources vs fossil fuels, most setups of renewable generation had comparable or lower LCOEs than fossil fuels under various conditions the firm modeled - without renewable subsidies, with subsidies, adjusting for fuel prices, a hypothetical carbon tax, component costs, and so on. Ultimately, Lazard's data demonstrates that renewables, which were once wildly expensive back in 2009, have generally reached price parity with fossil fuels over their operational lifespan. In fact, it has been argued that renewable energy sources, specifically solar, wind, and battery storage, have already been cheaper than fossil fuel energy sources for over a decade as measured by LCOE. Regardless, the cheapness of renewable power, once added to the energy market, stands to significantly lower the cost of energy wherever it is installed.

Consider the example of Texas. The state is famous for its history of oil production on account of its nearly 50 years of undisputed oil dominance beginning in the early 20th century, and Texas still produces a plurality of the United States' oil today. The state has no qualms about diversifying its energy sources though, as it also consumes and produces large quantities of natural gas as part of its energy mix, along with notable amounts of coal and nuclear energy. As the major producer of its most in-demand energy sources, Texas, unsurprisingly, has had some of the country's lowest energy prices over the last 50 years, according to the Energy Information Administration (opens in Excel).

This was all made possible on the back of cheap fossil fuels produced close to home. Yet even in Texas, renewables outcompete fossil fuels on price. Based on an analysis of Texas's power grid with vs. without renewable energy, renewables saved Texans up to several billion dollars in electricity costs annually between 2010 and 2022. This demonstrates that renewables can easily be a cheaper source of power than fossil fuels under real world conditions, even when fossil fuels enjoy the benefits of historical dominance and favorable market forces that contribute to their entrenchment in a given region.

All this to say, renewable energy sources are now a cheap alternative for cities, states, provinces, and countries to use to power their economies. From the developing world to the developed world, from transportation to utility scale storage to steelmaking, and even in coal-heavy China, renewables are often the go-to option for power plant buildout, since they may now be one of the less expensive options available. Furthermore, renewables are not just cheap in terms of direct costs, but are also cheap due to their lack of external costs compared to fossil fuels.

Now that renewable energy combined with storage is about as cheap as fossil fuels, with renewable LCOEs and battery prices still falling, future technologies and energy projects will likely use renewable power, displacing some aging fossil fuel-based projects on the basis of cost alone. This will devastate oil in particular, especially in the US. Electric vehicle registrations are rising rapidly, and the adoption of electrified industrial machines powered by renewable energy will likely follow, both spurred on by lower renewable energy costs compared to fossil fuels.

Assuming these trends persist and broaden, they will destroy most of the demand for oil, since in recent years the transportation and industrial sectors have generated ~95% of US oil demand and about two-thirds of global oil demand (aggregating Road, Rail, Aviation, and Industry). As these sources of demand dry up, the oil industry will almost certainly be forced to shrink significantly to adjust to the new normal.

Two Important Points Regarding the Transition to Renewables

To round this section out, let me highlight two important points. According to the International Energy Agency, "[t]he global energy crisis is driving a sharp acceleration in installations of renewable power, with total capacity growth worldwide set to almost double in the next five years," and "renewables are set to account for over 90% of global electricity expansion" in that same time span. Point number 1: there isn't just high demand for cheap renewables that is destroying demand for fossil fuels - there is also an accelerating supply of renewables to meet it.

Additionally, there is now widespread agreement within the scientific community that it is physically possible to replace fossil fuels with renewables in the majority of countries in the world, and eliminate over 99% of global carbon emissions to boot. Point number 2: the planet can fully transition to renewables if it chooses to, regardless of terrain.

If renewables are becoming the cheaper option for the nations of the world, renewable supply and demand are ramping up worldwide, and almost every nation can physically switch from fossil fuels to renewables, then almost every nation will do so. This will allow fast-spreading renewable energy sources to proliferate until they comprise virtually the entire energy sector, in turn giving renewable energy companies a global total addressable market.

In short, not only are oil and other fossil fuels set to fall out of favor with the arrival of cheap renewables, but renewables are also being installed at a blistering pace around the world, surpassing fossil fuels as a proportion of new energy installations. Further, renewable energy is liable to completely replace global fossil fuel use based solely on market forces and nations' economic preferences, and will be mostly unhindered by differences in national landscapes.

But the bad news doesn't end there.

Fossil Fuels' Climate Impact is Forcing Governments to Act

As with our ability to switch to renewables, the science is also clear about the nature of our current bout of climate change: humans are largely responsible for it, and the consequences are being felt, and measured, all over the world. If the climate becomes as unstable as current models predict, it will negatively affect the weather patterns of many cities, nations, and whole continents. Severe storms, floods, freezes and droughts are already becoming more commonplace, and things are only set to worsen. Left unchecked, climate change will reduce resource availability and cause devastating ocean current disruptions, a one-two punch that will greatly disrupt the living conditions of many people and significantly increase human suffering.

Because of this, governments and regulators the world over are starting to flex their muscles, putting laws and policies in place to keep the damage done by climate change to a minimum. Some nations, such as those that joined the Kyoto Protocol, acted faster than others, but virtually all nations now acknowledge the threat of a world destabilized by climate change, or are being forced to act on the matter by politically active constituents.

Accordingly, European court rulings, various pieces of European Union ("EU") legislation and policies like the European Green Deal, and US laws like the Inflation Reduction Act ("IRA"), are stuffed with climate-related mandates and incentives. Governments and regulators are getting serious about curbing the flow of excess carbon into the atmosphere, including tackling the root cause: fossil fuels. Multiple US states and the entire EU bloc have decided to ban sales of internal combustion vehicles by 2035, this being just one of several steps taken by governments to reduce citizens' fossil fuel consumption.

Additionally, the aforementioned climate mandates and incentives passed in recent years have made private investment in climate-friendly programs and technologies much more appealing - possibly more appealing than investment in fossil fuels.

For instance, per McKinsey and Company, much of the IRA's funding is "designed to catalyze private investment in clean energy, transport, and manufacturing" (emphasis added). In other words, IRA funding is meant to jump-start an even larger buying spree of renewable energy tech, as well as even greater spending on its deployment in multiple industries; this is likely the goal of all climate legislation being introduced and passed into law.

Needless to say, regulators and governments actively codifying incentives and mandates that favor the renewable energy industry over the next 10-15 years is a major secular headwind for the fossil fuel industry, and does not set it up for a decade of success. Some may point out that there are fossil fuel goodies baked into these climate pronouncements, but the long-term trend toward fossil fuel elimination is unmistakable.

To illustrate, a portion of IRA funding goes toward propping up the US fossil fuel industry, to the disappointment of many environmentalists; however, an analysis of the law by "[t]he think tank Energy Innovation calculates that for every ton of carbon emissions from new oil and gas, there will be 24 tons reduced due to measures governing buildings' energy use, home electrification, and green lands set aside as carbon sinks" (emphasis added). While the real-world ratio for carbon saved vs carbon emitted under the IRA may differ from the estimates, the intent and impact of the law is clear: ramp up renewables, curb carbon.

These legal and regulatory headwinds to the oil industry, and to the fossil fuel industry at large, will only get stronger as the effects of climate change become more severe and more frequent this decade. For all intents and purposes, governments and regulators have announced last call for fossil fuel use, and their word is law.

Investment in Renewables is Rising, and Fossil Fuel Subsidies Will Start Falling

Governments subsidize fossil fuels to the tune of trillions of dollars per year. The US is an infamous example of this, having lavishly funded the industry for at least a century. However, as renewable energy technology has evolved, governments and other entities have begun to invest in it as well. According to Bloomberg, global renewable energy investments in 2022 rose to match investments in fossil fuels for the first time, representing a 31% increase from 2021.

As renewable energy investment continues trending upward, governments will find it fiscally unpalatable to spend money on two competing energy sources, especially governments of countries with large debts and deficits like the United States. Soon, these governments will be forced to subsidize just one.

Assuming they are rational in their decision, they will opt to subsidize the energy class that has low direct costs and fewer externalities (i.e., choose renewables), and phase out their fossil fuel subsidies. Even if they choose to stop subsidizing the fossil fuel industry without redirecting those funds to renewables, it will be a big financial blow to the industry, including oil firms.

If cost alone doesn't make the decision for governments easy, the following consideration might force their hand.

Oil Dependence is a National Security Concern

What are two things that Russia, Saudi Arabia, and Iran have in common? They are among the top 10 oil exporters in the last decade, and they are geopolitical adversaries of Western nations. Western nations' interests consist primarily of protecting human rights, defending global law and order, and preserving political liberalism (not to be confused with partisan liberalism). By contrast, Russia, Saudi Arabia and Iran are disinterested in, or actively opposed to, these notions.

To be fair, these three nations do not represent all top oil producers or exporters - Canada and Norway are top producers too, after all. But many such nations do often engage in very destructive behavior that runs counter to Western interests, and they fund their activities in part by selling their oil to the world. Should the world and its governments transition away from oil and produce their own renewable energy, Russia, Saudi Arabia, Iran, and other such oil-rich nations' influence and ability to cause trouble would decline. Therefore, Western governments will come to view the abandonment of oil as a national security objective, and will pursue it as they do other national security issues.

Additionally, the Organization of the Petroleum Exporting Countries (OPEC/OPEC+), which was formed to set global oil prices by controlling output levels, is capable of disrupting Western and world affairs by altering the price of oil as it sees fit. Switching to renewable energy sources would grant energy independence and price stability to not just Western nations, but most nations on earth, and would diminish OPEC's influence on energy prices and global affairs. Many nations would therefore follow the West in abandoning oil for renewables, if only to free themselves from OPEC's price controls.

All of this will further contribute to the steep decline in oil demand, as well as the decline in revenues and profits for the oil industry.

Oil Companies' Past and Profits Will Exacerbate the Coming Demand Destruction

As if the consequences of using its main product were not already controversial enough, the oil industry often courts scandal and garners mistrust. From the Exxon-Valdez and Deepwater Horizon spills, to the constant stories of lies and real or perceived corruption involving the oil industry, be it global or national, recent or historical, the well-publicized fiascos surrounding oil companies have caused many people to view them with negative sentiment ranging from cautious suspicion to reflexive conspiratorial distrust. This sentiment is captured in well-worn tropes in entertainment media that oilmen are immoral robber barons, and that the entire industry is led by crooks, thieves, and liars in fancy suits.

More importantly, the industry's scandals and reputation, its rising profits, and the rising prices of gasoline/petrol have earned it a conspicuous lack of customer loyalty. These companies have a lot of negative favorability built into their customer base, and by the same token likely have low organic fidelity among consumers. This isn't all that surprising - people, especially Americans, have held negative opinions of oil companies dating back over a decade, and such disdain likely has a much longer history.

What's more, oil companies don't seem prepared to use consumer data to boost customer loyalty. According to at least one data analytics firm, only a third of the oil industry has invested in utilizing Big Data and data analytics to improve their business. This includes building systems and programs that leverage consumer data to improve customer retention and increase customer loyalty. Without these Big Data approaches or other strategies, most of the industry will find it even more difficult to woo new customers to their business, or ensure existing customers keep using their products instead of the viable substitutes that will become widespread this decade.

When the ease of switching to renewables for consumers and institutions becomes readily apparent, and when the severity of headwinds to the fossil fuel industry reaches a critical mass, ordinary consumers and large entities will both flock to renewables in droves, resulting in sudden, severe, and sustained demand destruction for oil and other fossil fuels.

This is almost certainly true for Exxon, which even has an oil spill named after it. Unfortunately for Exxon, the reputational damage and name recognition from the spill never quite faded from the public consciousness; this increases the likelihood that consumers will pivot away from its products at the downstream level earlier and faster than for other downstream oil firms, worsening its position as the energy transition kicks off.

Investment Implications

Taken together, all signs point to a grim prognosis for Exxon Mobil, the oil industry, and the rest of the fossil fuel industry, as the world and the energy sector replace fossil fuels with renewables. As such, I believe investors should mark the 2020s as the last time they can profit off of companies in the fossil fuel industry, and should strongly consider abandoning these companies, including Exxon, as long term investments.

Winners and Losers

Companies that are heavily invested in fossil fuels and are slow or reluctant to embrace renewable energy will perform poorly over time, and will likely experience a major crash by the end of the decade from which they probably will not recover.

This includes Exxon, of course, as well as names such as Chevron Corporation (CVX), The Phillips 66 Company (PSX), Sempra (SRE), ONEOK, Inc. (OKE), OGE Energy Corp. (OGE), Brooge Energy Ltd (BROG), WEC Energy Group, Inc. (WEC), White Energy Company Ltd (OTCPK:WECFF), Magellan Midstream Partners (MMP), Sunoco LP (SUN), CenterPoint Energy, Inc. (CNP), Enbridge Inc. (ENB), TC Energy Corporation (TRP), TotalEnergies SE (TTE, OTCPK:TTFNF), Marathon Oil Corporation (MRO), Marathon Petroleum Corporation (MPC), Valero Energy Corporation (VLO), NuStar Energy LP (NS), Ovintiv Inc. (OVV), Cenovus Energy Inc. (CVE), ConocoPhillips Company (COP), Eni S.p.A. (E, OTCPK:EIPAF), Plains All American Pipeline LP (PAA), Ring Energy Inc. (REI), VAALCO Energy, Inc. (EGY) Occidental Petroleum Corporation (OXY), Petróleo Brasileiro S.A. (aka Petrobras) (PBR), Pampa Energía S.A. (PAM, OTC:PPENF), Callon Petroleum Company (CPE), Imperial Petroleum Inc. (IMPP), NiSource, Inc. (NI), Devon Energy Corporation (DVN), Energy Transfer LP (ET), Ecopetrol S.A. (EC), Vistra Corp. (VST), The Williams Companies, Inc. (WMB), Canadian Natural Resources Limited (CNQ), Koninklijke Vopak N.V. (OTCPK:VOPKF, OTCPK:VOPKY), InPlay Oil Corp. (OTCQX:IPOOF), Inpex Corporation (OTCPK:IPXHY, OTCPK:IPXHF), Shell plc (SHEL, OTCPK:RYDAF), Dominion Energy, Inc. (D), Duke Energy Corporation (DUK), Baker Hughes Company (BKR), Enterprise Products Partners L.P. (EPD), APA Corporation (APA), Chesapeake Energy Corporation (CHK), Warrior Met Coal, Inc. (HCC), PBF Energy Inc. (PBF), and many more.

On the other hand, pure play renewable energy companies, and other firms fully entrenched in the renewable energy space, have a bright future ahead of them in this decade and beyond. These include Enel S.p.A. (OTCPK:ENLAY, OTCPK:ESOCF), Ørsted A/S (OTCPK:DNNGY, OTCPK:DOGEF), Iberdrola S.A. (OTCPK:IBDRY, OTCPK:IBDSF), ReNew Energy Global plc (RNW), Carnegie Clean Energy Ltd. (OTCPK:CWGYF), Ocean Power Technologies (OPTT), Tesla Inc. (TSLA), Sunlight Financial Holdings Inc. (SUNL), Brookfield Renewable (BEP, BEPC), Freyr Battery (FREY), Array Technologies, Inc. (ARRY), Nano One Materials Corp. (OTCPK:NNOMF), Novonix Ltd (NVX, OTCQX:NVNXF), LiCycle Holdings Corp (LICY), Maxeon Solar Technologies (MAXN), First Solar Inc. (FSLR), Azure Power Global Ltd (OTC:AZREF), Centrais Elétricas Brasileiras S.A. (aka Eletrobrás) (EBR), Acciona, S.A. (OTCPK:ACXIF), Nextracker Inc. (NXT), AmmPower Corp. (OTCQB:AMMPF), Enphase Energy, Inc. (ENPH), Fluence Energy, Inc. (FLNC), and Vestas Wind Systems A/S (OTCPK:VWDRY, OTCPK:VWSYF), among others. Investors who stick with companies like these will be able to capitalize on the ongoing energy transition that stands to imperil fossil fuel producers, including the oil industry.

A Note on the Inclusion of Renewable Energy Utilities

As an aside, you may notice the presence of renewable energy utility companies among the "winners" in the energy transition, despite my belief in the likely disruption of utility companies in the long term. The reason I list them here is because I believe that if any group of utility companies can survive and endure the transition to decentralized renewable energy, it will be the renewable energy utilities. These are the types of utilities that government regulators and average citizens would be most likely to support keeping as grid stabilizers, much like natural gas peaker plants support the current fossil fuel-based energy grid today. This is assuming that grid stabilization by renewable utilities is even needed in the future, considering the rise of virtual power plants in tandem with the transition to decentralized renewable energy use.

Nevertheless, even if renewable utilities see a slump in demand long-term as renewable energy production decentralizes, they will still be winners compared to traditional utilities, which will likely decline much further by comparison due to their centralized nature combined with their fossil fuel-based energy generation, a double whammy for their prospects.

How Things Play Out For Energy Investors

Like the contributor who wrote the article stating her belief in a new age of oil, many investors assume that demand for oil will remain robust for an extended period of time; they may even have a multi-decade timespan in mind. Therefore, the coming wave of demand destruction throughout this decade will likely catch investors and the oil industry by surprise, and will trigger a collapse in industry revenues and profits. This in turn will cause an investor panic and a selloff of oil stocks, creating a vicious cycle of oil industry underperformance and investor backlash.

This cycle will be compounded by the transformation of productive and valuable oil assets (e.g. drilling equipment, pipelines, refineries, thermal power plants, gasoline/petrol station infrastructure, etc.) into unproductive stranded assets that further damage company balance sheets across the industry. Investors who keep their faith in the industry will ignore the warning signs and may double down as this all unfolds, retaining their shares or even buying dips on the expectation of a recovery. When the dust settles, many oil investors will have lost significant sums of capital. They won't be alone, though - investors in companies across the fossil fuel industry will sustain similar losses.

For Exxon Mobil, all of these negative consequences will be felt even more severely, since it is exposed to all three streams (upstream, midstream, and downstream) in the oil industry. Exxon's exposure to all three streams also makes it the likeliest to feel these consequences first, since they could appear in any one of these streams before the others. Perhaps in the medium term Exxon will be able to shift its primary operations to whichever stream seems to be declining the slowest, but the eventual collapse of all three streams will ensure that, barring an exit from the oil industry, Exxon will decline severely along with the oil industry.

Meanwhile, as fossil fuel projects age, become socially or politically unpopular, or become uneconomical to operate or maintain, they will be replaced by renewables. As fossil fuel firms start to fail, renewable companies will proliferate and grow. Renewable firms will take market share and capital from the old guard, and will become the vanguard leading the energy sector. These renewable companies will then steadily increase in status, value, and market cap, and will handsomely reward investors who sent capital their way - especially the early investors.

For those currently invested in oil companies like Exxon, and fossil fuel companies in general, the best way to avoid the negative repercussions of the energy transition is to get out of these companies as soon as possible, and pivot to renewable energy firms.

A Note on Fossil Fuel Companies' Net Zero and Renewable Energy Goals

The Inadequacy of Fossil Fuel Companies' Transition Promises

Several fossil fuel companies have claimed that they will engage in renewables adoption, carbon emissions reduction, and carbon capture so as to reach "carbon neutrality" or "net zero carbon emissions" by 2050. This includes many oil and gas companies listed in the last section, including Eni, Shell, The Williams Companies, and of course, Exxon. Respectfully, I believe that these pledges to be carbon neutral by 2050 may amount to plans to be bankrupt by 2035.

The renewable energy transition will transform the energy sector, and other sectors, in a span of years, not decades. Former fossil fuel companies like Enel and Ørsted have already invested heavily into renewables, and now only have to focus on expansion, demonstrating much greater foresight in the past and reaping the rewards for it today. In my view, the factors causing the ramp up of renewable energy usage will trigger rapid, exponential demand destruction of fossil fuels throughout the energy, transportation, and industrial sectors during the 2020s decade, leaving little room for fossil fuel firms in most markets by the mid-2030s. Fossil fuel companies that have no plans to be carbon neutral or renewables-focused by then would consequently have little recourse as multiple sectors of the global economy leave fossil fuels behind.

Further, while many fossil fuel companies are taking credit for building up renewable energy generation capacity, these companies still rely almost entirely on fossil fuel energy to prop up their business. Shell is a good example: a renewables-focused section of its website touts its wind and solar projects as contributing 1 terawatt hour (expressed as 1000 gigawatt hours) of renewable energy to the grid, but even if Shell's total renewables amount was doubled to account for nuclear, hydropower, green hydrogen, etc., it would still account for less than one percent of Shell's 251 terawatt hours of total energy produced in 2021, with the difference being made up of fossil fuels. This is at a point in time when, according to the International Energy Agency and International Council on Clean Transport, electric vehicles jumped from 4% to 8% to 13% of the global car market for the years 2020, 2021, and 2022, respectively.

In other words, as one of the biggest sources of global demand for Shell and other oil companies products, gasoline/petrol, is being eroded at an annual rate of 4-5% in absolute terms, and with an acceleration of such erosion very likely due to the factors detailed throughout this article that will boost renewable technology adoption, Shell declares that it is still more than 99% dependent on the very product whose demand is being eroded. This clearly does not bode well for oil companies' prospects during the energy transition, as many, if not most, other oil companies are in roughly the same condition of oil dependence as Shell, and display a severe lack of urgency in switching to renewables.

But even when these companies promise to transition to renewables or go net zero, there is no guarantee they will follow through. Oil firm BP p.l.c. (BP, OTCPK:BPAQF) pledged in 2020 to cut natural gas production by 40% and end oil and gas exploration for the foreseeable future, among several other climate initiatives. Yet now, the company is scaling back on its climate plans, perhaps due to a banner year for its finances on the back of record oil profits in 2022 that the company is loath to give up. Whatever the reason, such backpedaling shows that oil and gas companies cannot be counted on to fully commit to transition to renewables.

The Inadequacy of Natural Gas and Carbon Capture

On top of this, many fossil fuel firms list natural gas as a renewable fuel, and count it as part of their net zero goals. NiSource is a good example of this. Its stated sustainability goal (page 14) is to reach net zero by 2040, which sounds impressive on its face, but the company goes on to say that it will do so by "advanc[ing] other low- or zero emission energy resources and technologies, such as hydrogen and renewable natural gas, and support the deployment of carbon capture and utilization technologies, if and when these become technologically and economically feasible" (emphasis added).

At baseline, the inclusion of natural gas, to be sure a more environmentally friendly fossil fuel than coal and oil, is nevertheless at odds with any zero-emissions goals. Pivoting to this slightly cleaner fossil fuel will only delay the inevitable for any company trying this strategy, because natural gas, even renewably generated gas, still produces carbon dioxide emissions when burned for energy, just like oil and coal do. To add insult to injury, the main component of natural gas, methane, has more much potent greenhouse effects than carbon dioxide when it leaks into the atmosphere instead of being burned. Natural gas is also usually mined or otherwise extracted from the ground in large deposits with other fossil fuels, with all the related environmental concerns that such extraction brings; this makes natural gas prone to the same centralization issues and market quirks that consumers dislike regarding oil. For these reasons, I think natural gas is on the fossil fuel chopping block this decade, along with oil and coal.

Worse yet, while NiSource acknowledges that its reliance on gas necessitates engaging in carbon capture to reach its 2040 net zero goal, the company cannot even guarantee that it will be able to capture as much carbon as it emits in 2040, since it is uncertain of the technological and economic feasibility of carbon capture by its 2040 timeframe. To be fair, I doubt any company can predict the long-term feasibility of carbon capture at this time. Logically, then, all companies relying on the assumption of feasible carbon capture to mitigate their natural gas or other fossil fuel usage are, in fact, merely hoping for net zero emissions by their stated timeframe, not actually committing to net zero.

Sadly, NiSource isn't the only firm choosing the speculative path of carbon capture. Per the company's 2023 Climate Solutions Report, Exxon states that "[t]hrough 2027, we plan to invest approximately $17 billion on initiatives to lower greenhouse gas emissions … and [help in] reducing others' emissions through commercializing and scaling carbon capture and storage …" (emphasis added). Exxon's 2023 Climate Report also states that "[a]ll energy sources are projected to remain important through 2050, with oil and natural gas accounting for 55% of the world's energy mix in 2050" (emphasis added). This is in addition to the "sustained investment" in oil and gas, presumably by Exxon, that the company claims will be needed to meet the world's energy demands in 2050.

Setting aside the strong possibility that oil and gas won't even make up a double digit percentage of the 2050 energy mix, this report makes me question whether Exxon's management is just skeptical of the coming wave of renewables this decade, or is simply ignorant of it. Either way, management's assumption of the continued reign of oil and gas, its implicit decision to divert even more funds toward oil and gas production over the next 27 years, and its inclusion of carbon capture as part of its net zero plans, reveal how unprepared it will be to steer the company out of danger if and when renewables begin to rapidly displace fossil fuels in the 2020s and beyond, putting Exxon's oil business and financial security at risk.

The Nonresponse from Coal Companies

For all their backsliding and sluggish execution, oil and gas companies appear to at least be talking the talk on adopting renewables and reducing carbon emissions. Coal companies seem content to say and do nothing, despite the even greater risks to coal as one of the dirtier and faster-declining fossil fuels (notwithstanding the current transient spike in coal demand due to the 2022 energy crisis). Case in point, coal companies Warrior Met Coal and Thungela Resources Limited (OTCPK:TNGRF) appear to have no plans to reach net zero anytime soon, even with the looming threat of electrified steelmaking technology indirectly disrupting the metallurgical coal industry, an industry central to both firms' businesses.

Closing Thoughts on Fossil Fuel Firms' Net Zero and Renewables Goals

In the end, the announced renewables projects and net zero goals by many fossil fuel companies, including Exxon, are unlikely to amount to anything substantial enough to save these companies from the harsh consequences of the energy transition, and they certainly won't be substantial enough to imperil my thesis. At the current glacial pace of renewables adoption these companies are engaging in, fossil fuel firms' oft-stated goal of net zero by 2050 is all talk. Unfortunately for these firms, while talk is cheap, renewables will be cheaper, and consumers will at least want to buy the latter by the mid-2030s.

The Main Takeaway

I believe that the oil industry, and the fossil fuel industry at large, is experiencing its last boom. Renewables are virtually at price parity with fossil fuels, declining further in cost, increasingly supported by regulators and governments, less risky in terms of geopolitics and national security, and are universally adoptable. Oil companies in particular have gained a negative reputation and a lack of loyalty from their customers, who will abandon them at the first opportunity. The headwinds that will catalyze said abandonment will strengthen over this decade, and soon the house of cards that is the oil industry's financial security may collapse quite suddenly. Subsequent revenue and earnings shortfalls will then trigger a major selloff of oil stocks, leaving many investors as blindsided bagholders.

Since Exxon Mobil's fate is intertwined with the oil industry, all of these events mean that Exxon Mobil, once a king in the energy sector, is likely doomed to shrink into a shadow of its former self as the oil industry contracts, assuming the company does not go into bankruptcy during the oil industry's decline. Significant sums of shareholder capital invested in the energy sector could be lost along the way if investors refuse to acknowledge this likely reality.

Meanwhile, renewable companies will become preferred providers of power, since their energy generation is a cheaper, safer, less risky alternative to fossil fuel use. Consequently, pure play renewable companies will gain the preferential treatment and market share advantages that fossil fuel firms, including oil companies, once enjoyed. This is in spite of fossil fuel companies' purported attempts to cut emissions and adopt renewables themselves; their lack of urgency exposes their renewable adoption efforts to be, at best, inadequate to address the challenges ahead of them as the energy transition proceeds in earnest.

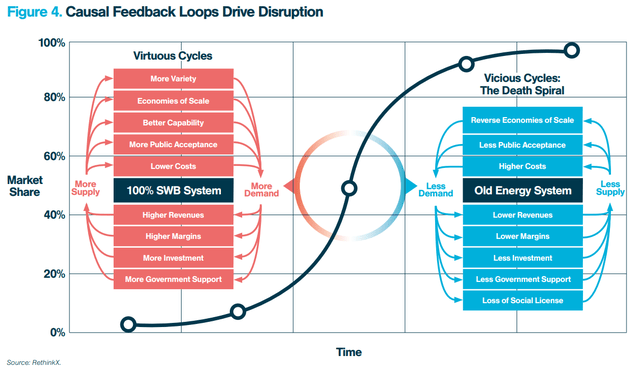

The trajectory of both renewable and fossil fuel energy sources is well-captured by a figure in a presentation by RethinkX, the think tank claiming that renewables have been cheaper than fossil fuels for over a decade. It visually depicts the feedback loops that tend to occur with most, if not all, innovative and disruptive technologies as they are introduced to the market and compete with traditional technologies. It also demonstrates the effect that these feedback loops have on market share; in effect, these loops propel disruptive technologies to exponentially capture share from traditional technologies until the disruptors completely replace the traditional players.

This specific RethinkX figure shows the S-curve of market share transfer that will occur in the energy sector as positive feedback loops boost renewables, labeled the SWB (solar, wind, and battery storage) System, and simultaneously crush oil and other fossil fuels, labeled the Old Energy System. If you come away with nothing else from this article, at least remember this figure:

Feedback Loops From Disruptive Technologies (RethinkX)

Conclusion

Ultimately, the trends taking shape this decade foreshadow a steep and lasting decline for the oil industry, and massive losses may be in store for investors who believe the runway for oil is many years, or even decades, long. I therefore strongly recommend that long-term investors in the energy sector pivot to renewable firms now, and ensure that they are on the right side of the energy transition before it's too late.

As for Exxon, needless to say, the company as we know it today is likely done for. Even if it becomes the undisputed king of the oil industry, it would make no sense to own the company's stock as the energy transition progresses, since Exxon will be taking a bigger slice of a shrinking pie. While renewables rise, fossil fuels, the oil industry, and Exxon itself will all be forced to contract in size, meaning that XOM stock will likely decline. As such, buying or holding XOM for the long term would only result in the destruction of shareholder capital.

Therefore, for long-term energy investors, I rate XOM a strong sell, and I suggest that long-term investors also reconsider their ownership of all other fossil fuel holdings.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

"Oil" - Google News

August 15, 2023 at 12:30AM

https://ift.tt/2yHCkrV

Exxon Mobil: A Strong Sell Ahead Of The Last Age Of Oil (NYSE:XOM) - Seeking Alpha

"Oil" - Google News

https://ift.tt/tD3GHLj

https://ift.tt/CTm849F

Bagikan Berita Ini

0 Response to "Exxon Mobil: A Strong Sell Ahead Of The Last Age Of Oil (NYSE:XOM) - Seeking Alpha"

Post a Comment