Natural gas futures on Monday advanced for a third consecutive session, propelled by festering worries about winter storage inadequacy. The October Nymex gas futures contract jumped 25.3 cents day/day and settled at $8.249/MMBtu. November rose 24.3 cents to $8.287.

At A Glance:

- Demand fades, production rises

- But storage remains relatively low

- Futures climb third straight day

NGI’s Spot Gas National Avg. followed suit, gaining 18.5 cents to $7.620.

“The storage situation is definitely not going away – unless we start to get a lot bigger injections over the next few weeks,” StoneX Financial Inc.’s Thomas Saal, senior vice president of energy, told NGI.

The U.S. Energy Information Administration (EIA) last Thursday reported an injection of 54 Bcf natural gas into storage for the week ended Sept. 2.

The result fell short of the five-year average build of 65 Bcf and left stocks well below historic norms. Working gas in storage rose to 2,694 Bcf, according to EIA. However, stocks were 222 Bcf lower than a year earlier and 349 Bcf below the five-year average.

Saal noted that production rose notably in recent weeks to meet both strong domestic demand and elevated calls from Europe and Asia for U.S. exports. At the same time, he said, cooling demand is fading as fall weather emerges in northern regions.

“Even so, we may need to see even more production increases,” Saal said. “Overall demand is going to stay high because the growth in LNG is real and looks likely to last” into next year and beyond.

Production on Monday hovered around 100 Bcf/d – near a 2022 high – and weather outlooks pointed to milder temperatures as September wears on. Domestic forecasts showed “a comfortable pattern dominating much of the U.S. this week, but still with a warmer than normal pattern setting up” late this week into next week that would deliver a “minor bump in national demand,” NatGasWeather said.

However, “this late in the season, above normal temperatures will be effectively countered by the lack of early season cool shots across the northern U.S.,” the firm said. Greater than normal cooling degree day totals for days six through 15 will coincide with below normal heating degree days “due to limited coverage of lows dropping into the 30s.”

Meanwhile, tropical cyclone activity as of early Monday was “back to quiet in both the Atlantic and Eastern Pacific basins, with no threats to the U.S. mainland for at least seven days.”

Still, traders in recent days focused on relatively low supplies in storage following a summer defined by blistering heat across the Lower 48 and elevated European demand for U.S. LNG. Countries across the continent are moving with haste to transition away from Russian energy because of the Kremlin’s war in Ukraine. Europe is buying up liquefied natural gas to make the transition.

Now, countries throughout Asia are also increasingly competing for LNG as they work to bolster supplies for the coming winter.

Analysts at The Schork Report said Monday that U.S. inventories are on a dubious trajectory as a result. They noted that EIA this month forecast the U.S. market would enter winter with about 3.4 Tcf of gas in storage – likely an adequate amount. However, with only eight more weeks of injections expected, the odds of reaching EIA’s target “are long and getting longer.”

The Schork team said the market would need to amass more than 700 Bcf of injections over the remainder of the season. Historically, utilities have increased stocks during the final eight weeks with cumulative builds in the 500s Bcf. As such, the analysts give the market only a 23% chance of meeting EIA’s projected total.

Saal said the global makeup of the natural gas market will likely continue to pressure both U.S. supplies and prices.

“Right now, the LNG buyer from Europe and Asia is outbidding everybody else in the U.S.,” Saal said. “As long as that remains the case, it’ll keep added pressure on prices here.”

Cash Prices Climb

Spot gas prices advanced Monday, led by gains in the West and parts of Texas, where late summer heat held strong to start the week.

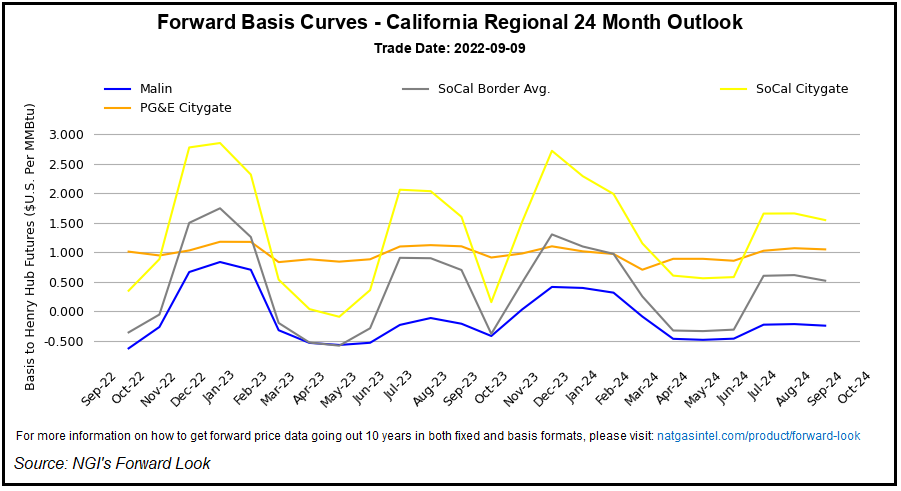

SoCal Citygate jumped 58.5 cents to $8.810 and PG&E Citygate spiked 85.5 cents to $9.665, leading an upward surge in California.

In the Southwest, KRGT Del Pool cruised ahead 78.5 cents to $8.555.

Meanwhile, in Texas, Katy climbed 23.5 cents to $7.515 and Houston Ship Channel rose 24.5 cents to $7.550.

As the week evolves, however, NatGasWeather said demand would be diminished by “a messy pattern” as “several weather systems track across the country with showers and comfortable highs of 60s to 80s.”

The firm sees hotter exceptions over Texas, the southern Plains and the Southwest deserts, with highs of 90s. California’s record breaking heatwave, which scorched the state much of the past two week, ended over the weekend. While still relatively hot inland to open the week with highs of 90s, NatGasWeather said, high temperatures will moderate by mid-week into the 80s.

“Overall,” the firm added, “light national demand this week due to limited coverage of highs into the 90s.”

Further out, “upper high pressure is still expected to expand and strengthen to rule much of the U.S.” by next week, “resulting in widespread above normal temperatures,” NatGasWeather said. “However, this late in the summer, this means perfect highs of 70s and 80s over much of the northern U.S. and why national demand is expected to be light.”

"gas" - Google News

September 13, 2022 at 04:08AM

https://ift.tt/kgsGmL0

Natural Gas Futures Extend Win Streak Amid Lingering Domestic, Global Supply Concerns - Natural Gas Intelligence

"gas" - Google News

https://ift.tt/2oaHOWI

https://ift.tt/3D0Wwg4

Bagikan Berita Ini

0 Response to "Natural Gas Futures Extend Win Streak Amid Lingering Domestic, Global Supply Concerns - Natural Gas Intelligence"

Post a Comment