As traders awaited the latest round of government inventory data, expected to show a below-average injection into U.S. stocks, natural gas futures hovered close to even early Thursday.

After plunging 30.3 cents in the previous session, the October Nymex contract was down 2.7 cents to $7.815/MMBtu as of around 8:50 a.m. ET.

Surveys ahead of the latest Energy Information Administration (EIA) storage report show expectations clustering around a build in the mid-50s Bcf. The 10:30 a.m. ET report covers net changes to U.S. natural gas stockpiles during the week ended Sept. 2.

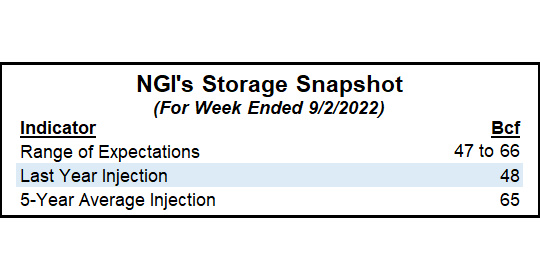

Results of Bloomberg’s survey showed a median injection projection of 56 Bcf, with estimates ranging from 47 Bcf to 66 Bcf. Reuters’ poll produced injection estimates that spanned 47 Bcf to 59 Bcf. It landed at a median of 54 Bcf. A Wall Street Journal tally found an average injection expectation of 56 Bcf, with a low estimate of 47 Bcf and a high of 66 Bcf.

In the comparable week last year, EIA printed an injection of 48 Bcf, while the five-year average injection is 65 Bcf.

EIA posted a 61 Bcf injection of gas into storage for the week ended Aug. 26, in line with expectations. The build raised working gas in storage to 2,640 Bcf. Still, stocks were 228 Bcf below year-earlier levels and 338 Bcf below the five-year average, EIA said.

For temperatures during this week’s EIA report period, “it was hotter than normal over much of the U.S. besides portions of Texas and the South, but even then, these areas were still quite warm with highs of 80s and 90s,” NatGasWeather told clients early Thursday. “We expect a build of 55 Bcf.”

As for overnight forecast trends, there were no changes to the timing of projected shifts in weather-driven demand over the next two weeks, according to the firm. Modeling advertised “just enough demand to prevent deficits from notably improving.”

Still, potentially more important to the market than weather trends in the coming weeks would be any “fresh news on when Freeport LNG will resume operations, and if Cheniere will be negatively impacted by environmental rulings on its turbines,” NatGasWeather.

Recent selling has given bears “some semblance of control for the first time in a month,” NatGasWeather added. The question heading into Thursday’s trading will be whether bears continue to send prices lower or if “bulls buy the dip, as they’ve done so often?”

From a technical standpoint, the October contract could be poised to continue heading lower absent quick intervention from bulls, according to ICAP Technical Analysis.

“I am not seeing any obvious signs of a bottom,” ICAP analyst Brian LaRose said ahead of Thursday’s trading. “Unless the bulls can promptly change that we will be taking aim at lower prices. Beneath $7.677 the next and nearest target I have is $7.122.

“Beneath $7.122 the door would be open for a dump to $6.744, $6.331-6.245-6.105,” or potentially lower.

"gas" - Google News

September 08, 2022 at 08:11PM

https://ift.tt/tuUJFe0

October Natural Gas Called Slightly Lower as Bears Take Breather Ahead of EIA Data - Natural Gas Intelligence

"gas" - Google News

https://ift.tt/Kw8iD7s

https://ift.tt/JTb6SE3

Bagikan Berita Ini

0 Response to "October Natural Gas Called Slightly Lower as Bears Take Breather Ahead of EIA Data - Natural Gas Intelligence"

Post a Comment