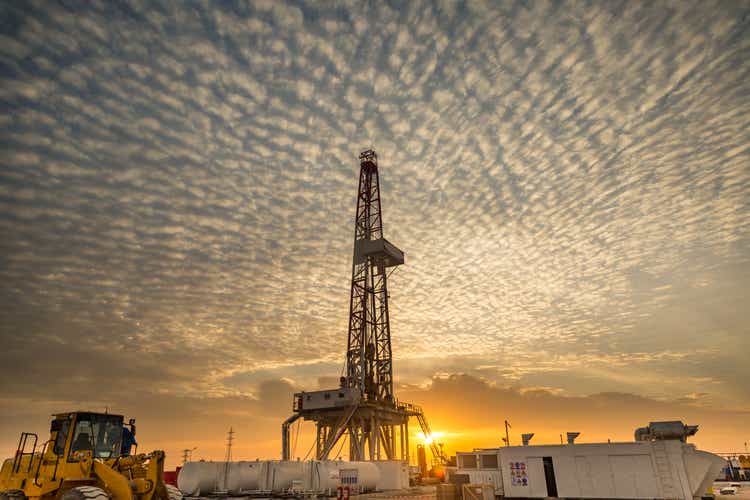

sasacvetkovic33/E+ via Getty Images

Diamondback Energy (NASDAQ:FANG) -1.7% post-market after reporting Q2 adjusted earnings that missed expectations while revenues fell 30% Y/Y to $1.92B, as energy prices fell from a year ago.

Q2 net income fell 60% Y/Y to $556M, or $3.05/share, from $1.42B, or $7.93/share, in the year-earlier quarter.

Diamondback (FANG) said Q2 production averaged 449.9K boe/day, as it drilled 86 gross wells in the Midland Basin and 12 gross wells in the Delaware Basin during the quarter, while its total average unhedged realized prices were $46.31/boe, well below last year's $79.49/boe.

Citing production outperformance so far this year as well as narrowing unit costs, Diamondback (FANG) said it raised guidance for full-year total production to 435K-445K boe/day from 430K-440K boe/day previously and for full-year oil production to 260K-262K bbl/day from its prior outlook for 256K-262K bbl/day.

The company also narrowed its full-year capital spending guidance to $2.6B-$2.675B from $2.5B-$2.7B previously, including $650M-$700M in Q3.

Diamondback (FANG) said it returned $473M of capital from stock repurchases and dividend to shareholders in Q2, representing 86% of the quarter's free cash flow.

More on Diamondback Energy:

"Oil" - Google News

August 01, 2023 at 03:56AM

https://ift.tt/mjr2oRa

Diamondback Energy's Q2 profit, revenues drop on weaker oil and gas prices (NASDAQ:FANG) - Seeking Alpha

"Oil" - Google News

https://ift.tt/ij4vl0W

https://ift.tt/MTyvCUh

Bagikan Berita Ini

0 Response to "Diamondback Energy's Q2 profit, revenues drop on weaker oil and gas prices (NASDAQ:FANG) - Seeking Alpha"

Post a Comment