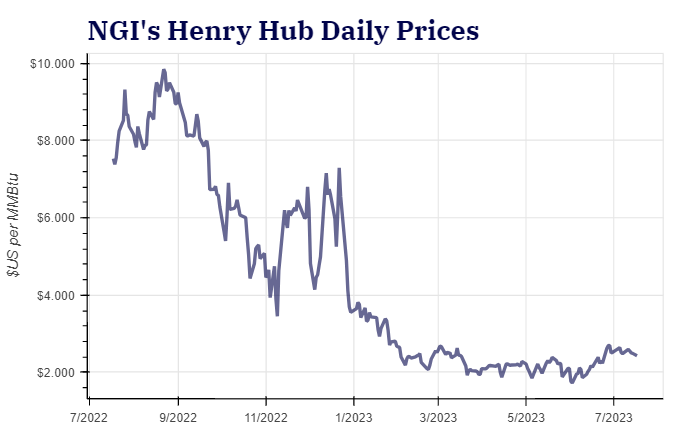

U.S. natural gas prices may be bottoming out, with more positive signs to the end of the year, according to several energy analyst teams previewing quarterly profits.

The top oilfield services (OFS) companies are set to roll out their second quarter 2023 results beginning this week, along with some midstream operators. In the next few weeks, a blizzard of reports by exploration and production (E&P) companies is set to follow.

Forecasts by several energy analyst firms point to capital expenditures (capex) holding steady to the end of the year, with potential upside for merger and acquisition (M&A) activity.

Look for Henry Hub gas prices to gain ground.

“Natural gas prices are expected to improve into the year‐end, and we see the potential for an aggressive buying...

"gas" - Google News

July 18, 2023 at 08:17PM

https://ift.tt/dOwU40u

Henry Hub Natural Gas Prices Rising and More M&A Likely, Energy Analysts Predict - Natural Gas Intelligence

"gas" - Google News

https://ift.tt/Rfy4lPH

https://ift.tt/wij6naD

Bagikan Berita Ini

0 Response to "Henry Hub Natural Gas Prices Rising and More M&A Likely, Energy Analysts Predict - Natural Gas Intelligence"

Post a Comment