- Climate change is making it costlier for oil and gas companies to operate.

- A growing number of U.S. industry executives expect U.S. oil production to peak within the next five or six years.

- Big Oil firms have started investing heavily in CCUS.

Rising sea levels, wild-fires, heat waves and extreme weather events are already wreaking havoc everywhere and could cost the global economy hundreds of billions of dollars in crumbling infrastructure, reduced crop yields, health problems, and lost labor. When most people think about climate change, the oil and gas industries tend to take the lion’s share of the blame due to their high levels of CO2 and GHG emissions. Few people, however, pause and consider that the same ecological fallout that is hurting communities is also taking a toll on the fossil fuel industry.

Climate change is making it costlier for oil and gas companies to operate. Indeed, climate-related?supply threats have already begun to manifest in the oil and gas industry, with more than 600 billion barrels equivalent of the world’s commercially recoverable oil and gas reserves, or 40% of total reserves, facing high or extreme risks. According to UK-based global risk and strategic consulting firm Verisk Maplecroft, the risk of?climate related events disrupting?the flow?of oil?to global markets?is highest in Saudi Arabia, Iraq and Nigeria.

This revelation is worrying considering growing signals of peak oil supply. A growing number of U.S. industry executives expect US. oil production to peak within the next five or six years while others think the peak will come much earlier, Expectations for another shale boom are quickly dying thanks to rising costs as well as limited supplies of labor and equipment hamstringing efforts by U.S. shale producers to quickly ramp up production.

Thankfully, the oil and gas industry is committing itself more to efforts aimed at slowing down climate change.

The Carbon Capture Opportunity

While trees and other plants naturally remove carbon dioxide from the atmosphere, most climate change experts now agree that we are just not capable of planting enough, fast enough, to limit the damage.

Carbon capture is one technology that has been proposed to limit global warming and climate change. Both the Intergovernmental Panel on Climate Change (IPCC) and International Energy Agency (IEA) consider carbon capture, utilization and storage (CCUS) an ideal solution for many hard-to-abate sectors such as aviation, hydrogen production and cement from fossil fuels. Related: Why U.S. Gas Production Is Growing So Fast

Unfortunately, the world has fallen woefully short when it comes to investing in CCUS: according to the International Energy Agency (IEA) there are only 35 commercial facilities globally that are applying CCUS to industrial processes, fuel transformation and power generation, with a total annual capture capacity of ~45?Mt?CO2. However, McKinsey estimates that global CCUS uptake needs to be 120x higher, rising to at least 4.2 gigatons per annum (GTPA) of CO2 captured, for the world to achieve its net-zero commitments by 2050.

Still, Big Oil is beginning to step up in a big way, even if it is, in the end, more of a way of extending life than contributing to a lessening of the effects of climate change.

Over the past few years, Big Oil firms have started investing heavily in CCUS, which many argue is simply Big Oil’s way of extending the life of oil and gas fields because captured carbon is used for enhanced oil recovery (EOR).

Two weeks ago, Exxon Mobil (NYSE:XOM) CEO Darren Woods told investors that the company’s Low Carbon business has the potential to outperform its legacy oil and gas business within a decade and generate hundreds of billions in revenues. Woods outlined projections showing how the business has the potential to hit revenue of billions of dollars within the next five years; tens of billions in 5-10 years, and hundreds of billions after the initial 10-year ramp-up. However, whether Exxon is able to actualize its goal will depend on regulatory and policy support for carbon pricing, as well as the cost to abate greenhouse gas emissions, among other changes, Ammann said.

Exxon believes that this will result in a "much more stable, or less cyclical" that is less prone to commodity price swings through predictable, long-term contracts with customers aiming to lower their own carbon footprint. For instance, Exxon recently signed a long-term contract with industrial gas company Linde Plc. (NYSE:LIN) that involves offtake of carbon dioxide associated with Linde’s planned clean hydrogen project in Beaumont, Texas. Exxon will transport and permanently store as much as 2.2M metric tons/year of carbon dioxide each year from Linde’s plant. Back in February, Linde unveiled plans to build a $1.8B complex which will include autothermal reforming with carbon capture and a large air separation plant to supply clean hydrogen and nitrogen.

SLB New Energy

Back in February, oil field services giant Schlumberger Ltd (NYSE:SLB) discussed its newly carved SLB New Energy unit with Bloomberg New Energy Finance (BNEF). According to SLB New Energy president Gavin Rennick, the unit is expected to hit revenue of $3 billion by the end of the current decade and at least $10 billion by the end of the next decade. SLB will focus on five key niches, each with a minimum addressable market of $10 billion.:

•Carbon solutions

•Hydrogen

•Geothermal and geoenergy

•Energy storage

•Critical minerals

Of these segments, Rennick says carbon capture, utilization and sequestration (CCUS) is the fastest growing opportunity thanks to the significant boost it got from the U.S. Inflation Reduction Act (IRA).

Occidental

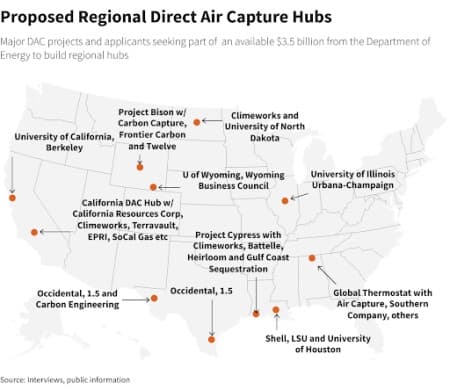

To achieve our climate goal, McKinsey has proposed the creation of CCUS hubs, essentially a cluster of facilities that share the same CO2 transportation and storage or utilization infrastructure. Currently, there are only 15 CCUS hubs across the globe; MckInsey estimates that there’s the potential to build as many as 700 CCUS hubs globally, located on, or close to, potential storage locations and Enhanced Oil and Gas Recovery (EOR/EGR) sites.

The U.S. government is currently backing four hubs, with two major Occidental Petroleum Corporation’s (NYSE:OXY) projects seen as strong contenders. The government is offering three levels of funding, ranging from $3 million for early stage feasibility studies to $12.5 million for engineering design studies to up to $500 million for projects ready to complete the procurement, construction and operation phases.

Swiss start-up Climeworks, which has raised more than $800 million to date, is among the most active CCUS firms so far.

Source: Reuters

McKinsey estimates that annual global investment in CCUS technology of $120 billion to $150 billion by 2035 is required for the world to achieve net zero. To scale the technology effectively, the firm notes that greater coordination across the value chain is necessary. Thankfully, large, incumbent energy giants appear keen to position themselves for what could be a multi-trillion-dollar industry as demand for fossil fuels cools off.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com:

Alex Kimani

Alex Kimani is a veteran finance writer, investor, engineer and researcher for Safehaven.com.

More Info"gas" - Google News

April 24, 2023 at 04:00AM

https://ift.tt/mSYDVhr

Oil & Gas In The Age Of Climate Change - OilPrice.com

"gas" - Google News

https://ift.tt/9jWvZlH

https://ift.tt/n83IbuM

Bagikan Berita Ini

0 Response to "Oil & Gas In The Age Of Climate Change - OilPrice.com"

Post a Comment