Natural gas futures continued to teeter-totter early Thursday amid little change in bearish near-term supply/demand balances. The June Nymex gas futures contract, marking its debut at the front of the curve, eventually settled 5.0 cents higher day/day at $2.355/MMBtu.

At A Glance:

- South Central tightening

- LNG demand fluctuating

- Cash off on mild temperatures

Spot gas, which traded Thursday for gas deliveries through Sunday, declined as national demand was expected to soften through the weekend before a series of weather systems hits the Lower 48 beginning Sunday to drive up heating loads. NGI’s Spot Gas National Avg. fell 16.5 cents to $1.990.

With no major changes in physical balances expected over the next two weeks, futures traders took their cue from the latest government inventory data. As expected, the Energy Information Administration’s (EIA) report showed an expansion in storage surpluses.

[How Will Natural Gas Continue to Decarbonize Transportation as EVs Enter the Fast Lane? Tune in to NGI’s Hub & Flow podcast for a deep dive into the evolution of transportation and the role natural gas is playing in it. Listen now.]

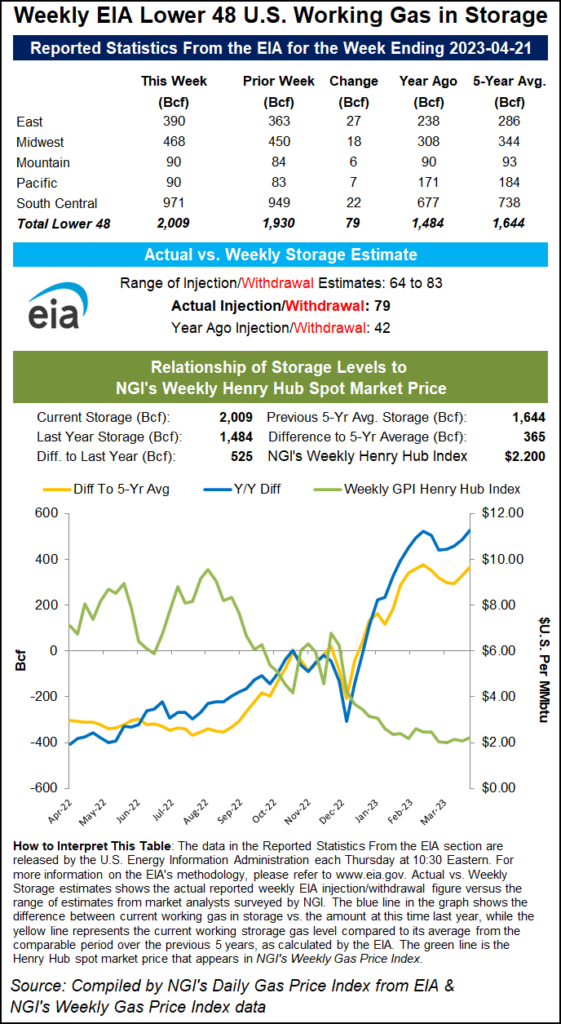

The EIA said stocks for the week ending April 21 rose by a slightly higher-than-expected 79 Bcf to 2,009 Bcf, which lifted the surplus over last year to 525 Bcf. The surplus to the five-year average swelled to 365 Bcf.

However, a closer look at the data showed continued tightening in the important South Central region. Stocks there increased by a net 22 Bcf, which included an 11 Bcf build in nonsalt facilities and a 9 Bcf build in salts, according to EIA. The agency noted that totals may not equal the sum of components because of independent rounding.

The net injection lifted regional inventories to 971 Bcf, which is about 32% above the five-year average. While still stout, South Central stocks were more than 38% higher than five-year average levels at the end of March. Notably, the latest EIA report was the sixth in a row in which the surplus in the South Central contracted.

Although 70-degree high temperatures have done little to bolster cooling demand in the region, robust LNG demand and a continued pull on natural gas for power generation in the low price environment have quickly tightened the balances. That said, maintenance events may keep flows to U.S. export terminals in check this spring.

For example, feed deliveries to Cameron’s liquefied natural gas facility dropped this week.

Earlier this month, Criterion Research LLC’s James Bevan, director of research, said he expected Cameron to take offline one train for planned maintenance during the second quarter. The decline in feed gas to Cameron lowered total deliveries to U.S. LNG terminals to around 13.8 Dth on Thursday, off from highs above 15 Dth/d last week.

“Fluctuating demand at Sabine Pass, Corpus Christi, Freeport and Calcasieu Pass have each contributed to supply falling 1.2 Bcf/d from weekend highs toward 13.7 Bcf/d,” said EBW Analytics Group’s Eli Rubin, senior energy analyst.

EBW continues to take the medium-term view that many analysts have “conservative” LNG exports pegged too low – and rising demand projections could be a bullish tailwind into the summer. In coming weeks, however, elevated maintenance expectations may increase daily fluctuations in demand.

“Still, weekly LNG demand remains near 100 Bcf/week and the seven-day LNG feed gas average is 1.9 Bcf/d above April 2022 volumes,” Rubin said.

Elsewhere throughout the Lower 48, storage inventories continued to balloon. The EIA said the East added a hefty 27 Bcf build to inventories, while the Midwest added 18 Bcf. Pacific stocks rose 7 Bcf.

Looking ahead to the next inventory report, participants in the online energy chat Enelyst estimated an injection in the 50 Bcf range, which would finally stall the growth in the surplus. For reference, EIA recorded a 72 Bcf injection for the similar week last year and the five-year average build for the period is 78 Bcf.

That said, with warmer weather expected by the middle of May, some Enelyst participants noted that the market could see the first triple-digit injection by that time.

To that end, Maxar’s Weather Desk (MWD) said above-normal temperatures continued to favor the Rockies, with the Central and Northern Plains likewise warming to above-normal levels in the 11- to 15-day timeframe. Below-normal temperatures should continue in California, where conditions are also wetter than normal, according to the forecaster.

The negative North Atlantic Oscillation was credited for the cooler conditions in the East in the long-range outlook, with the pattern also lending itself to cool weather in California and the Southwest. Meanwhile, the models projected a wetter-than-normal period for Texas, with the American model pointing cooler in the Lone Star State. There is also a risk that the eastern United States stays cooler for longer, MWD forecasters said.

“The resulting pattern appears largely devoid of fundamental demand nor any hints of early-season heat that could stir bullish market sentiment,” EBW’s Rubin said. “While forecast evolution can always shift the most-likely scenario, the current outlook does little to inspire a bullish short-term market call.”

Cash Sell-Off

With spot gas trading Thursday for the gas deliveries through the end of the month, discounts were steep across the country.

Some of the most pronounced declines were seen in California, where warmer weather is on the way. The National Weather Service (NWS) said a strengthening upper-level ridge across the West through Friday would lead to gradual warming of temperatures across the region.

Above-average temperatures should be most notable across the West Coast, where a few record high maximum/minimum temperatures could be tied or set on Friday. Temperatures in the Desert Southwest could exceed 100 degrees, slightly warmer than usual for this time of year. However, from the Rockies eastward, temperatures were forecast to be generally below normal for many areas through Friday.

As for prices, SoCal Citygate was still the highest in the country, but prices plunged $1.710 day/day to average $5.145 for Friday-Sunday deliveries. PG&E Citygate cash was down 71.0 cents to $4.035.

Steep losses extended into the Desert Southwest as well. KRGT Del Pool spot gas fell 58.0 cents on the day to average $2.245. In the Rockies, Northwest Sumas led the region with an 88.5-cent decline to $1.900.Most locations across Texas slipped by a few cents day/day, with similar shifts seen from the Midwest to Appalachia. Some locations posted sharper decreases in the East. Transco-Leidy Line was down 23.0 cents to $1.515, while Algonquin Citygate was down 36.5 cents to $1.720.

"gas" - Google News

April 28, 2023 at 05:07AM

https://ift.tt/5Ep80NH

Natural Gas Futures Up Slightly After EIA Storage Data Shows Ballooning Surplus - Natural Gas Intelligence

"gas" - Google News

https://ift.tt/hOqZiuv

https://ift.tt/AQb26H9

Bagikan Berita Ini

0 Response to "Natural Gas Futures Up Slightly After EIA Storage Data Shows Ballooning Surplus - Natural Gas Intelligence"

Post a Comment