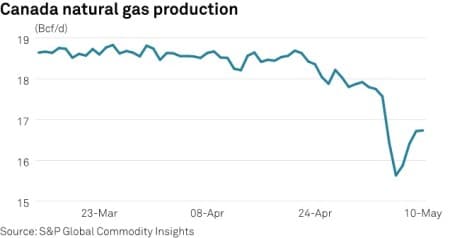

1. Canada Wildfires Curb Gas Output

- Canada’s ongoing state of emergency that was triggered by rampant wildfires across the province of Alberta is taking a heavy toll on gas production in the country, shedding some 15% from production levels in April.

- Seven oil and gas producers announced production curtailments totaling 319,000 barrels of oil equivalent per day, followed by shut-ins of gas processing plants.

- The decline in natural gas production has pushed Canadian gas prices higher in both Alberta and British Columbia, both up 60-70 cents per mmBtu compared to last week and trading around 2.5 per mmBtu.

- Simultaneously, Canadian gas exports to the US have dropped from 5.2 BCf per day to 3.9 BCf per day, and even though there has been some upside, supplies into the Pacific Northwest depend on the weather in Alberta.

2. Lithium Merger to Create Battery Metal Major

- The $10.6 billion merger of two lithium-focused mining companies, Australia’s Allkem and the US-headquartered Livent, is set to create the world’s third-largest lithium miner.

- Livent CEO Paul Graves will become chief executive of the new company, to be US-based and listed on NYSE, whilst Allkem’s non-executive chairman will be its chairman.

- The deal has buoyed shares of other lithium producers as more M&A deals are now on the table, in a bid to consolidate production lines and ease sourcing for EV carmakers globally.

-…

1. Canada Wildfires Curb Gas Output

- Canada’s ongoing state of emergency that was triggered by rampant wildfires across the province of Alberta is taking a heavy toll on gas production in the country, shedding some 15% from production levels in April.

- Seven oil and gas producers announced production curtailments totaling 319,000 barrels of oil equivalent per day, followed by shut-ins of gas processing plants.

- The decline in natural gas production has pushed Canadian gas prices higher in both Alberta and British Columbia, both up 60-70 cents per mmBtu compared to last week and trading around 2.5 per mmBtu.

- Simultaneously, Canadian gas exports to the US have dropped from 5.2 BCf per day to 3.9 BCf per day, and even though there has been some upside, supplies into the Pacific Northwest depend on the weather in Alberta.

2. Lithium Merger to Create Battery Metal Major

- The $10.6 billion merger of two lithium-focused mining companies, Australia’s Allkem and the US-headquartered Livent, is set to create the world’s third-largest lithium miner.

- Livent CEO Paul Graves will become chief executive of the new company, to be US-based and listed on NYSE, whilst Allkem’s non-executive chairman will be its chairman.

- The deal has buoyed shares of other lithium producers as more M&A deals are now on the table, in a bid to consolidate production lines and ease sourcing for EV carmakers globally.

- The world’s largest lithium miner Albemarle has already announced its interest in purchasing Australia’s Liontown for $3.7 billion, although the first offer was snubbed by the developer.

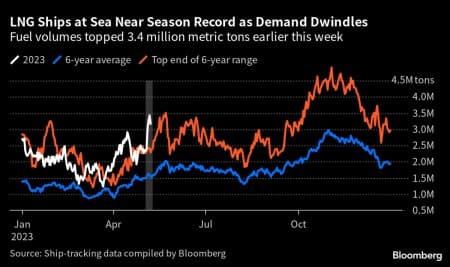

3. Weak European Gas Demand Leads to LNG Build-Up

- A prolonged shoulder season in Europe when heating season is already over, and hot weather is yet to materialize across the continent is keeping gas demand lukewarm.

- According to Bloomberg, the volume of LNG floating storage has jumped to the highest seasonal level since at least 2017, indicating difficulties with discharging cargoes.

- Similarly, the average speed of the global LNG vessel has declined in the past weeks, going from an average of 14 knots to 13 knots this April.

- The demand weakness led to Europe’s spot natural gas benchmark TTF dropping to the lowest reading since December 2021, breaching the €35 per MWh psychological threshold.

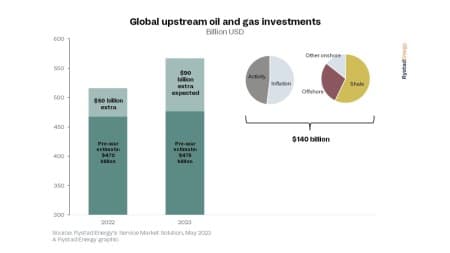

4. Oil & Gas Investments Soar

- The Russia-Ukraine war ratcheted up global investments into oil and gas upstream operations by $140 billion, with this year’s total climbing to the highest since 2014, at $565 billion.

- Shale production, especially in the United States, accounts for two-thirds of the investment increments as oilfield services soared 50% compared to pre-war levels and activity climbed 30%.

- Rystad Energy expects annual investments into renewables to surpass the oil & gas sector by 2025, with low-carbon industries slowing their pace of growth in 2023 due to high inflation.

- Service companies have been making most of the increased investments, with more than half of the increments being an increase in their profit margins, rather than actual activity.

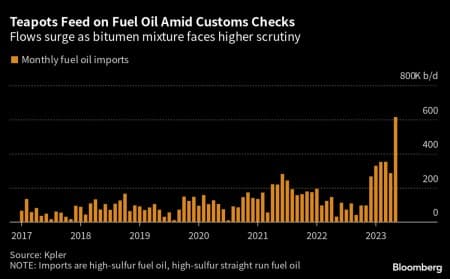

5. Deprived of Import Quotas, Teapots Binge on Fuel Oil

- According to Kpler data, imports of fuel oil into Chinese ports climbed to an all-time high of 580,000 b/d in April and are set to rise even higher in May as Shandong independents ratchet up purchases.

- The Chinese government is squeezing teapots, preferring state-owned oil refiners and private conglomerates with sizable refining capacity, allotting a much lower crude import quota allocation for them in 2023.

- The increase in imports comes even though customs authorities in Shandong province started conducting thorough checks in April, wary that Venezuelan and Iranian oil is masked as atmospheric residue.

- Chinese independent refiners have also greatly increased their purchases of Russian fuel oil, soaring almost tenfold year-on-year and becoming the largest buyer of it globally.

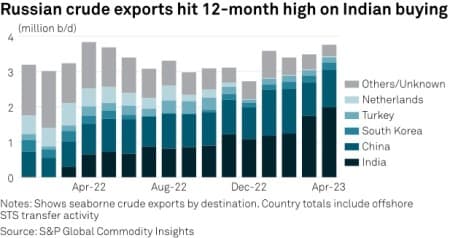

6. Indian Buying Lifts Russian Exports to Highest in a Year

- Despite Russia pledging to cut production by 500,000 b/d, seaborne exports from the country rose to a 12-month high in April and averaged 3.76 million b/d.

- India’s buying has been the main reason for such export strength, marking another record high as Indian refiners bought more than 2 million b/d of oil, approximately 40% of the country’s needs.

- Having classified oil production statistics, the Russian Energy Ministry claims it has already reached its target output level in April, averaging 10.6 million b/d.

- In contrast to stable flows to India, Chinese imports of Russian crude have fallen back after hitting a record high in March (2.4 million b/d), reflective of the overall lull in China’s market presence.

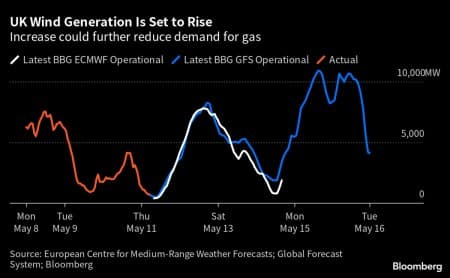

7. Revival in Wind Fortunes Squeezes Power Prices

- Apart from weak natural gas demand, Europe’s electricity prices are set to be influenced by unusually robust wind generation this upcoming week.

- Capacity factors for offshore wind in Europe have been relatively weak in the first 10 days of May, around 10-11% and a mere half of onshore wind, but that is set to change as windy weather is returning to the North Sea area.

- The benchmark for Northwest Europe, German power prices have been on a continuous decline since early April with peak-load electricity prices for June 2023 falling below €100 per MWh for the first time in months.

- Counteracting the current lull in demand, the EU’s Copernicus Climate service predicted a probability of more than 60% that Mediterranean countries will see temperatures well above average this year.

Editorial Dept

More Info"gas" - Google News

May 13, 2023 at 12:30AM

https://ift.tt/iQxY2RB

Global Investment In Oil And Gas Soars - OilPrice.com

"gas" - Google News

https://ift.tt/vndjgBY

https://ift.tt/yX85V9P

Bagikan Berita Ini

0 Response to "Global Investment In Oil And Gas Soars - OilPrice.com"

Post a Comment