Henrik5000/E+ via Getty Images

Co-authored with Long Player.

Natural gas has been an unexpected beneficiary of the green revolution. Even without that benefit, companies that supply major parts necessary for the natural gas business, like Chart Industries, Inc. (GTLS), report that business is booming and that booming business is very likely to continue.

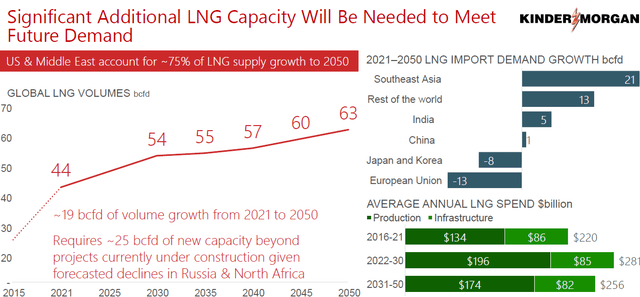

Kinder Morgan Feb 2023, Shareholder Presentation

Natural gas was so cheap that it was the preferred fuel for a long time. But natural gas is also used for other products. For example, ethane (to make ethylene) and propane (to make propylene) are used to make plastic, which has a huge role in the green revolution. Natural gas is also the preferred raw material for the rapidly growing hydrogen market.

The result of all of this is that even if natural gas as a fuel use were to decline, there are so many other uses for natural gas that the use of the gas is projected to grow for the foreseeable future. Furthermore, the midstream industry is fully prepared to participate in that future. This midstream industry, which transports and stores natural gas products, is already edging into parts of the cracking process (or steps) that change ethane to ethylene and propane to propylene. It will not take a lot of encouragement for the midstream segment to edge further into the process.

When the time comes, the industry is fully prepared to transport hydrogen. Right now, that is not a consideration, but the knowledge is available to build pipelines that can transport hydrogen when the time comes.

A few months back, Vicki Holub, CEO of Occidental Petroleum Corporation (OXY), surprised the market by stating that using carbon dioxide to enhance the recovery in unconventional wells could triple (very roughly) the recovery of oil from unconventional wells. The unconventional part of the business is a relatively young business. Furthermore, the United States has many times the unconventional (potential) reserves of the conventional business. So, there is still a lot of oil to be recovered, as well as some formations we still do not know how to recover oil from. It is going to be a very long time, probably centuries, before we run out of oil.

For years, I used to go to geological presentations, and every single one stated that the industry had recovered less than 5% of the earth’s reserves. I believe technology will continue to advance as it has in the past to enable us to recover more natural gas at a reasonable cost for centuries to come.

In the meantime, there is a way for income investors to participate in this boom and enjoy growth. The midstream industry has long been a relatively low-cost way to participate in the continuing natural gas boom. This industry has long been considered the utility of the natural gas industry because of its relative safety. Most midstream companies have take-or-pay provisions to limit the downside when upstream cycles lower. This limits earnings volatility and makes the stock price more stable. The great thing about investing in midstream companies is that most pay hefty yields, often 8% or more. That is great news for investors who are looking for recurrent income.

Pick #1: Hess Midstream – Yield 7.9%

Hess Midstream LP (HESM) is a fee-based, growth-oriented, midstream company that owns, operates, and develops a diverse set of midstream assets. It owns oil, gas, and produces water-handling assets that are primarily located in the Bakken and Three Forks Shale plays in the Williston Basin area of North Dakota.

Also, Hess Midstream takes care of the Bakken operation of its sponsor Hess Corporation (HES). Hess Midstream was established as a separate entity to provide cash flow for Hess Corporation in case that was needed until the Guyana Partnership began to produce positive cash flow. The strong commodity prices of the fiscal year 2022 enabled that partnership to cash flow probably earlier than many expected.

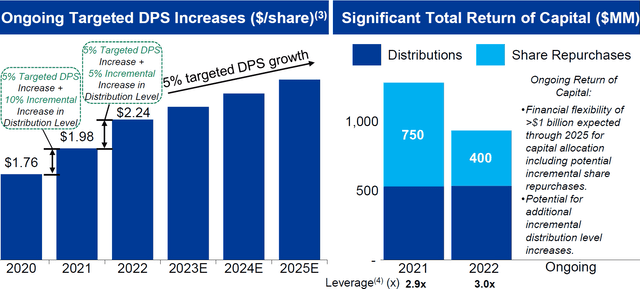

In the meantime, the partners wanted HESM to be attractive to investors. To do this, HESM hikes its distribution every quarter, which is a big plus for income investors! The latest increase was at an annual increase rate well above their 5% growth target. The company also continues to repurchase its own shares to reduce the number of shares outstanding. This is another move that adds value to investors.

HESM is a very attractive investment. Generally, its management keeps the debt ratio nearer to 3, which is a very conservative midstream ratio, and some of the lowest in the industry. The distribution coverage is big – closer to 1.6, which makes it safer. Both of those ratios have room for more stock or unit repurchases and distribution hikes in the future. Currently, management is guiding to continue to increase the distribution quarterly at a 5% annual rate for the next few years.

The main customer is its partner Hess Corporation, which is the smallest partner in the Guyana discoveries. As such, Hess has an interest in a very profitable world-class project. Finances are no longer a worry as a result. The Bakken operation is another cash flow source to help service the offshore discoveries should that cash flow be needed. Hess Midstream is growing by servicing more and more of the Hess Bakken needs. Currently, that strategy enables about a 5% per year growth for the foreseeable future.

The common units currently yield 7.9%. The latest distribution declared is $0.5851 – an increase of 2.7% for an annual rate of $2.34 per share. We expect them to hike every quarter as they have done in the past.

Hess Midstream Presentation March 2023

The valuation of Hess Midstream based on EV/EBITDA (or enterprise value to projected EBITDA) is around 10 times, which is cheap and very attractive for a growing midstream company with a well-covered distribution.

The share repurchases have enabled growth per share to exceed the business growth in the past. That is likely to continue into the future. Hess Midstream is a great investment for those who like high yields plus growth. Those distributions keep growing!

HESM has converted into a C-Corp as of 2020. Shareholders will receive a form-1099 for tax purposes

Pick #2: Crestwood Equity Partners – Yield 10.5%

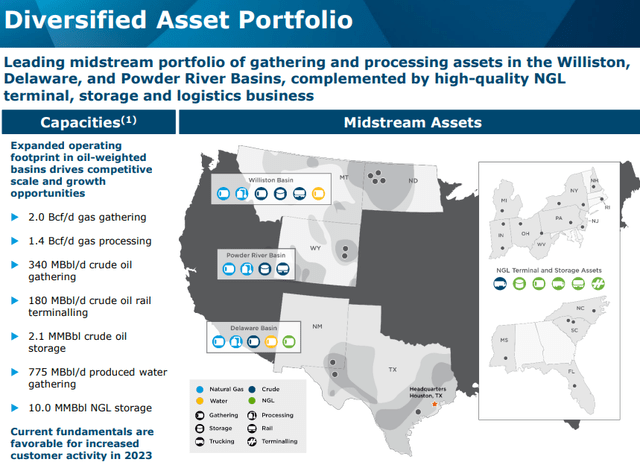

Crestwood Equity Partners LP (CEQP) is a midstream company primarily operating in the Bakken, the Delaware, and Powder River Basins. This partnership has both oil and natural gas business, with natural gas being a big part of their operation, and the ability to grow both in the future. Crestwood began its existence by getting into relatively new basins first (for the most part). But as time has gone on, the company has watched its operators get acquired and has dealt with any problems before those problems became noticeable. So the list of operators serviced has overall matured from the early days of the pipeline.

Crestwood Equity Partners March 2023, Investor Presentation

Crestwood Equity Partners is primarily involved in three basins. Two of those basins are growing significantly in the future, the Delaware and the Powder River Basins. The Bakken (within the Williston Basin), on the other hand, is expected to experience steady demand for midstream services for the foreseeable future. The business does have sufficient diversification.

The company’s debt ratings are a little below investment grade. But are highly satisfactory for a midstream company. The leverage ratio is 4.0x and the distribution coverage ratio is 1.5x.

CEQP reported Q1 earnings on May 2nd. Its net income of $41.6 million, compared to $22.2 million in the first quarter of 2022, is an increase of 87% year-over-year. Adjusted EBITDA increased 11% year-over-year.

Because this company is smaller, the expansion projects and occasional sales of parts of the pipeline system generally are more significant for a company of this size. This company can and usually will grow faster than most midstream companies. Crestwood Equity Partners has a $2.62 dividend that will likely be raised soon. The dividend is at a whopping 10.5% yield.

For risk-averse investors who prefer lower price volatility, we like Crestwood's preferred stock (CEQP.P) as a solid investment with a fabulous yield of 9.4%. CEQP.P is a great preferred stock to own for safer recurring income! It is preferred stocks like this that we like to target for the 'High Dividend Opportunities' Portfolio!

Note that CEQP issues a Schedule K-1 at tax time.

Summary

The midstream industry is currently out of favor, but is gradually returning to favor as one of the better performers in the current market. Still, many midstream companies offer a distribution equal to the rate many investors report for total long-term annual returns. Any growth is icing on the cake that is far less risky as a midstream company than upstream.

It should be noted that the capacity to transport oil and gas is getting tight to the point where requests are starting to come in for more capacity. Both companies have well-covered distributions. Now, the question remains if there is enough liquidity to fund customer transportation requirements once projects get past the planning stage to the construction stage.

The market changed from selling stock to fund the capital part of new projects to a demand for companies to self-fund growth projects. Therefore, capital retained has to meet the customer demands of the business sufficiently. This is likely to be the first cycle where that is put to the test. Both companies appear to be in good shape to meet that demand.

We believe every investor should have exposure to natural gas, as we do in our "model portfolio" that our members can use as a base for their investments. This portfolio currently yields +9%. With natural gas being the unexpected beneficiary of the green revolution, it is time to get exposure if you have not done so yet. And you can do it with big yields, enjoying both income and probable growth in your retirement portfolio!

"gas" - Google News

May 17, 2023 at 06:35PM

https://ift.tt/opqQd4I

Natural Gas Demand Is Booming: 2 Great Yields To Buy - Seeking Alpha

"gas" - Google News

https://ift.tt/PkqNYEa

https://ift.tt/mbwxYNf

Bagikan Berita Ini

0 Response to "Natural Gas Demand Is Booming: 2 Great Yields To Buy - Seeking Alpha"

Post a Comment