Amid lower-than-expected heating demand this winter, the Energy Information Administration (EIA) said Tuesday it is raising its projected end-March storage carryout to more than 1.9 Tcf, a 27% increase compared to projections issued in January.

A 1.9 Tcf end-March carryout would also represent a 23% surplus to the prior five-year average, EIA said in its updated Short-Term Energy Outlook.

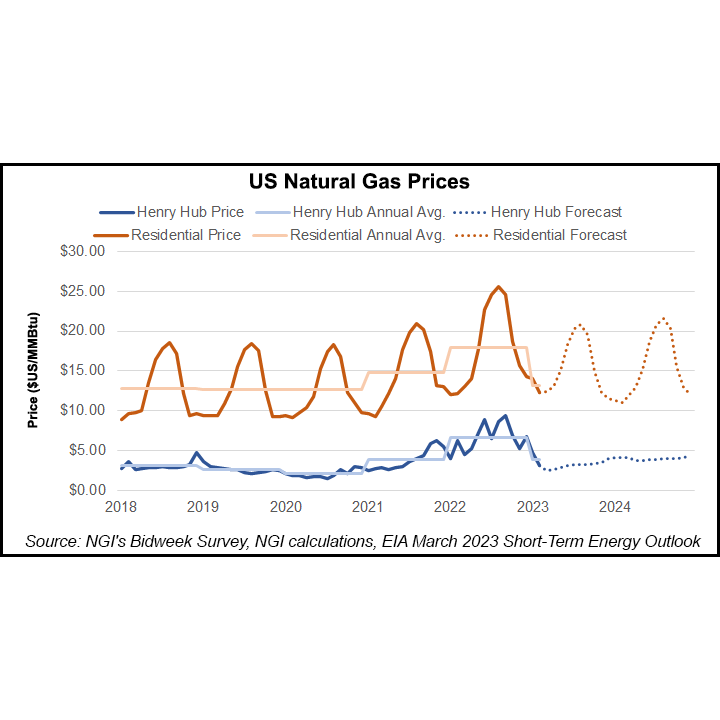

EIA said it now expects Henry Hub to average around $3/MMBtu in 2023, down 50% year/year. Perhaps unsurprisingly given the precipitous downward trajectory natural gas futures have traced this winter, EIA’s latest Henry Hub outlook reflects a hefty 50% discount versus January forecasts. Last month, EIA modeled an average Henry Hub spot price of $3.40 for 2023.

Henry Hub spot prices averaged $2.38 in February, the lowest monthly average since September 2020, the STEO data show.

In terms of domestic consumption, residential/commercial demand for natural gas is on track to decline 11% year/year in the first quarter on mild winter temperatures — historically mild, in fact, according to the agency.

“Preliminary data from the National Oceanic and Atmospheric Administration for January and February indicate the first two months of 2023 may be close to the warmest on record for that period in data going back to 1895,” researchers said. “The mild weather was concentrated in the eastern part of the United States.”

EIA said it expects residential/commercial demand to average near 32 Bcf/d in March, close to the five-year average, with heating degree days expected to total closer to historical norms for the month.

Total U.S. consumption is set to average 99.1 Bcf/d in 1Q2023, down 5% from 1Q2022 levels, according to the latest STEO.

Despite lowering its Henry Hub forecast in the latest STEO, EIA said it still expects rising prices in the coming months as the Freeport LNG terminal’s roughly 2 Bcf/d of capacity comes back online and drives an increase in export demand.

Also contributing to upward pressure on prices will be “seasonal increases in natural gas demand in the electric power sector,” researchers said. “In addition, we expect natural gas production will be relatively flat for the rest of 2023 as producers reduce drilling in response to lower prices.”

Once all three Freeport trains are back in service, U.S. liquefied natural gas exports are forecast to surpass 12 Bcf/d “in most months for the rest of the forecast period” and reach 14 Bcf/d by December 2024, according to EIA.

Meanwhile, plummeting natural gas prices are expected to put downward pressure on wholesale electricity prices in 2023, the agency said.

“In addition, increasing electricity generation from renewable sources contributes to lower power prices,” researchers said.

"gas" - Google News

March 08, 2023 at 04:48AM

https://ift.tt/G1ehikL

EIA Cuts Henry Hub Forecast as January, February Possibly Warmest on Record - Natural Gas Intelligence

"gas" - Google News

https://ift.tt/n7Ejba3

https://ift.tt/pgq6I3F

Bagikan Berita Ini

0 Response to "EIA Cuts Henry Hub Forecast as January, February Possibly Warmest on Record - Natural Gas Intelligence"

Post a Comment