bymuratdeniz

Vista Energy (NYSE:VIST) is up 59% since we wrote about it recently in an article exclusive to Seeking Alpha. Although this is a huge move, we believe this is a strong company and would add to the position on any dips. We will explain why in this follow up.

Macro Background

Oil markets are complex, because the consumers of Oil are mostly in Western modernized societies, and the Oil deposits are mostly in undeveloped, sometimes authoritarian regimes. Money markets are also complex, adding to the mystery of why inflation was so bad since the War in Ukraine started. But the economic action is simple, by removing the largest supplier in the market (Russia) it forced buyers to seek Oil elsewhere, driving up the price. Or in other words, the Sanctions are the main driver of inflation domestically in the US, according to Money.com:

The crisis in Ukraine has the potential to drive the inflation rate over 10%, according to an analysis by consulting firm RSM. The price of oil could rise to $110 per barrel, which — combined with the spillover impact on natural gas prices, consumer confidence and uncertainty — could push the rate of inflation 2.8 percentage points above where it is now, according to the firm. Financial markets are worried about a disruption in the supply of oil to markets, driving up the price of that oil, says Joseph Brusuelas, chief economist at RSM.

Russia is one of the world’s largest oil and gas producers, and any snags in those industries will be felt across the globe in the form of higher energy prices. “Those prices are then passed along to consumers downstream,” Brusuelas says. “So anyone who buys heating oil for their homes, or puts gasoline in their cars, or flies on a jet for business or personal reasons is going to feel the pinch.”

Vista Energy is a net beneficiary of this situation because they are an American company (operating in North and South America) and have been able to provide an alternative to thirsty Western consumers. Gas prices have returned to pre-War levels in many states, and Oil markets themselves have stabilized. Vista should remain a strong alternative going forward, or in other words, it doesn't look like the situation with Russia is going to be unwound anytime soon.

Energy Diversity

What's great about Vista Energy is that it's not just an Oil company, although Oil remains the leading source of revenues. They have projects using Solar, Biomass, Wind, and Thermal projects, as well as LNG.

Vistaenergylp.com

Vista Energy is taking a proactive approach to being more than just an Oil and Gas company, by pursuing projects in Wind, Solar, and Biomass. The fact is that operating an Oil and Gas facility is complex, and they are taking that operational experience to other sectors of energy. Each of these sustainable alternatives is a paradigm shift for a company like Vista, that is part of the "Big Oil" energy establishment, and a positive shift toward a sustainable future.

Typically, investors need to invest in private equity funds or venture capital funds in order to access sustainable investment opportunities. Here, investors only need to buy the stock. That's what separates Vista from some of their peers. But that's not the only thing, they do a great job of managing their Oil properties as well. Vaca Muerta remains to be the 2nd largest shale resource in the world:

Vista, Argentina's third-largest oil producer and the bloc's operator, will foot 75% of the costs and retain 75% of rights over the output. The companies have also extended by twelve months a prior crude and oil purchase agreement, under which Vista will sell Trafigura 380,000 barrels of crude per month during the first half of 2023, and 345,000 per month during the second half. Vista said the deal would help it shore up cash to accelerate its investment in infrastructure at Vaca Muerta, reduce its debt and return capital to shareholders through buy-backs or dividends.

This isn't new information, this is why the stock is up. Our point is that Vista is sitting on a strong foundation and leaves little room for investors to stay away.

Company-specific metrics

On March 3rd, Vista released numbers which although they missed by .25c - were overall fantastic. From Seeking Alpha:

- Vista Energy, S.A.B. de C.V. press release (NYSE:VIST): FY GAAP EPS of $2.75 misses by $0.25.

- Revenue of $1.15B (+76.4% Y/Y) in-line.

- Now Read: Vista Energy, S.A.B. de C.V. (VIST) Q4 2022 Earnings Call Transcript

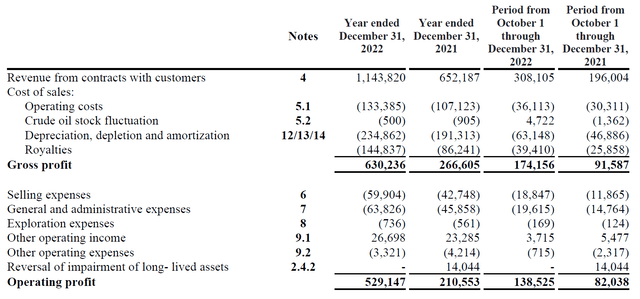

+74.4% Year on Year growth is amazing. Companies dream about having growth like that. And so it's not surprising that Vista stock is up too. Take a look at granular financials (for some of us, who look at this all day - this will be meaningful):

Vista Energy

This image and more can be obtained from their financial report recently released, titled Unaudited interim condensed consolidated financial statements as of December 31, 2022 and 2021, and for the years and for the three-month periods ended December 31, 2022 and 2021.

If you compare these results with some of Vista's peers, Vista stands out from the rest. In terms of comparing apples to apples, competitors of Vista Energy include Par Pacific (PARR), Earthstone Energy (ESTE), Crescent Energy (CRGY), Talos Energy (TALO), Hess Midstream (HESM), Dorchester Minerals (DMLP), Vermilion Energy (VET), Kimbell Royalty Partners (KRP), Vital Energy (VTLE), and Callon Petroleum (CPE). Take any one, let's pick Par Pacific - Y/Y growth is more like 55%, according to SA.

And there are sellers in the market, who are speaking about their sales, such as this SA author.

Talos Energy, their growth is only 32% Y/Y - and KRP is 59%.

The industry / peer average is 49%, so 76.4% really sticks out. This is just another reason why we like Vista Energy, and probably why the stock has done so well in recent markets (which hasn't been too friendly to most stocks).

Conclusion

Although the stock has appreciated a lot, we believe that there is room to go higher. We suggest to buy on dips to accumulate a position in Vista Energy stock, and stick with it. Compared to other energy stocks, Vista emerges as a real leader.

"Oil" - Google News

March 09, 2023 at 08:57AM

https://ift.tt/ajRl8PU

Vista Energy: A Rare Find In The Crowded Oil Space (NYSE:VIST) - Seeking Alpha

"Oil" - Google News

https://ift.tt/C8dpZ9B

https://ift.tt/cHkG9uF

Bagikan Berita Ini

0 Response to "Vista Energy: A Rare Find In The Crowded Oil Space (NYSE:VIST) - Seeking Alpha"

Post a Comment