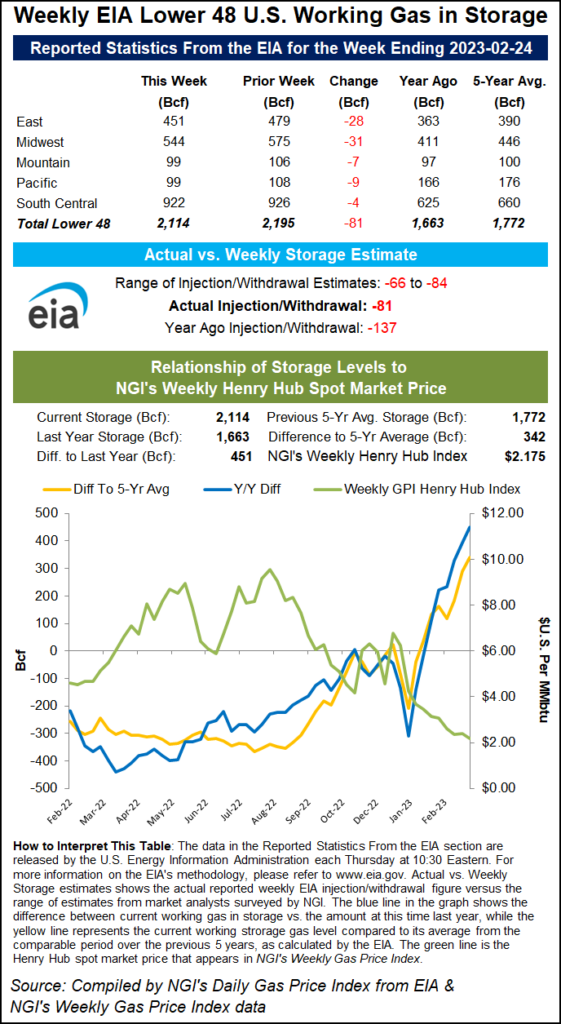

Utilities pulled 81 Bcf of natural gas from storage for the week ended Feb. 24, the U.S. Energy Information Administration (EIA) reported Thursday. The result proved slightly steeper than forecasts but anemic relative to averages, driving Nymex natural gas futures into the red.

Ahead of the 10:30 ET release, the April futures contract was essentially flat around $2.810/MMBtu. The prompt month lost a penny from the prior day’s close to $2.801 when the EIA data was posted.

By around 11 a.m. ET, it was off 3.5 cents on the day at $2.776.

[It’s Called the Wild West for a Reason: Tune into NGI’s Hub & Flow podcast as they dive into what’s driving record-high natural gas prices in California. Listen now.]

Prior to the report, NGI modeled a 76 Bcf pull, and major surveys also found expectations for a draw in the 70s Bcf. A Reuters poll showed withdrawal estimates ranging from 66 Bcf to 84 Bcf, with a median pull of 76 Bcf. Bloomberg’s survey found a narrower span of estimates and landed at a median draw of 74 Bcf. A Wall Street Journal survey ranged from draws of 66 Bcf to 78 Bcf and showed an average draw of 74 Bcf.

EIA recorded a 137 Bcf withdrawal for the year-earlier period, while the five-year average pull was 134 Bcf. Thursday’s print marked another in a long string of bearish storage results in 2023 amid seasonally mild weather and strong production.

“It was much warmer than normal over the southern and eastern U.S., while cool to cold versus normal over the West and Plains,” NatGasWeather said of temperatures during the EIA report period. The firm had projected a draw of 78 Bcf.

The latest withdrawal left inventories at 2,114 Bcf, well above the year-earlier level of 1,663 Bcf and the five-year average of 1,772 Bcf.

By region, the Midwest and East led with pulls of 31 Bcf and 28 Bcf, respectively, according to EIA. Pacific inventories fell by 9 Bcf, while Mountain region stocks declined by 7 Bcf. The South Central decrease of 4 Bcf followed and included a 3 Bcf pull from nonsalt facilities and a 1 Bcf decrease in salts.

Looking ahead to the next EIA print, analysts are expecting a result in the ballpark of the latest result. This would leave storage at a substantial surplus to the five-year average.

“It will be up to a cold March pattern” to force steeper draws “or surpluses will remain over 300 Bcf going into April,” NatGasWeather said.

Early estimates submitted to Reuters for the week ending March 3 ranged from withdrawals of 63 Bcf to 83 Bcf, with an average decrease of 75 Bcf. That compares with an actual decrease of 126 Bcf during the similar week last year and a five-year average decline of 101 Bcf.

"gas" - Google News

March 02, 2023 at 11:22PM

https://ift.tt/PbxR7mD

Weak Winter Storage Withdrawal Sends Natural Gas Futures Lower - Natural Gas Intelligence

"gas" - Google News

https://ift.tt/RhYFDJx

https://ift.tt/3AFoONt

Bagikan Berita Ini

0 Response to "Weak Winter Storage Withdrawal Sends Natural Gas Futures Lower - Natural Gas Intelligence"

Post a Comment