Oil prices were relatively steady early on Friday morning as inflation fears and rising inventories battled with optimism regarding China's rebounding economy. Then rumors began to circulate that the UAE was considering leaving OPEC and oil prices dropped dramatically.

Oilprice Alert: Whether you are new to the oil and gas industry or an energy market veteran, you will regret not signing up for Global Energy Alert. Oilprice.com's premium newsletter provides everything from geopolitical analysis to trading analysis, and all for less than a cup of coffee per week.

Friday, February 24th, 2023

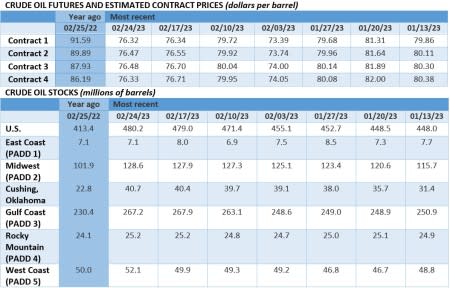

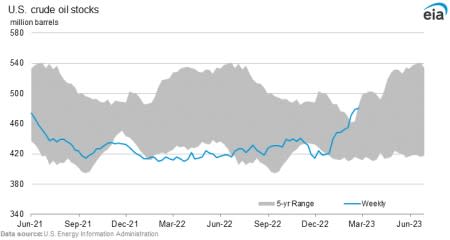

China’s economic rebound has been the main bullish factor for oil prices this week, after the country’s PMI index surged to 52.6 in February, the highest reading since April 2012 and a sign of industrial activity coming back to life. The China bulls had buoyed oil markets to such an extent that their sentiment overshadowed growing inflation fears in the European Union and rising U.S. inventories. Then, on Friday morning, the Wall Street Journal reported that the UAE had debated leaving OPEC and boosting production, which sent oil prices falling.

US Eyes SPR Refill Soon. The US Department of Energy is seeking to start purchasing oil to partially refill the Strategic Petroleum Reserves depleted by rounds of releases across 2022-2023, with top officials indicating it might buy 40-60 million barrels within the next year, depending on market conditions.

Saudi Aramco Eyes LNG Investment Abroad. The Saudi national oil company Saudi Aramco (TADAWUL:2222) is reportedly considering a major investment into LNG facilities outside of the kingdom, seeking to secure an offtake agreement after its 2019 deal with Sempra fell over.

Energy-Related CO2 Emissions Hit Record High in 2022. The International Energy Agency stated that energy-related CO2 emissions rose to a record high of 36.8 million tonnes last year, up 0.9% compared to 2021, led by increases in coal and oil, with their year-on-year hikes coming in at 1.6% and 2.5%, respectively.

The Last Hurrah of Iranian Nuclear Diplomacy. The head of the International Atomic Energy Agency Rafael Grossi will travel to Iran to meet with Iranian president Ebrahim Raisi in an attempt to find common ground with Tehran after the IAEA found traces of 84% enriched uranium at the Fordow nuclear plant.

Glencore Fined $700 Million in Bribery Case. The US District Court in Manhattan ordered global trading major Glencore (LON:GLEN) to pay a $700 million fine after its guilty plea over a decade-long scheme to bribe foreign officials in countries like Nigeria, Venezuela, or DRC to win deals and avoid audits.

Brazil Starts Taxing Oil Exports. As Brazil seeks to mitigate the effect of its recent decision to reintroduce transportation fuel taxes waived by the Bolsonaro government, the Lula administration will levy a 9.2% tax on oil exports for the next four months to ease the 38 billion budget deficit expected for 2023.

Chevron’s Venezuela Upside Capped by Politics. US oil major Chevron (NYSE:CVX) has ramped up production from its Venezuelan joint ventures to 90,000 b/d, almost double its 2022 average, although CEO Mike Wirth believes political risks are capping further output upsides.

Pemex’s Flaring Problems Get Worse Despite Publicity. In one of the most flagrant cases of excessive gas flaring, Mexico’s state oil company PEMEX increased the extent of burning at its major Ixachi field to an estimated 1.3 BCf despite publicly pledging to cut down on the practice last year.

China Finds More Oil in Bohai Sea. China’s state-owned offshore driller CNOOC (HKG:0883) discovered an oilfield with estimated reserves of almost 800 million barrels of light crude in the Bohai Sea along the country’s northern coastline, however complex geology means only a fraction of those reserves might be recovered.

EPA Wants Higher Ethanol Mandates in US Midwest. The US Environmental Protection Agency proposed a rule that would allow for sales of E15 gasoline in Midwest states, with the 15% ethanol content requirement set to lower gas prices and provide farmers with higher demand from the oil industry.

Norway Buys Up North Sea Fields. Only days after Norway’s state oil and gas company Equinor (NYSE:EQNR) bought stakes in five fields from Wellesley, it is reportedly nearing a deal to buy Suncor’s (NYSE:SU) assets in the UK North Sea for a reported sum of around $1 billion.

Oman to Launch New Licensing Rounds. Oman is preparing to launch an oil and gas licensing round by the end of March, with the first round of concession areas comprising both tested discoveries and untapped areas onshore whilst the second round will focus on offshore zones exclusively.

Cenovus Expands US Downstream Presence. Canadian oil firm Cenovus Energy (NYSE:CVE) has finalized its purchase of BP’s (NYSE:BP) 160,000 b/d Toledo refinery in Ohio for $370 million even though a 2022 fire has forced the refinery offline, taking its total downstream refining capacity to 740,000 b/d.

Lured by Copper Prospects, BHP Courts Argentina. The world’s largest miner BHP (ASX:BHP) is eyeing investment opportunities in Argentina’s copper sector as its top officials were meeting with the governor of the San Juan province, expanding copper exposure after the acquisition of OZ Minerals.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com:

Read this article on OilPrice.com

"Oil" - Google News

March 03, 2023 at 10:00PM

https://ift.tt/kRiG57z

Oil Prices Fall On Rumors Of An OPEC Split - Yahoo Finance

"Oil" - Google News

https://ift.tt/z3hplYB

https://ift.tt/tWSGF1y

Bagikan Berita Ini

0 Response to "Oil Prices Fall On Rumors Of An OPEC Split - Yahoo Finance"

Post a Comment