Brandon Bell

Occidental Petroleum's (NYSE:OXY) stock is finally getting interesting again. OXY spent most of the last 12 months at a historically high stock price. For the last five of those months, the price was too high given what was happening with the price of oil. The price of WTI oil began falling in July, bottoming out at $66 earlier this month. For most of the period when this fall in the price of oil was occurring, OXY didn't move much at all, remaining at a stock price that would seem to imply either positive or at least flat 2023 earnings. Such a stock price would be questionable since oil has fallen enough that 2023 earnings will likely fall too. I held some OXY shares last year, but I sold them after noting this discrepancy in the stock's price and the price of oil.

Today, however, OXY is back at March 2022 prices-it might be a buy here. The current stock price ($62) is close to the level I entered at last year ($59), albeit on lower oil prices. I do not think that the stock is as good of a buy as it would be with early 2022 oil prices, but it's still much cheaper than it was late last year.

In fact, on balance, I consider Occidental Petroleum a slight buy today. I think people buying today will do reasonably well, and I'd personally consider buying again at $55. In the ensuing paragraphs, I'll explain my moderately bullish thesis on OXY stock.

Oil Will Likely Recover

One big reason why OXY will likely perform well is because oil prices will probably rise from today's levels.

When I covered oil last year, I was careful to note that oil prices would probably fall from their peak levels (about $123 WTI Crude), but I observed that they would still be pretty cheap even with lower oil prices. In 2021-when oil prices were similar to today's levels-OXY had $8.09 in free cash flow per share. Take today's stock price ($62) and divide it by 2021's FCF, and you still get a 7.66 price/FCF ratio, which is cheap. So, Occidental Petroleum doesn't need 2022-level oil prices to be a good value at today's prices. Even 2021's prices could produce enough FCF for a satisfactory investment result. That's before even thinking about other factors OXY has going for it that could juice results in 2023, like the $10.5 billion worth of debt it repaid last year.

So, even without oil prices rising, there's a case to be made that OXY is worth buying right now.

With that being said, I think there is a decent case to be made that oil will, in fact, rise from today's levels, making OXY more valuable than in the conservative scenario discussed above. There are three main observations that lead me to this conclusion:

-

OPEC is cutting output this year. In January, for example, output fell 50,000 barrels per day from December.

-

China is re-opening. In December, China ended all of its previous COVID curbs, and that brought some demand back.

-

The U.S. possibly replenishing the Strategic Petroleum Reserve. On March 2, the Department of Energy reported that it was prepared to start re-buying oil after selling it from the SPR in 2022. Such a purchase program would create extra demand and likely push the price of oil upward.

So, there are plausible reasons to think that oil will rise from today's levels. That would be very bullish for OXY. And, as you're about to see, OXY could actually benefit more from high oil prices than other oil companies would.

OXY's Business Mix - Perfectly Positioned to Capitalize on Higher Oil

One of the big advantages OXY has over other oil companies is the fact that it's a pure-play E&P company. It has no refining operations and is only minimally involved in midstream. Selling crude oil is the most lucrative energy activity when oil prices are rising. So, OXY's focus on that one activity could benefit it in a scenario where oil prices rise.

Let's compare OXY to two of its larger competitors: Exxon (XOM) and Chevron (CVX).

As you can see, Exxon and Chevron both have significant amounts of refinery activity, OXY has none. Why is this a boon to OXY? Because selling crude benefits from high oil prices more directly than refining does. It's often thought that refining makes less money when oil prices are high, and more money when prices are low. It's not really that simple: It depends on the "crack spread," the difference between the price of crude and the price of refined products. Let's say oil is $100 per unit and gasoline is $120 per unit. In this scenario, a refiner pockets $20 less any overhead costs they have. The wider this spread is, the more refiners make. It's not necessarily the case that higher oil prices mean less profits for refiners, but it is the case that their profits don't correlate with oil prices as tightly as those of companies that sell oil wholesale-like OXY.

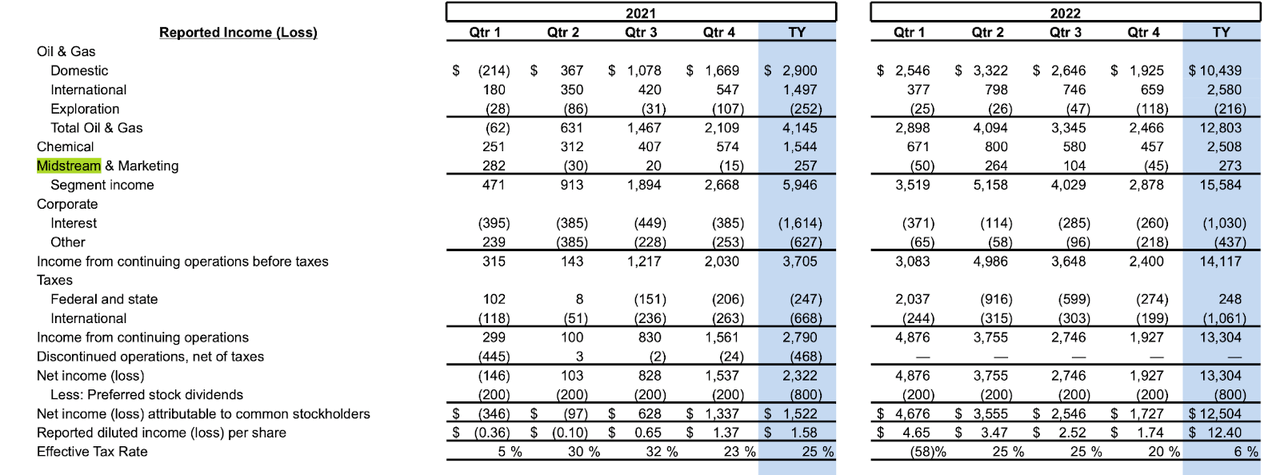

It's a similar story with midstream. Midstream companies usually "rent out" pipeline space to customers, who then get to use the pipe to transport oil. The revenue tends to be fairly stable regardless of where the price of oil goes. Some pipeline companies have contracts that let them capture more revenue when the price of oil goes up, but they generally don't join the party when oil prices rise anywhere near to the extent that E&Ps do. OXY has some presence in midstream, but it's fairly small as a percentage of the whole. In 2022, the company did $273 million in midstream earnings compared to $12.5 billion in the whole year net income. So, OXY's business mix positions it well for a future uptick in the price of oil.

OXY segment earnings (Occidental Petroleum)

Valuation

Having looked at OXY's business prospects, both with and without growth in the price of oil, we can now turn to its valuation. At today's prices, OXY trades at:

-

6.6 times earnings.

-

1.57 times sales.

-

2.75 times book value.

-

3.3 times operating cash flow.

-

4.66 times free cash flow.

A fairly cheap valuation going by trailing 12-month earnings. Of course, the TTM period includes many quarters in which oil was more expensive than it is now. If the stock price didn't change, then these multiples would likely rise in the quarters ahead, where OXY is to earn lower levels of earnings. Recall earlier, I calculated a 7.66 price/FCF multiple for OXY using 2021's free cash flow in place of the actual TTM free cash flow. That's still cheap. Also, remember that OXY has paid off $10.5 billion worth of debt: the earnings about to be released could be surprisingly high, despite the price of oil having fallen.

Two Big Risks to Watch Out For

Taking everything together, OXY looks like a pretty good value. It's cheap, it has good margins, and it's well positioned for a future rise in the price of oil. However, there are two big risks for investors to watch out for:

-

An unforeseen fall in oil prices. Low oil prices are bad for all oil companies, but they're particularly bad for E&Ps like OXY, whose earnings are the most directly correlated with oil prices. As I wrote earlier, there are many reasons to think that oil prices will rise in the months ahead. OPEC is cutting output, China is reopening, and the U.S. government may even re-fill the SPR! The fundamentals are certainly there for higher oil prices, but recall that, in 2015, few people saw the crash to $50 that was coming that year. It looked like a healthy environment for oil, but it wasn't.

-

Political risk. Oil companies in general have a pretty high level of political risk. Pipeline projects are sometimes shut down by governments. Regulations sometimes make building new infrastructure difficult. Governments often pressure oil companies to lower the price of gasoline. These risks are usually just background noise that don't affect the day-to-day operations of companies, but sometimes they become very real, like when the Keystone XL Project was cancelled by the Biden administration.

The risks above are real ones that investors would do well to keep in mind. Nevertheless, Occidental Petroleum is one of the better-positioned oil companies out there. It's cheap, it's paying off debt, and it's able to capitalize on any future rise in the price of oil. Definitely a stock worth researching, maybe even buying.

"Oil" - Google News

March 31, 2023 at 05:28AM

https://ift.tt/YegISc0

Occidental Petroleum: Oil Is Getting Interesting Again (NYSE:OXY) - Seeking Alpha

"Oil" - Google News

https://ift.tt/ij7AMOS

https://ift.tt/hoLE0Q8

Bagikan Berita Ini

0 Response to "Occidental Petroleum: Oil Is Getting Interesting Again (NYSE:OXY) - Seeking Alpha"

Post a Comment