Natural gas futures forged ahead Friday, boosted by colder forecasts and expectations for back-to-back bullish storage prints relative to historic norms. The April Nymex gas futures contract settled at $2.216/MMBtu, up 6.2 cents day/day. May rose 7.8 cents to $2.361.

At A Glance:

- Bullish storage print in cards

- Supplies hold at robust levels

- Week-ahead weather shifts colder

NGI’s Spot Gas National Avg. gained 18.0 cents to $2.285.

NatGasWeather said weather data, while inconsistent through most of the past week, flipped back colder heading into trading Friday. The European weather model added several heating degree days for the next two weeks. This, the firm said, advertised a cooler-than-normal pattern heading into April and provided a bump for futures.

That noted, price movement was modest as cool temperatures in late March and early April rarely translate into robust demand. At the same time, high temperatures across the South are projected to range from the 60s to the 80s – shoulder season conditions that tend to minimize both heating and cooling demand.

Friday’s prompt month close was notably below the previous week’s finish at $2.338.

EBW Analytics Group’s Eli Rubin, senior analyst, said bulls also have in their favor Freeport LNG’s gradual return to full service. The liquefied natural gas export facility, knocked out of commission last year after a fire, recently drew 1 Bcf/d of gas from domestic supplies, adding to demand. However, the plant’s efforts to build back to capacity of nearly 2.4 Bcf/d have been slowed by complications.

“Demand expectations have been parried by news concerning damage to one train at Freeport LNG during the long-awaited startup,” Rubin said Friday. “While we favor modest upside for natural gas on a medium-term basis, if support near $2.12 fails it could open up a test near the $2.00 psychological level heading into the monthly contract rollover” in the week ahead.

Analyst Brian LaRose of ICAP Technical Analysis similarly viewed a test of sub-$2 prompt month pricing as possible. “Watching intently for any signs of bottoming action as we head into the end of the month,” he said. “Bulls would need to get Henry Hub over $2.514 to have a shot at gaining a foothold.”

Plentiful Supply

Traders on Friday also took note of a seasonally stout storage result and expectations for another favorable print in the coming week.

The U.S. Energy Information Administration (EIA) on Thursday reported a withdrawal of 72 Bcf natural gas from storage for the week ended March 17. It compared bullishly with a pull of 55 Bcf a year earlier and a five-year average decline of 45 Bcf. The decrease lowered inventories to 1,900 Bcf.

Compared to degree days and normal seasonality, the withdrawal appeared loose by about 2.4 Bcf/d versus the prior five-year average, according to Wood Mackenzie.

A late-winter blast cold fueled the draw. That chilly weather system extended into the following week and could drive another solid pull.

Early estimates for the week ended March 24 submitted to Reuters ranged from pulls of 38 Bcf to 76 Bcf, with an average decrease of 55 Bcf. The projections compare with an increase of 15 Bcf a year earlier and a five-year average decline of 17 Bcf.

Still, stocks remained far in excess of the year-earlier level of 1,396 Bcf and the five-year average of 1,549 Bcf. These surpluses developed over an early 2023 defined by a relatively mild winter that intersected with steady production levels around 100 Bcf/d.

Analysts at The Schork Report said late-season bullish prints would do little to eat into the market’s elevated supplies. Even though utilities are 90% through the withdrawal season, “the market has only delivered 77% of last summer’s 2.262 Tcf refill,” they said Friday.

Cash Price Recovery

Spot gas prices on Friday varied by region but advanced overall for the first time in an otherwise dismal week.

NatGasWeather said below average temperatures would track across the western, central and northern United States early in the week ahead, delivering lows from the teens to the 30s and highs of 30s to 50s for moderate national demand. But the firm said benign conditions in the South would prove a notable offset.

The forecaster said in the first week of April, “a mild ridge will rule the southern and eastern U.S. early with highs of 50-80s for light demand.” However, weather systems were to continue over the West and Midwest, paving a path for chilly rains and brief shots of snow. These conditions could reach the Northeast later in the week. Again, though, pleasant conditions in the South could keep overall spot market demand in check.

Against that outlook, prices in the West, which had slumped earlier in the week, bounced back and led the upward climb Friday.

SoCal Citygate gained $1.185 day/day to average $9.525 and Malin advanced $1.085 to $3.860.

In the Rockies, Kingsgate jumped $1.610 to $4.000, while El Paso Bondad gained 70.0 cents to $2.495.

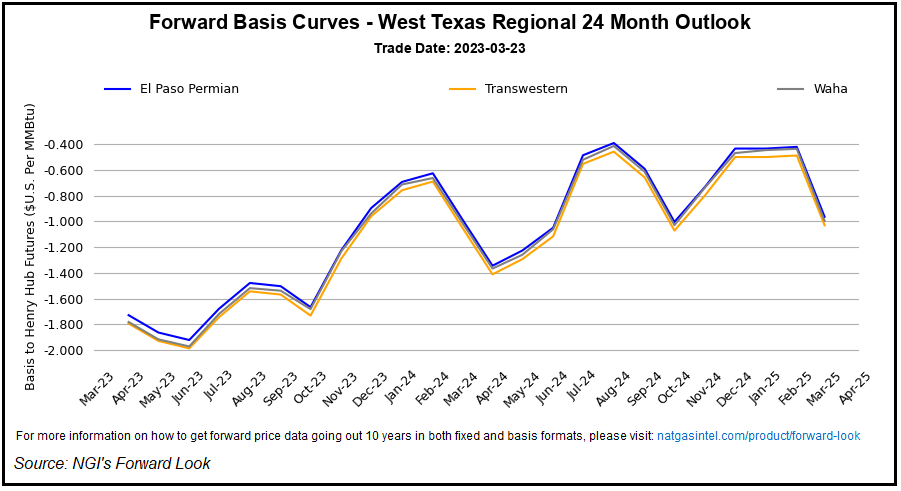

East Daley Analytics noted on Friday ongoing price weakness in West Texas.

The long-awaited return of Kinder Morgan’s El Paso Natural Gas Line 2000 in February brought producers in the Permian Basin a few weeks of price relief, given it created capacity to send more fuel to the West.

“The return of Line 2000 on Feb. 15 added 600 MMcf/d of takeaway to the Southwest region, loosening up space on crowded pipelines and allowing gas in the Permian to swing to higher bidders,” East Daley analysts said. Prices at Waha advanced in response.

However, prices at the key West Texas hub have since struggled, falling in March. On Friday, Waha dropped 24.0 cents to 67.5 cents. Prices in West Texas were the lowest found across the Lower 48.

This “suggests the newly available pipeline capacity has already filled, confirming East Daley ‘s view that Permian gas production will quickly grow into pipeline expansions planned in the back half of 2023,” the analysts said. “In our Permian supply and demand forecast, we project egress pipelines are currently running at 97% of effective egress capacity out of the basin, and to run at an average 99% of effective capacity through” year-end 2023.

The pipeline limits also help explain the relatively lofty prices in the West, a region that depends on gas from the Permian.

"gas" - Google News

March 25, 2023 at 05:07AM

https://ift.tt/WaLd53M

Natural Gas Futures, Spot Prices Find Path Forward as Forecasts Tilt Colder - Natural Gas Intelligence

"gas" - Google News

https://ift.tt/TaNkeQv

https://ift.tt/WkZejin

Bagikan Berita Ini

0 Response to "Natural Gas Futures, Spot Prices Find Path Forward as Forecasts Tilt Colder - Natural Gas Intelligence"

Post a Comment